|

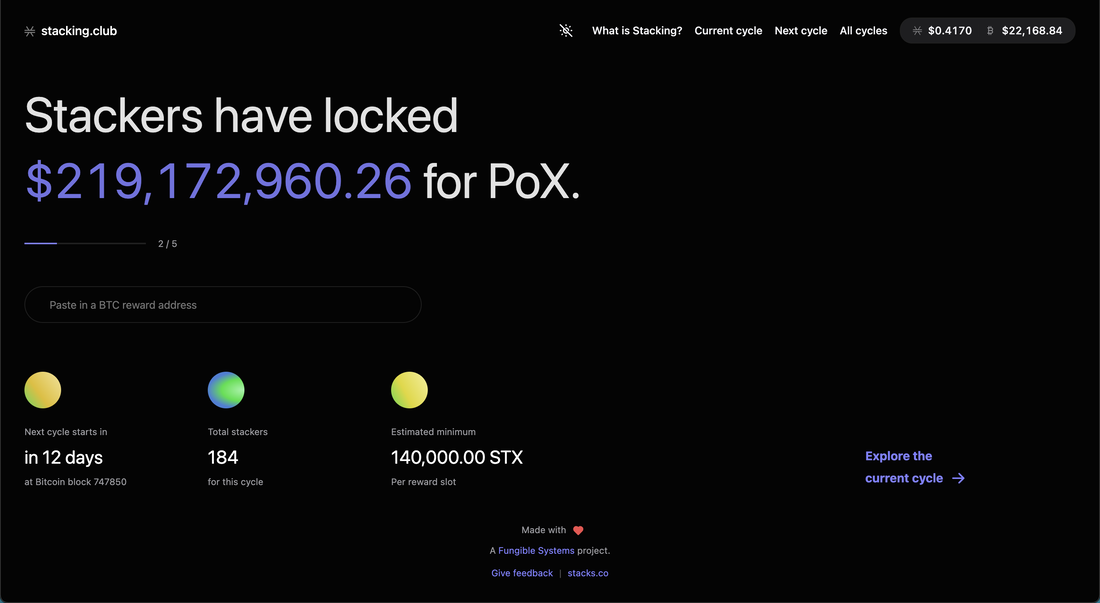

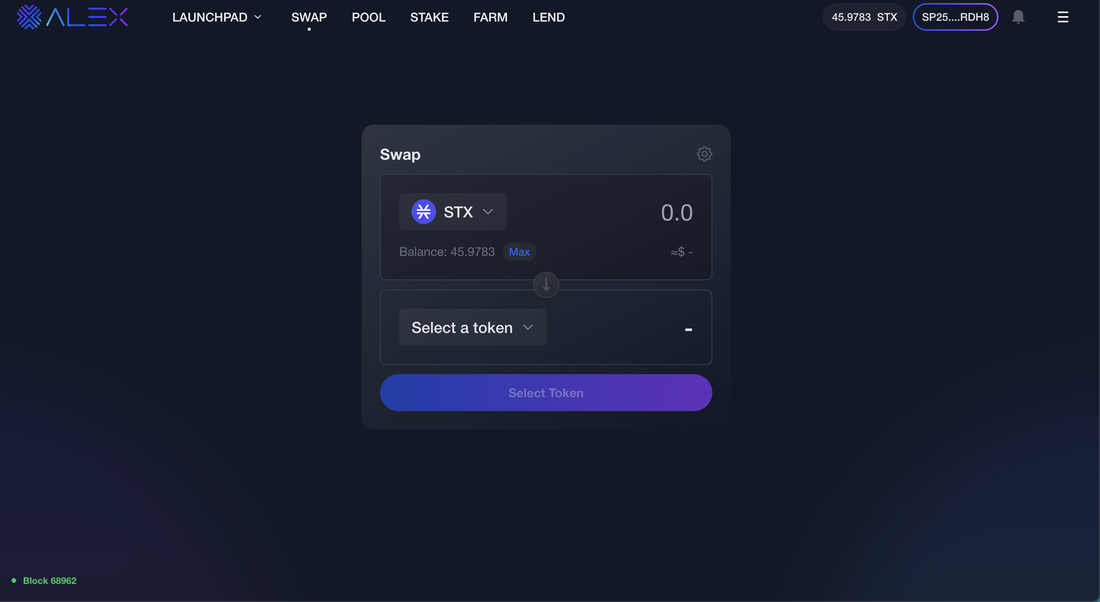

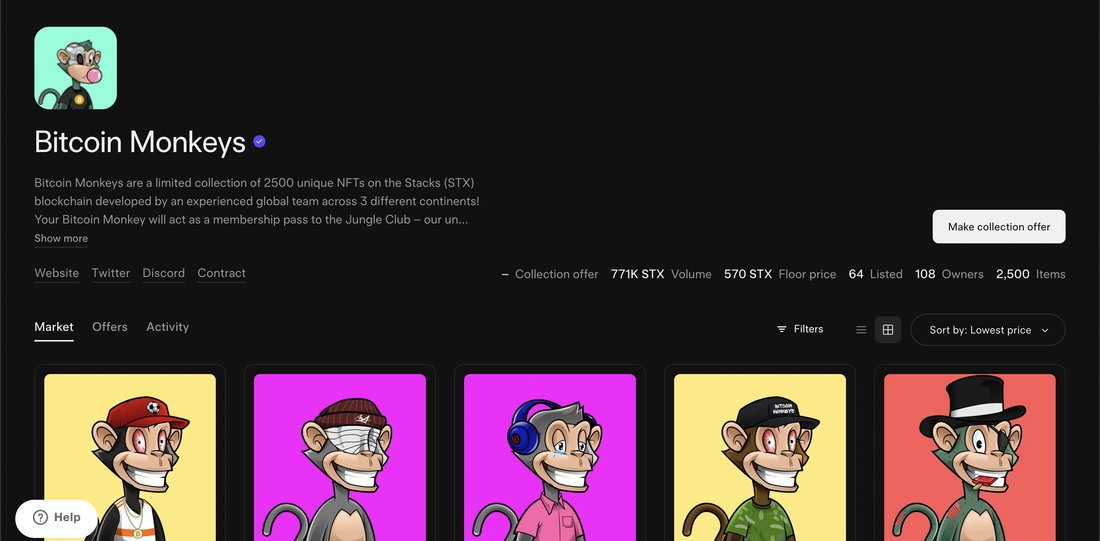

Here is the summary of current Dapps mostly used on Bitcoin (excluding Lighting apps). Stack is the smart contract layer of Bitcoin with PoX (Proof of transaction) which generates BTC rewards. https://www.stacks.co/ Hiro wallet is both browser and desktop wallet for stacks app. https://www.hiro.so/wallet You will need hiro desktop to solo stake STX. APY is 7 - 11% currently. Stacking detail is here; https://stacking.club You will need 140,000 STX = 57,400 USD as of now to stack solo Or Stake here for less amount and you will also get NFT https://boom.money/nft/boombox Alex is the most used Bitcoin Defi app as of today. https://app.alexlab.co/swap There is huge farming reward at the STX/ALEX pool. Single staking with Alex is also over 100% APY. Alex platform has IDO (ICO platform) and lottery and also doing Alex lockdrop reward which is distributing reward for Auto Alex holder. Alex is also working closely with Bitcoin monkey NFT project. https://bitcoinmonkeys.io/ These monkeys are traded on these 2 NFT market. https://byzantion.xyz/collection/bitcoin-monkeys-labs https://gamma.io/collections/bitcoin-monkeys These are the summary of current BitFi ecosystem. Not much yet but it is getting bigger.

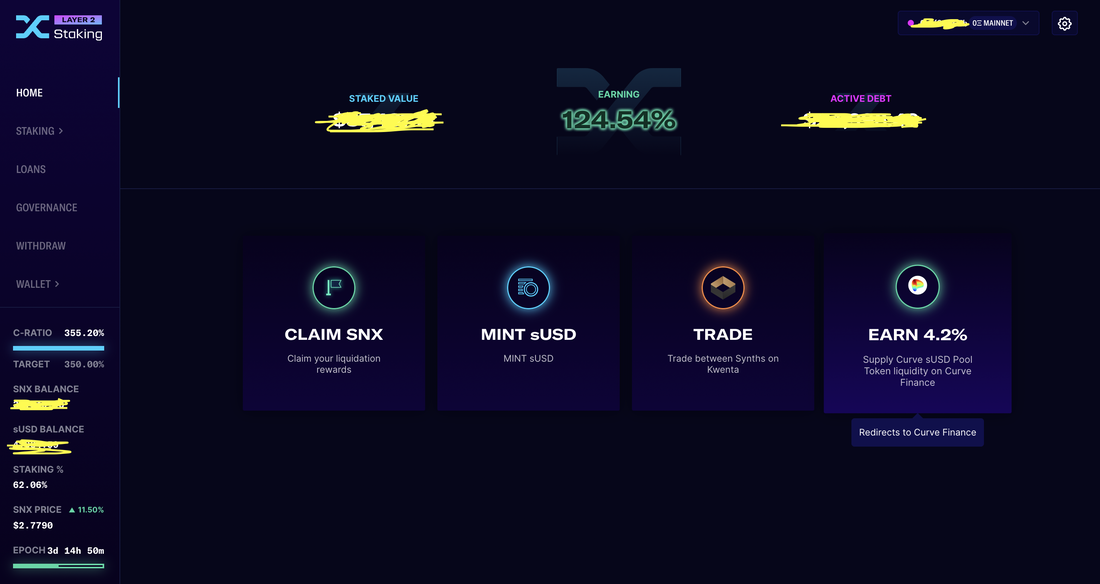

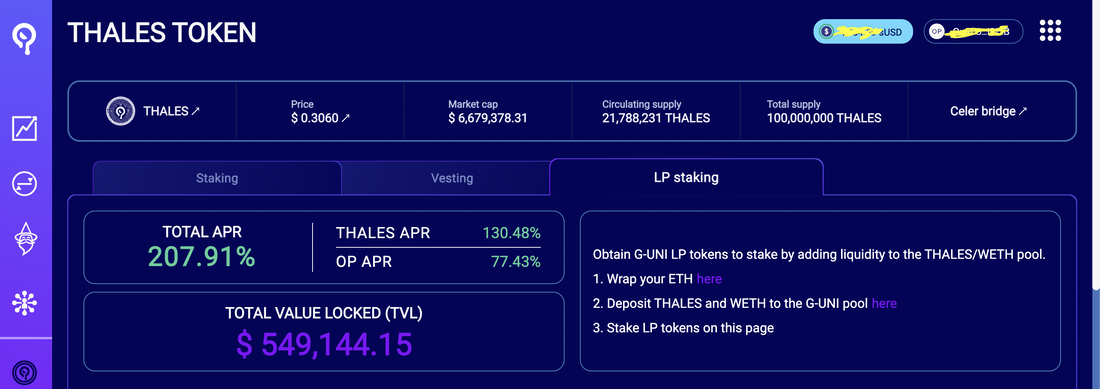

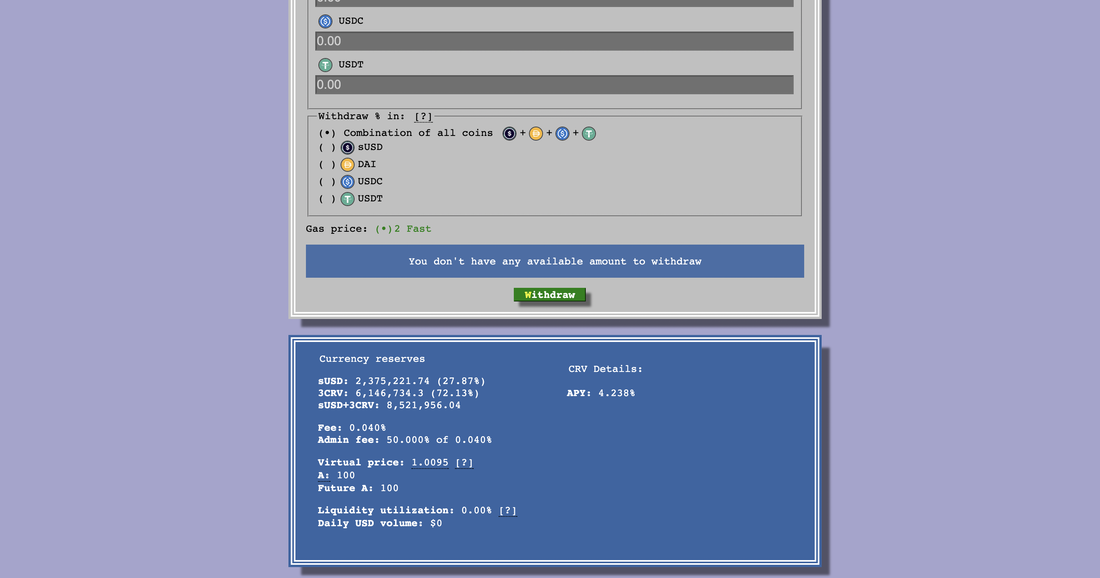

Sideway market is boring. Staking on Optimism has been great. 1: Synthetix (SNX) https://staking.synthetix.io/ 124.54% on OP Great FYI 45.01% on Mainnet Reward claim TX cost is less than a dollar. It costs a lot more (I remember it went as far as 60$) on mainnet, surely depending on gas fee. Why not migrate to L2 for more APY and cheaper tx fee Note that there is 1 year escrow so that you can not move the staking rewards till then but can stake them. 2: Thales https://thalesmarket.io/markets Crypto derivative market 207.89% for LP reward Great I prefer single staking though They started bribe with OP which giving additional 77.43% o top of THALES APR 3: Curve https://optimism.curve.fi/factory/0 4.238% APY not much but there is no need to worry about price change as you will be staking stable coin(s). Conclusion

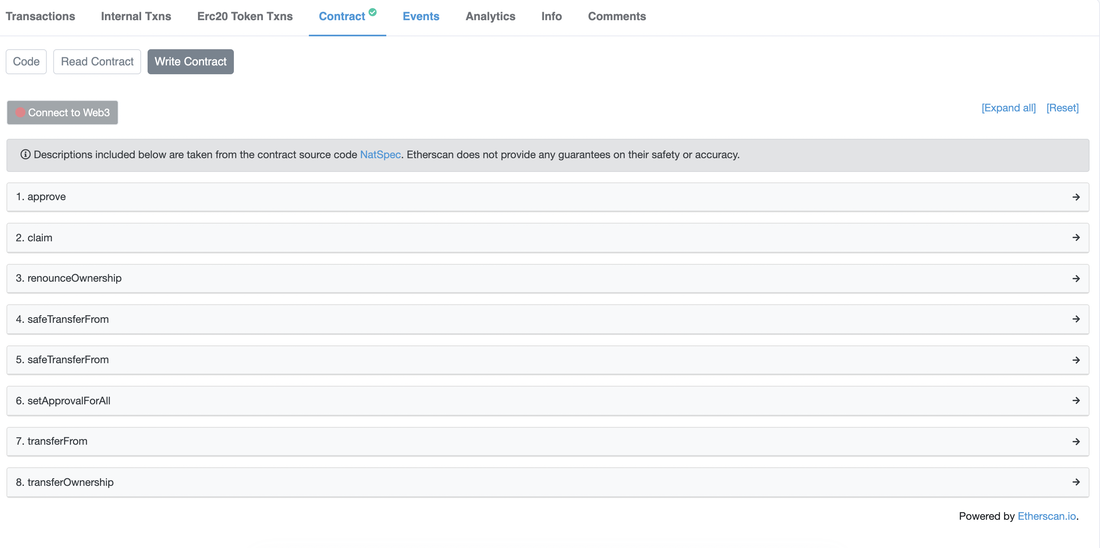

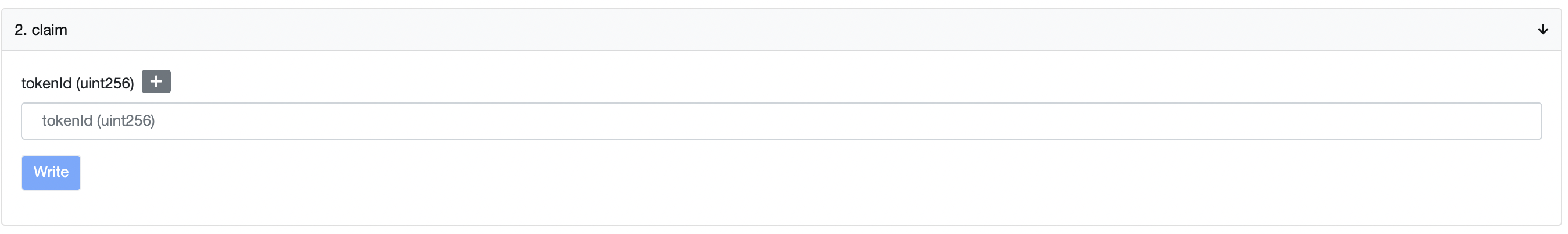

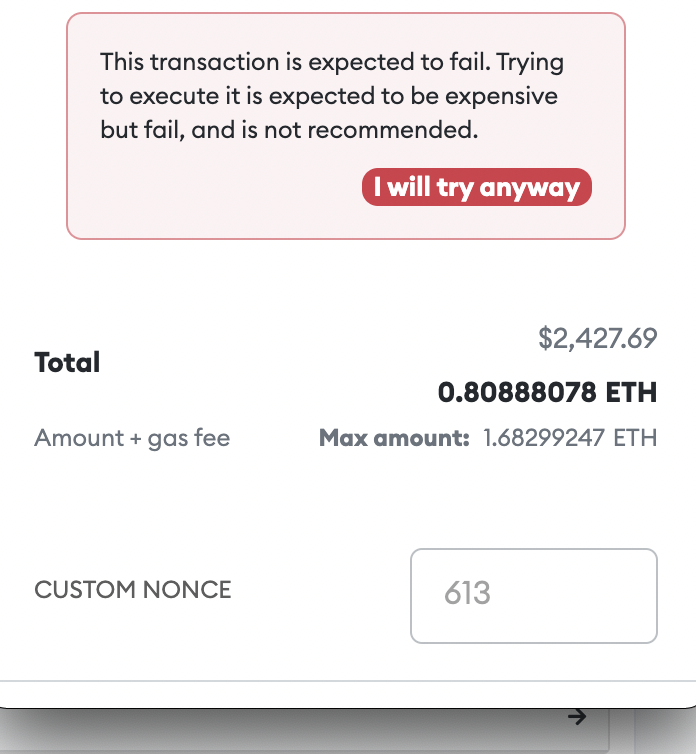

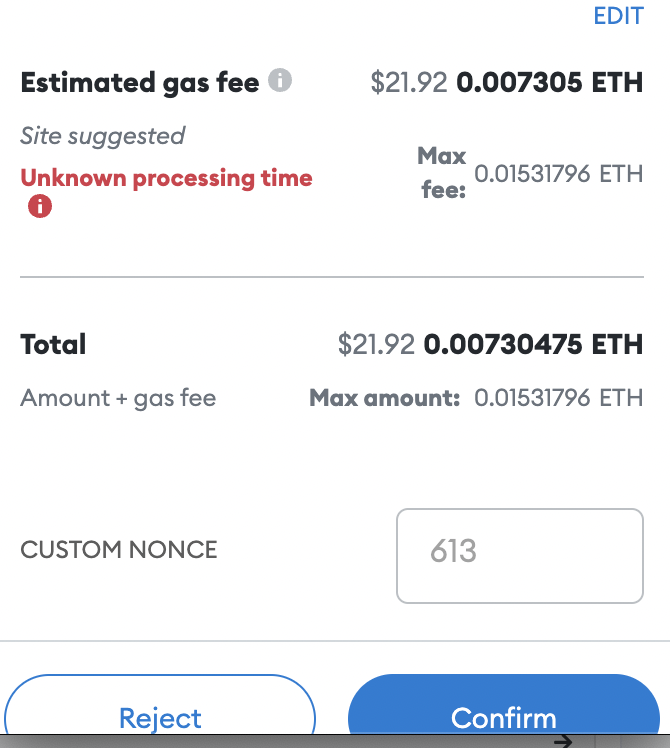

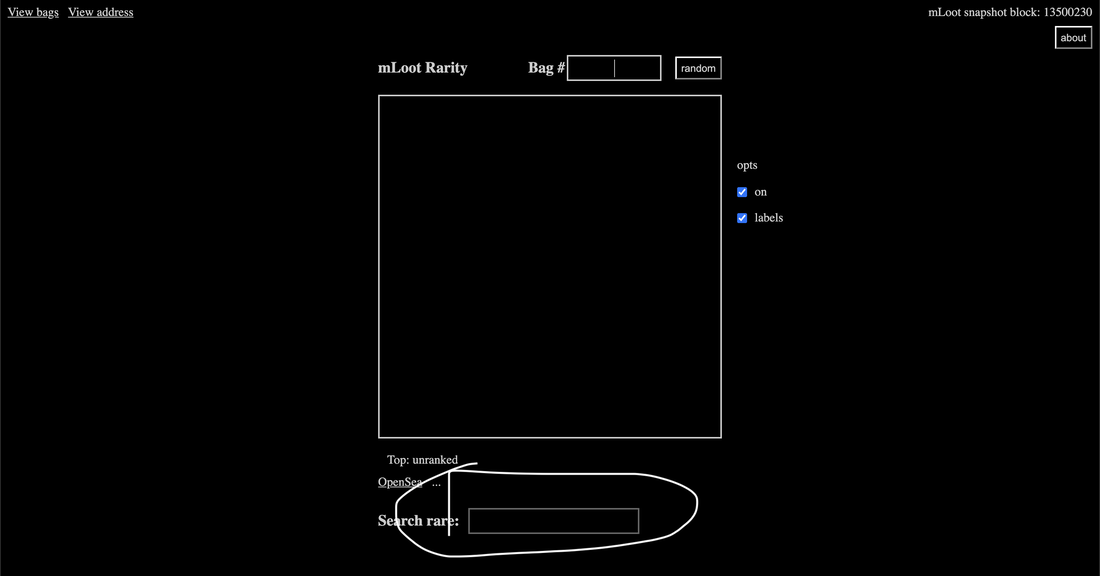

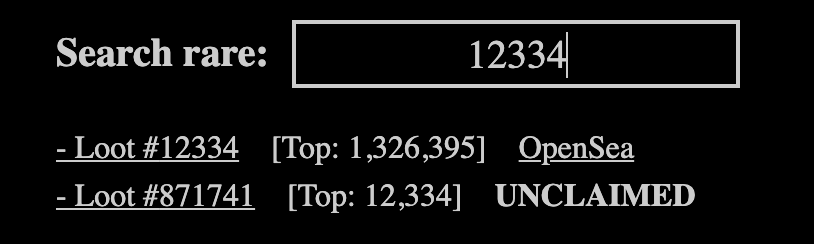

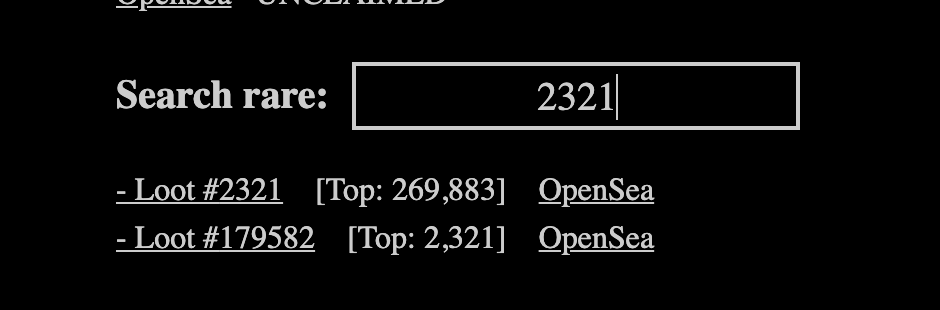

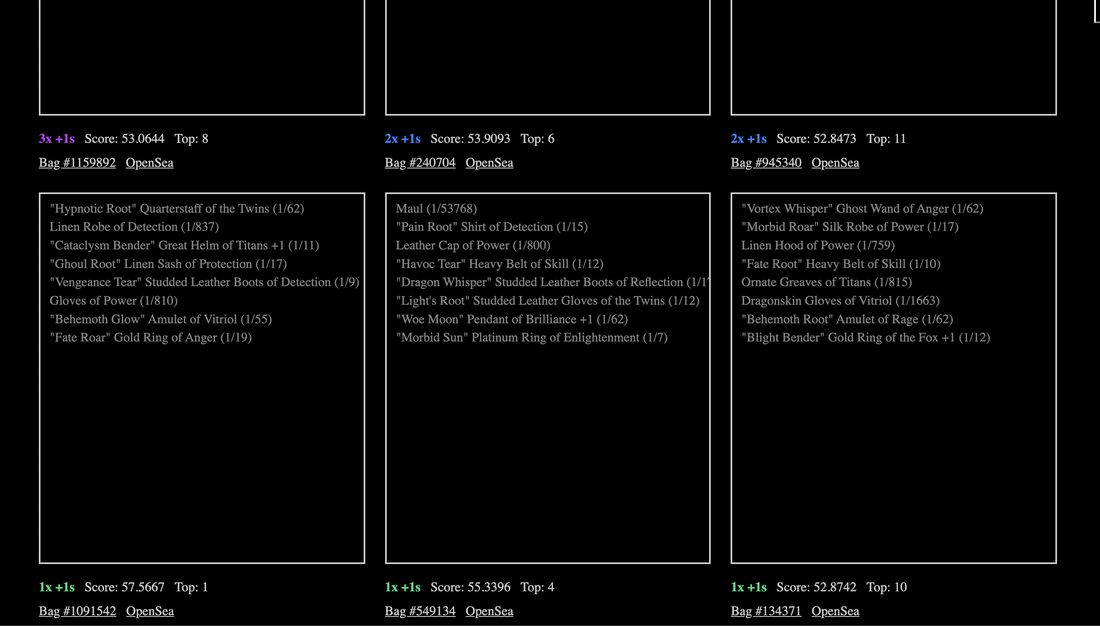

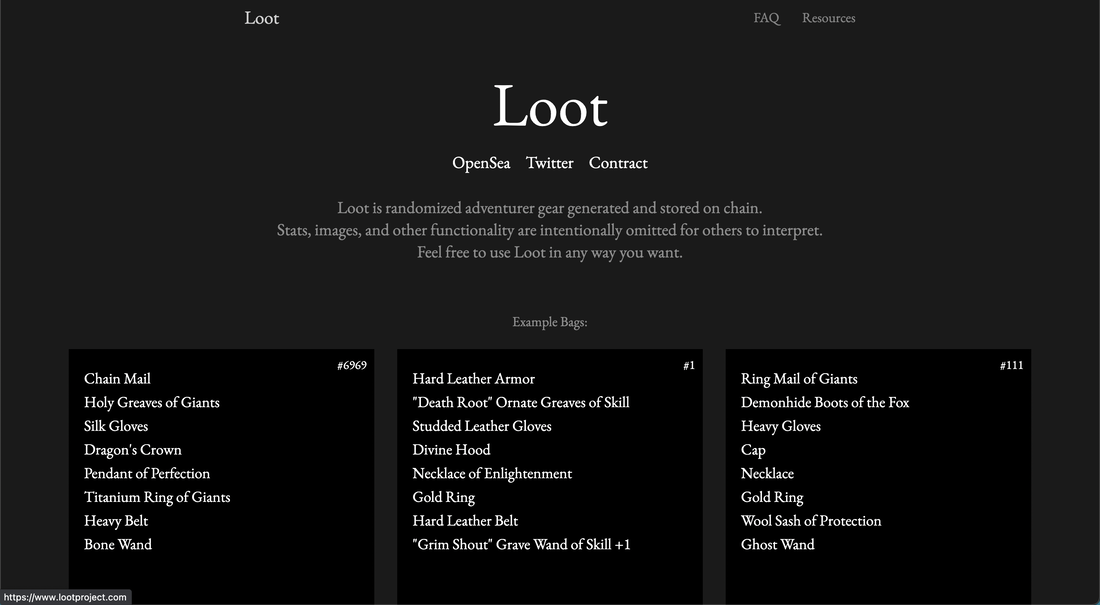

SNX staking is profitable, not inly staking reward but also trading fee for the stakers. Example staking strategy 1: Stake SNX and get sUSD 2: Stake sUSD on Curve or convert to WETH and THALES to LP stake on THALES for more APY 3: Be careful of SNX liquidation This is about how to mint More Loot (mLoot) and to check the rarity in order to mint effectively. The crypt will be releasing chapter 2 for mLoot holders https://thecrypt.game/ This may help for you to win the raid Link to mint https://etherscan.io/address/0x1dfe7ca09e99d10835bf73044a23b73fc20623df#writeContract Check Rarity https://mloot.art/#/ Below is the website to mint 1: connect to web3 (Metamask) 2: go to 2 "claim" make sure the number (TokenID) you put is unclaimed otherwise transaction fee will be nearly 1 ETH = 3000USD. It should cost 20USD with gas cost with 30gwei Left is the NG and right is the ok. You can go ahead with NG if you have ETH more than the cost. (And going to lose) That's it. I minted 50+ with putting random numbers and found this website https://mloot.art/#/ I have already spend time and lowest (Rarest) rarity number I claimed is around 5000. 1 is the highest and bigger the lower rarity. Try to find lower and unclaimed Under 10,000 is hard to find. Most of them are already claimed This is the bag with #1

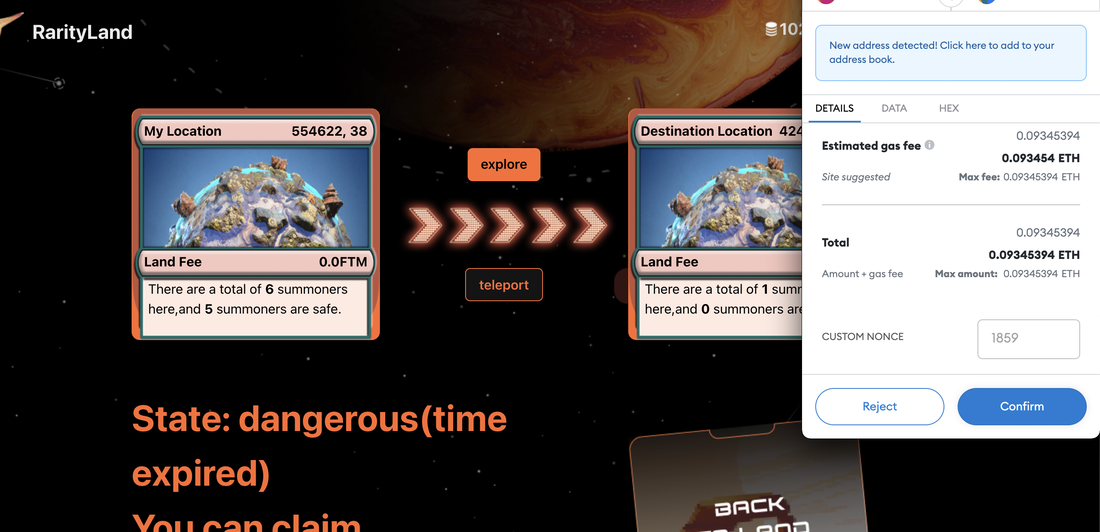

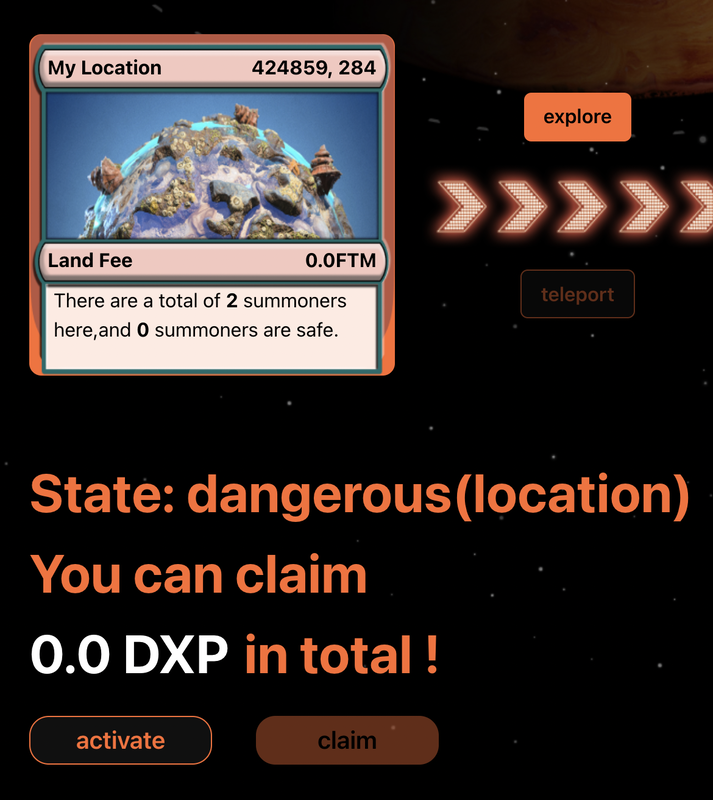

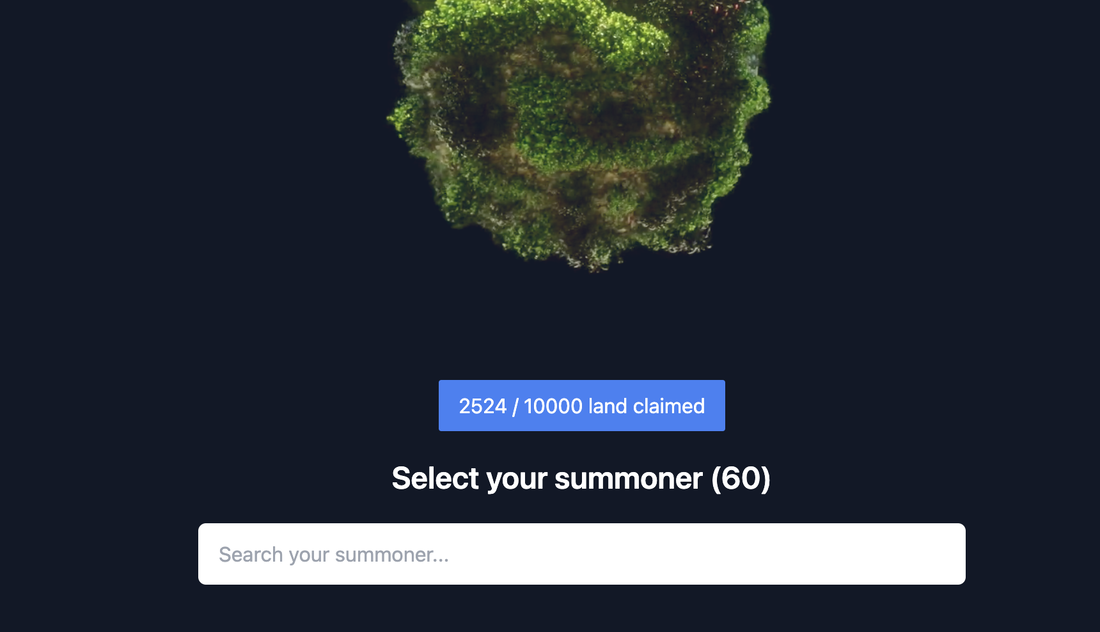

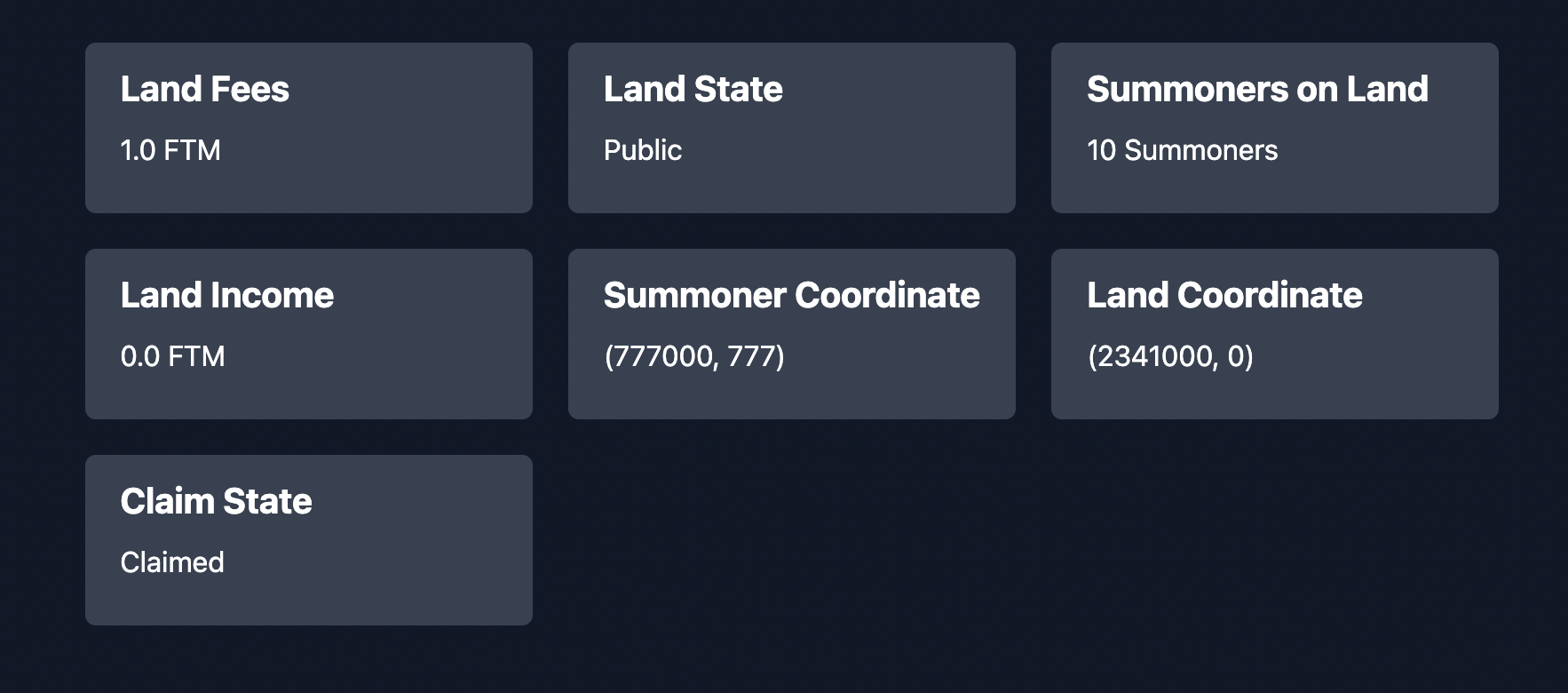

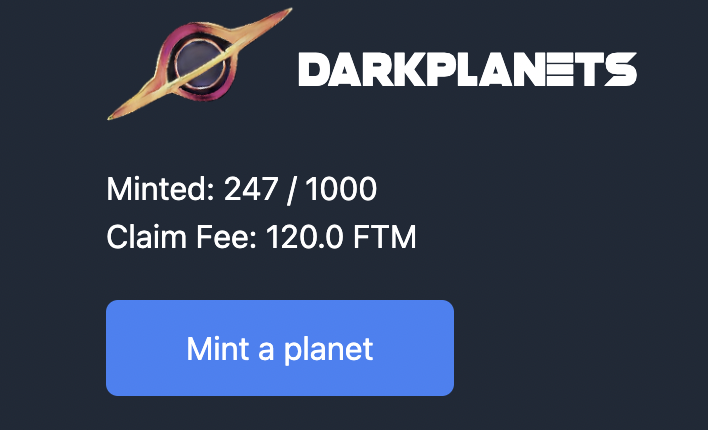

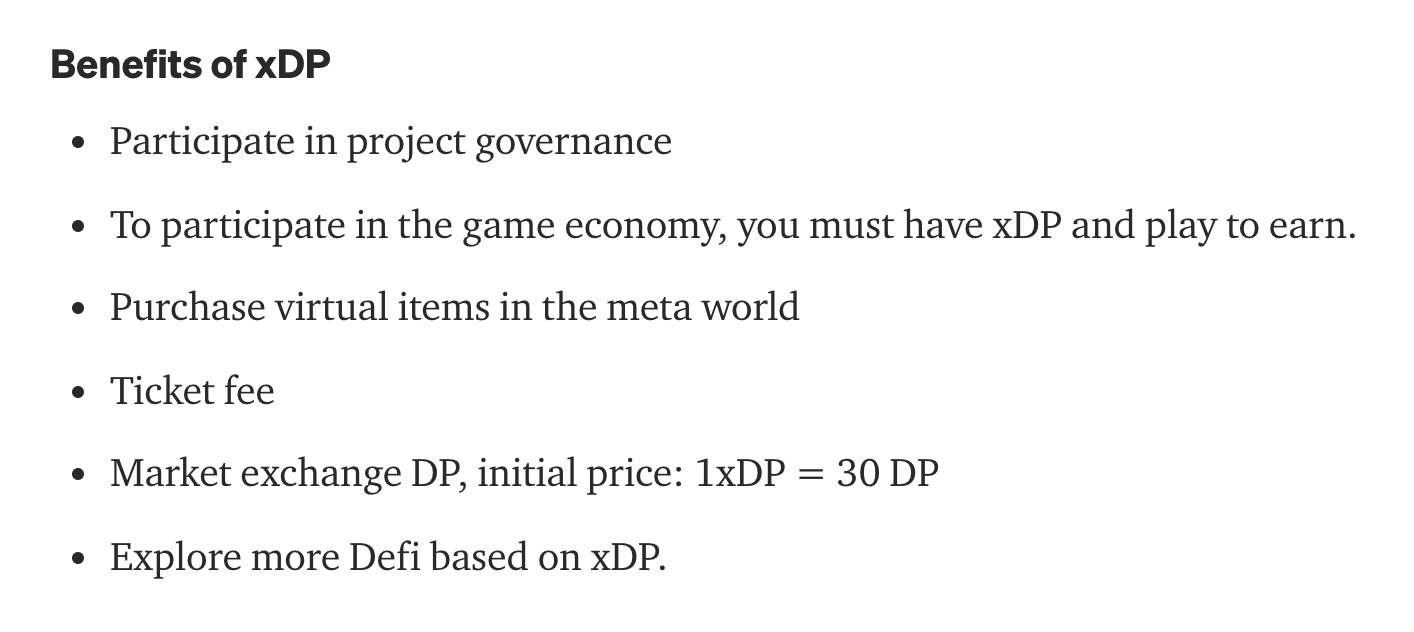

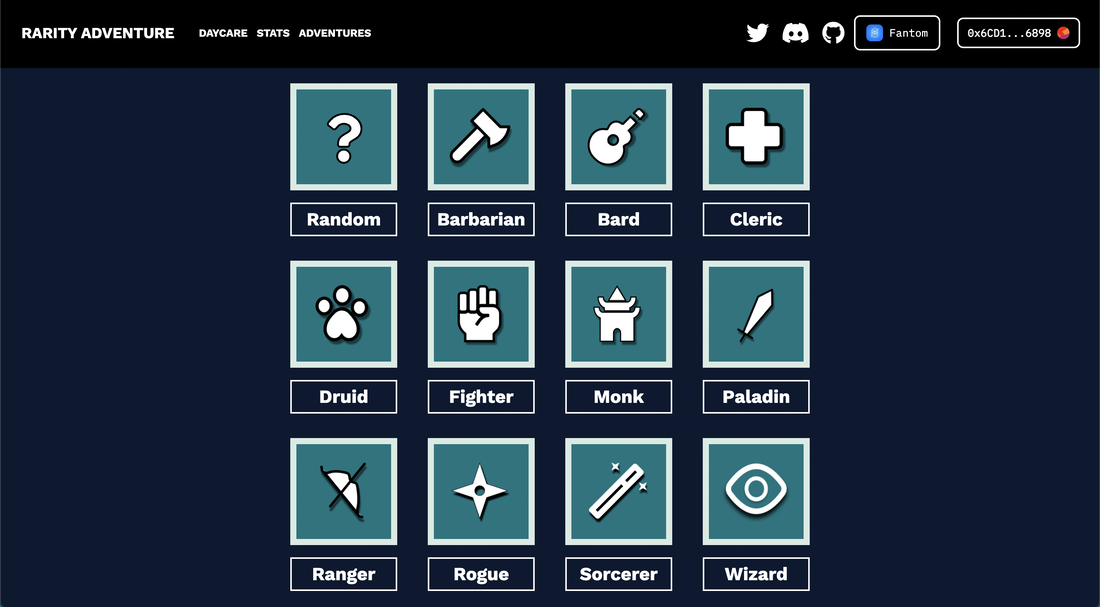

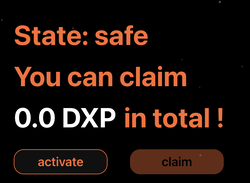

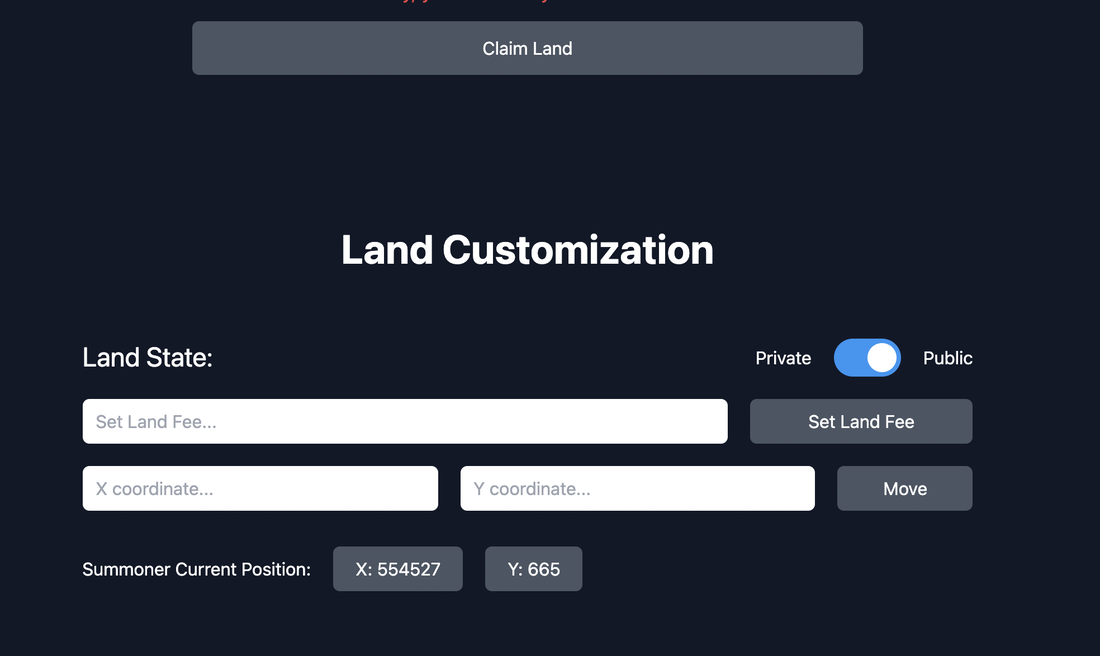

https://mloot.art/#/address/0x99fc8cb20c8dfebb9742d72f47be98f9845b7e7f This account has only super rare bags, I can say that this account already found out how to mind rare number (TokenID) to mint Dark Planetのプレイの仕方を説明します。 https://www.darkplanets.world/ Dark PlanetはRarity Rarity ManifestedというAndreがオープンソース作ったゲームのキャラクターを用いた戦略ゲームです。 まずはキャラクターが必要なのでサモンします。 https://darkplanets.vercel.app/summon Dark Planetのプレイ上今のところ何をサモンしても同じですがサイドクエストでクラフトに使うものを稼ぐことも考えるとFighterがいいです。 まずはDXPの稼ぎ方から始めます。DXPはまだ使えませんがこれから始まるPlanet戦に向けての必要なエナジーです。 https://darkplanet-dxp.vercel.app/ 右上のSelect Summonersからサモンしたキャラクターを選び移動させます。 Exploreでランダムに場所を選びます。 その際に - まだLand Feeが0の土地が多いので "Land Fee 0.0 FTM"を選んだ方がお得です。出ないとFee分のFTMをLand Ownerに支払います。 Land Feeについては後ほど説明します。 - サモナー10人以下を選びます。でないとDXPが稼げません。 そして”Teleport”で移動します。 下記の土地にTeleportしました。 2サモナーでFee0です。 ”Activate”を押しましょう。 すると下記のようになるので完了です。 注意点は72時間でDXPの獲得期間が終わるので3日後にまた別の土地に移動します。 72時間のフルで2400DXPくらい稼げます。  ではRarity Landの土地について https://darkplanets.vercel.app/rarityland サモナーをクリックし、土地をClaimしましょう。現時点で10FTMです。 Land Feeもここで設定できます。 ここをまだ設定指定いないひとが多いので無料で使える土地が多いわけです。 これを設定し誰かが自分の所有している土地に入ってきた場合FTMが稼げます。  Land Feeを1にセットしたので下記のように確認できます。 またX coordinate, Y coordinateでもサモナーが動かせますがUI的に https://darkplanet-dxp.vercel.app/ でやった方が簡単です。 まだ始まっていませんがここでPlanetをMintできます。 https://www.darkplanets.world/darkplanet 現時点で120FTMです。 今後このPlanetでの冒険でDXPが必要になるわけです。 最後にxDPについて https://darkplanet-finance.vercel.app/ DPのStakingにより獲得できます。 Spooky Swapでも買えますが DPトークンが必要です。 https://spookyswap.finance/swap xDPについては下記の通り https://medium.com/@geekery_eth/dark-planet-governance-token-xdp-20244948a276 次はPlanet戦が始まったらアップデートします。

でわGN These are Experimental metadata open-source gaming projects

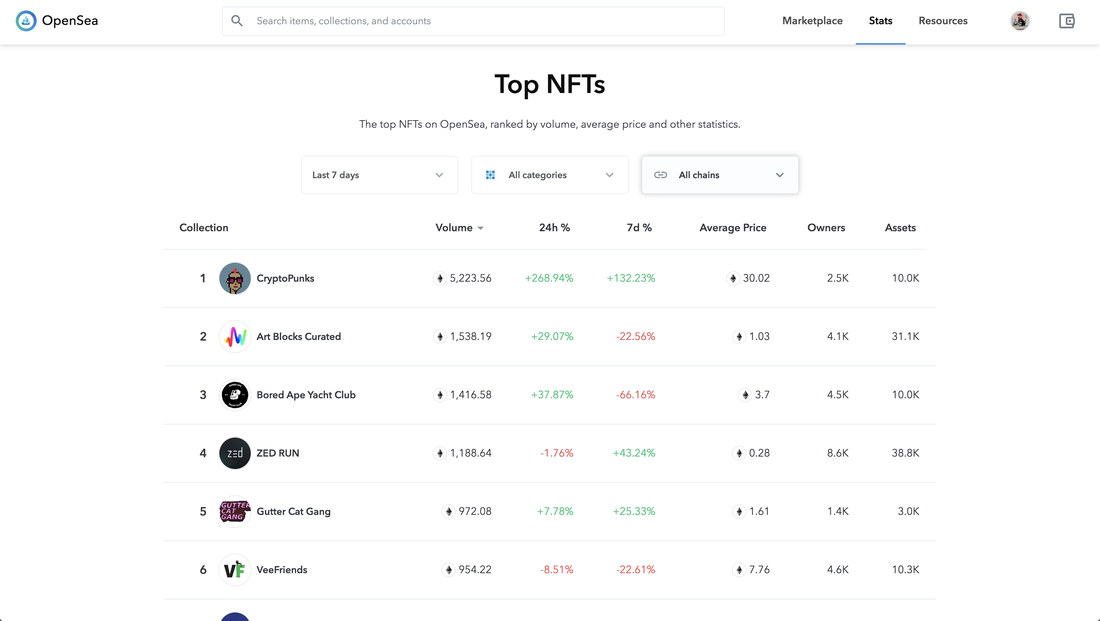

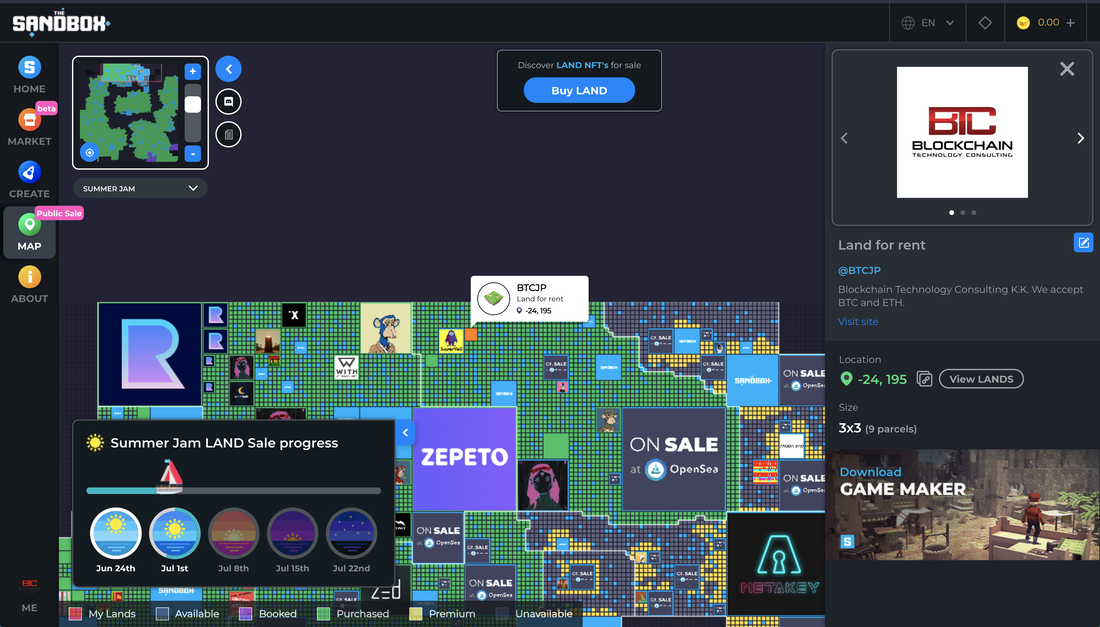

No UIs to start, there are some made by community which are listed below. Originally looks like this https://ftmscan.com/address/0xce761d788df608bd21bdd59d6f4b54b2e27f25bb#writeContract Rarity Manifested https://github.com/andrecronje/rarity#codex UIs https://raritymmo.com/ https://rarity-visualizer-ui.vercel.app/ https://rarity.game/ Loot https://www.lootproject.com/resources Market https://opensea.io/collection/lootproject Thoughts about NFT: - Opensea https://opensea.io/ - Sandbox https://www.sandbox.game/en/ NFT market as shown on the screenshot, opensea. CryptoPunks has 12mUSD sales volume last 24 hours. They sell pixel arts. Sandbox, Metaverse gaming platform, land sells at the moment. The 3x3 land costs 60,000 Sand (about 13,000 USD) at the public auction. Selling arts here:

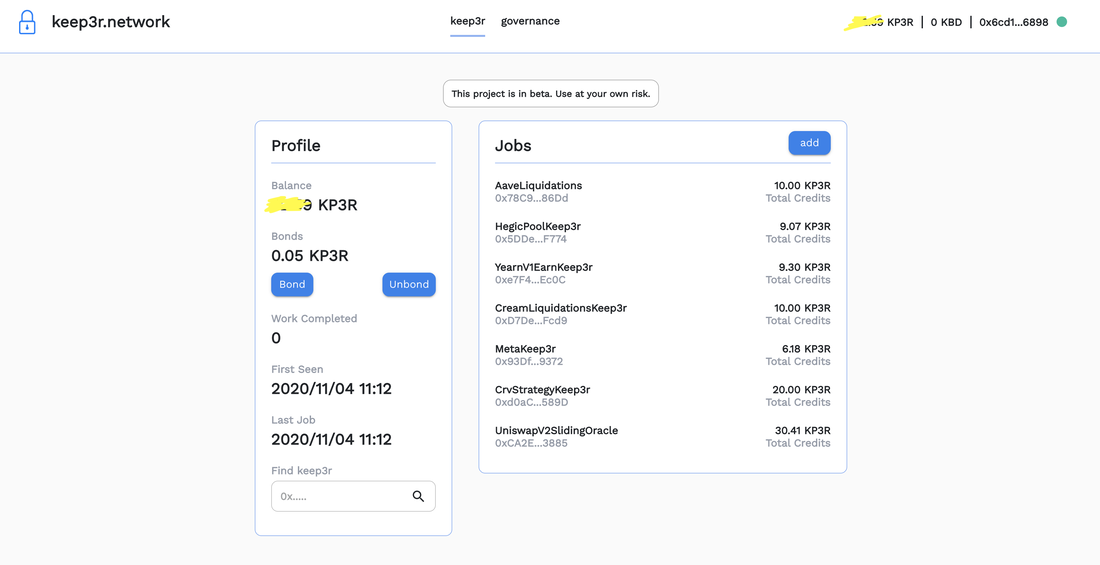

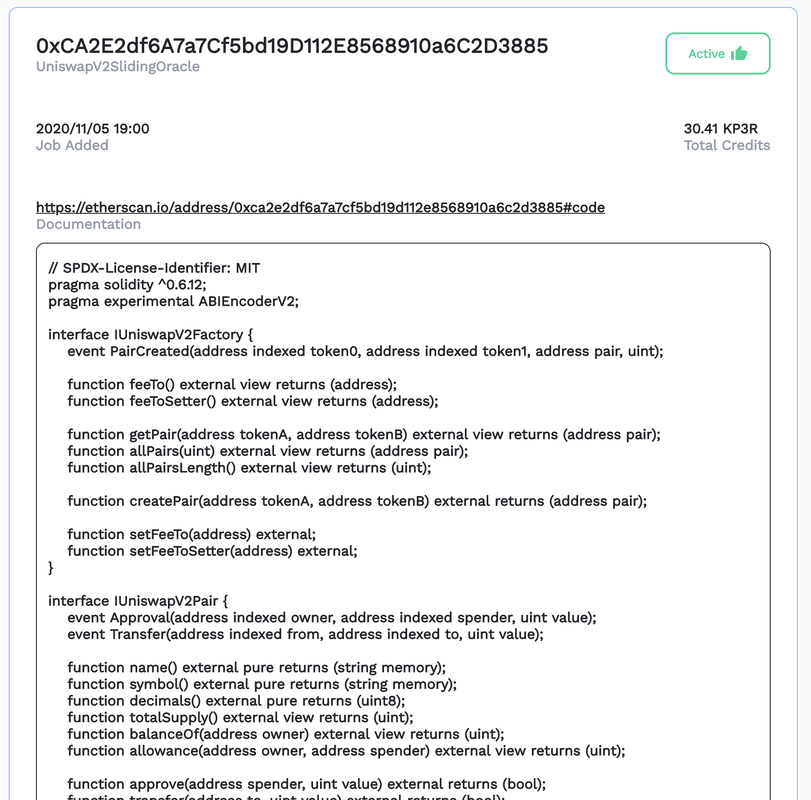

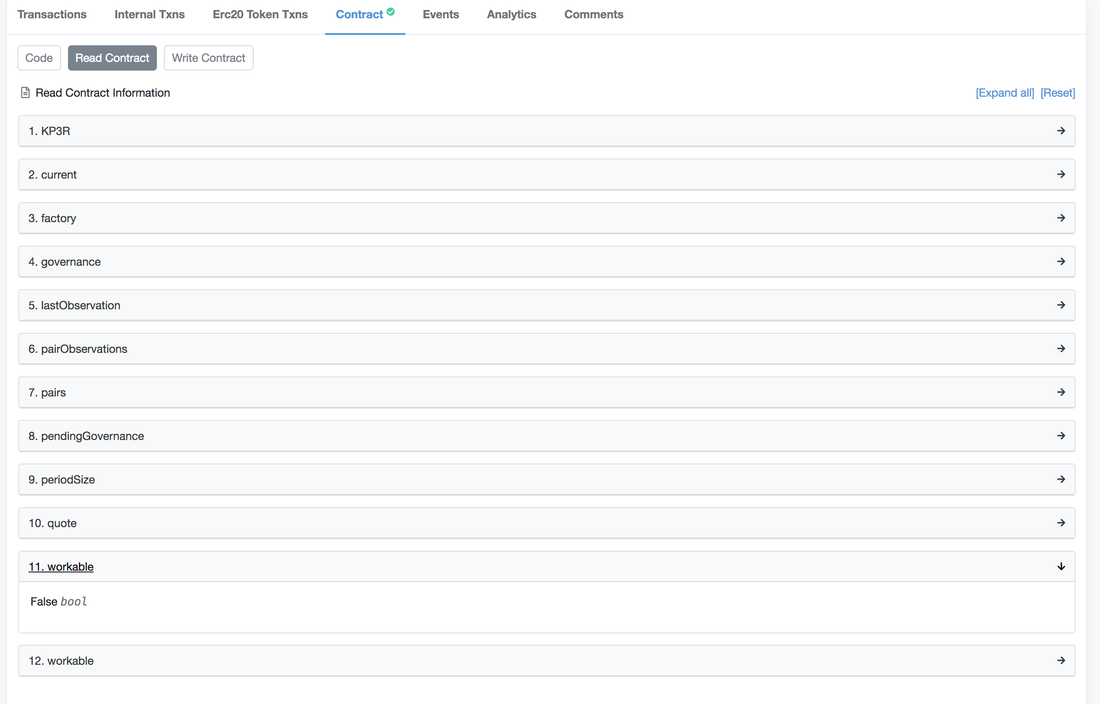

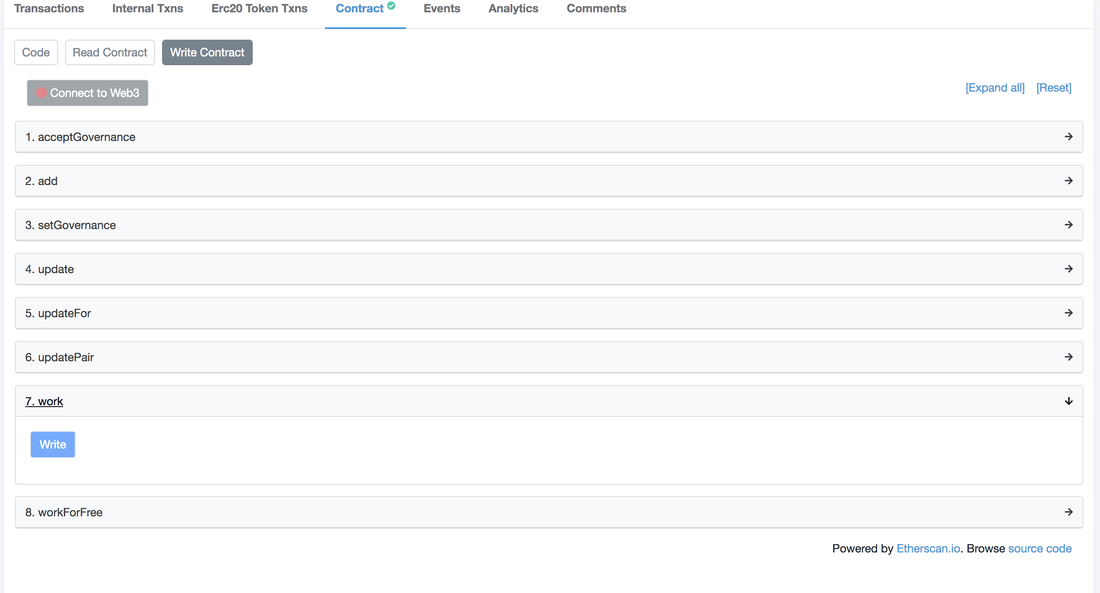

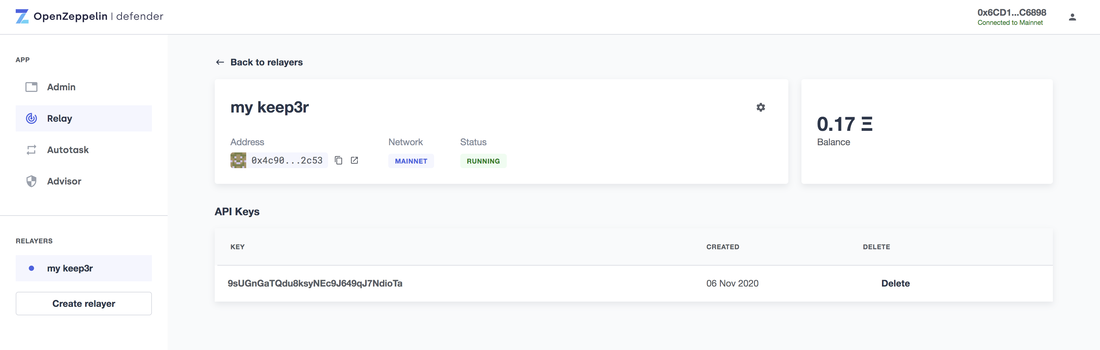

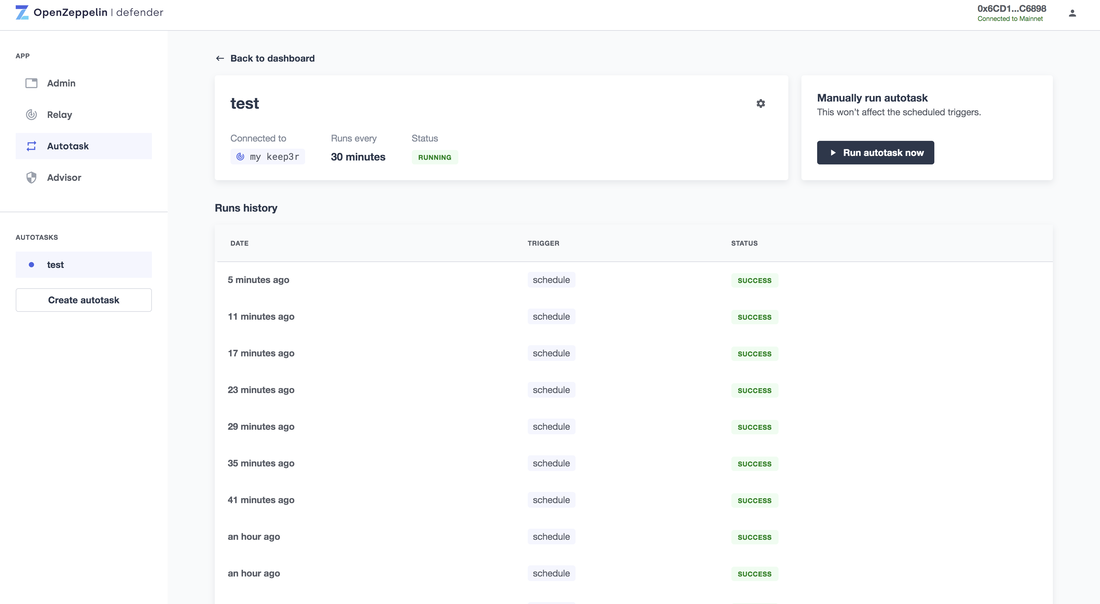

https://opensea.io/collection/hiphop-crypto Please contact [email protected] for more info. How to work as a keeper. Keep3r https://keep3r.network/ For more detail https://docs.keep3r.network/ Openzeppelin defender https://defender.openzeppelin.com/#/admin Defender/Keeper forum https://forum.openzeppelin.com/c/support/defender/36 Medium post https://andrecronje.medium.com/ 1: Activate keeper account. It will take 3 days to activate. You will get refund the GAS you spent for the transaction with KP3R. The screenshot below is already activated. 2: Pick a job to work. The screenshot below is UniswapV2slidingOracle For more details https://docs.uniquote.finance/#integrating Price feeds https://feeds.uniquote.finance/ https://andrecronje.medium.com/keep3r-network-on-chain-oracle-price-feeds-3c67ed002a9 3a: Work Go to the contract (UniswapV2slidingOracle) https://etherscan.io/address/0xCA2E2df6A7a7Cf5bd19D112E8568910a6C2D3885#readContract 1: Go to "Read Contract" and check "workable" = true, but this shows false most of the time. 2: If you are lucky enough to get true and go to "Write Contract" 3b: Autotask with Defender You need to add ETH to the relayer account you created. **Each Autotask costs GAS** Create an account https://defender.openzeppelin.com/#/admin Get a mainnet access **Well, this free for now but it will not!** Thank you for the Openzeppelin team for the access!! Creare a relayer For more details https://docs.openzeppelin.com/defender/guide-keep3r I changed from 5 mins to 30mins as it used lots of GAS. about 0.03 in 3 hours...

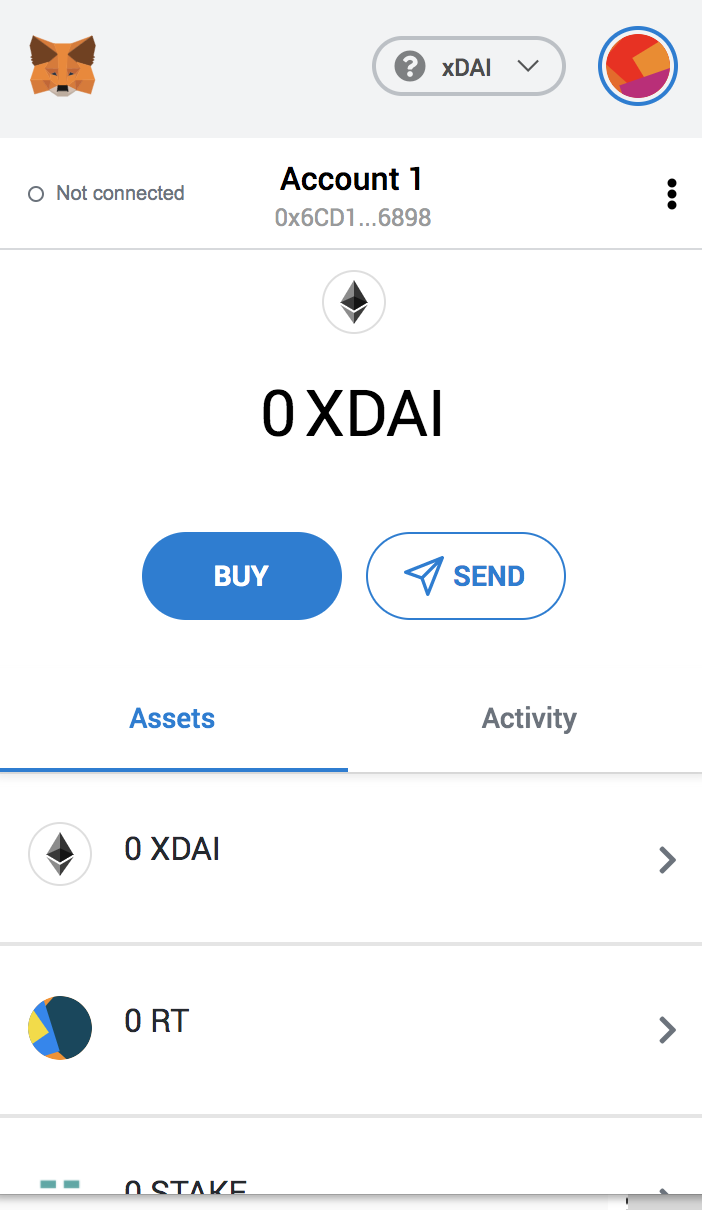

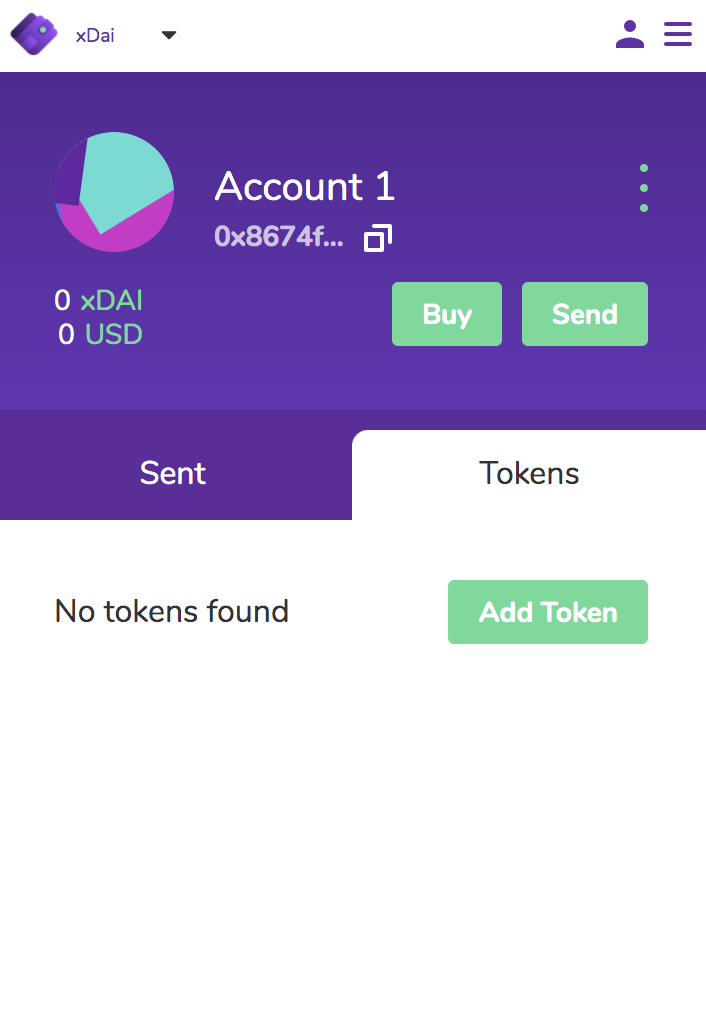

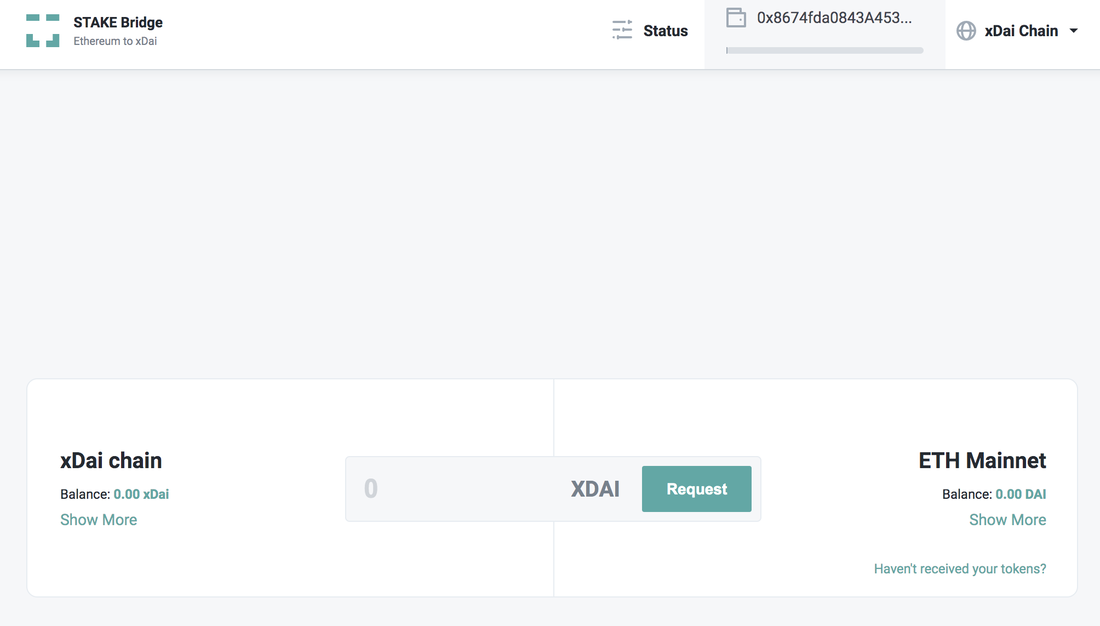

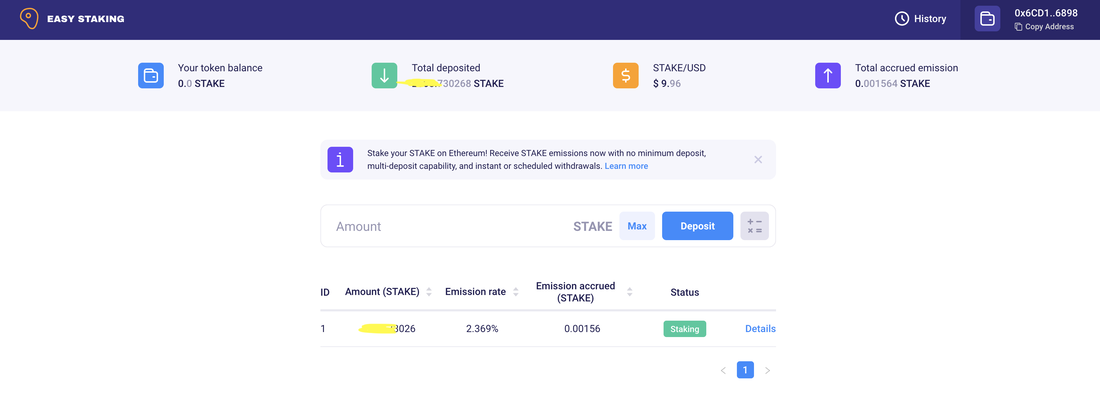

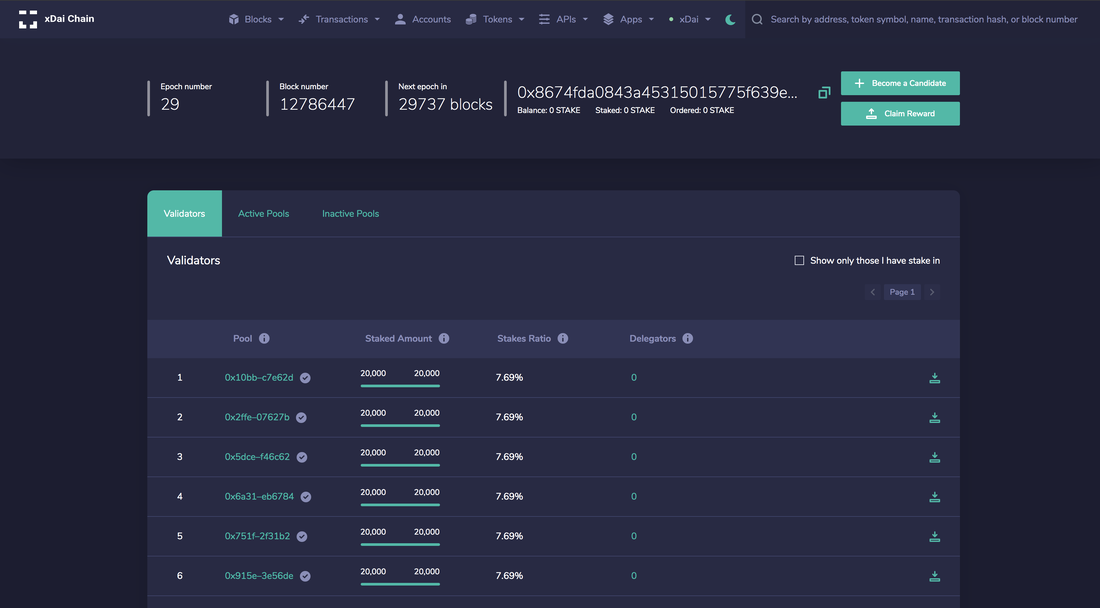

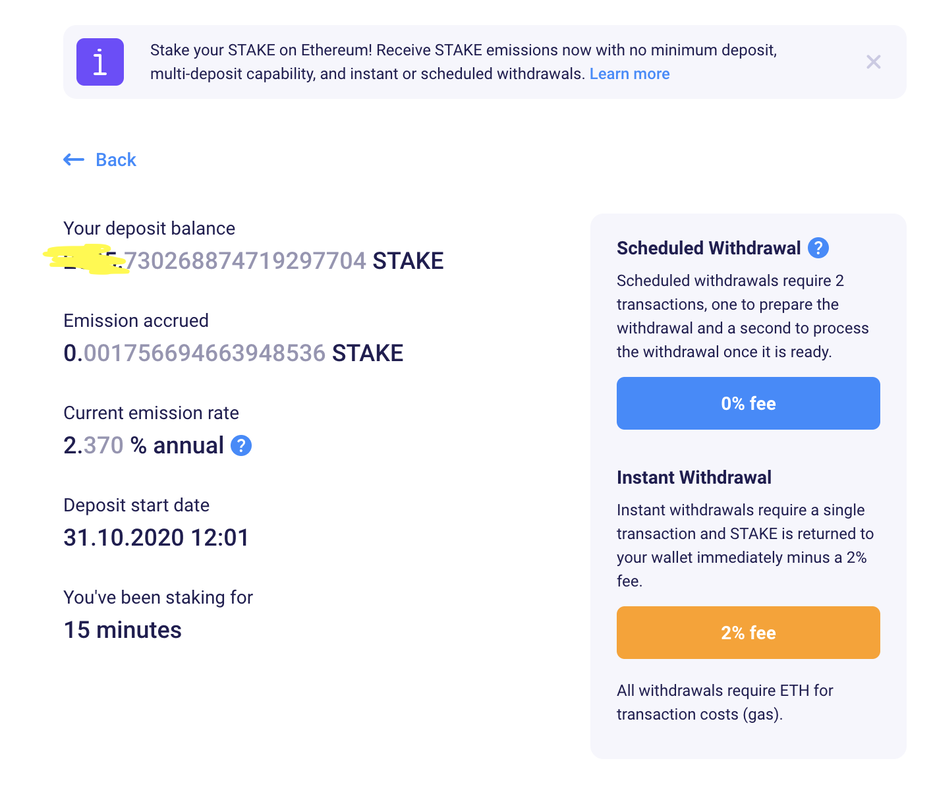

I have never got work before, I hope it works! xDAI is a POSDAO consensus sidechain of Ethereum with native currency of xDAI instead of GAS (ETH) to use for onchain transaction. Website: https://www.xdaichain.com/ Blockexplore: https://blockscout.com/poa/xdai/ TokenBridge (DAI to xDAI): https://docs.tokenbridge.net/xdai-bridge/about How to use: 1: Setup wallet Here are screenshots and links of wallets. Metamask setup with RPC Please follow the instruction below https://www.xdaichain.com/for-users/wallets/metamask/metamask-setup or Use Nifty wallet which is native xDAI wallet. https://chrome.google.com/webstore/detail/nifty-wallet/jbdaocneiiinmjbjlgalhcelgbejmnid/related?hl=en 2: Get xDAI Use xDAI xbridge to convert DAI to xDAI. https://bridge.xdaichain.com/ I connected both metamask and Nifty wallet and the website automatically chose Nifty wallet to connect as of 31/Oct/2020. 3: Stake "Stake" It is recommenced too use easy-staking by xDAI website. https://easy-staking.xdaichain.com/ Scheduled withdrawal take 12 hours to withdraw with 0% fee.  There is also stake Beta version function on Blockscout which needs "STAKE" token on xDAI chain. Easy-staking is using "STAKE" on mainnet.

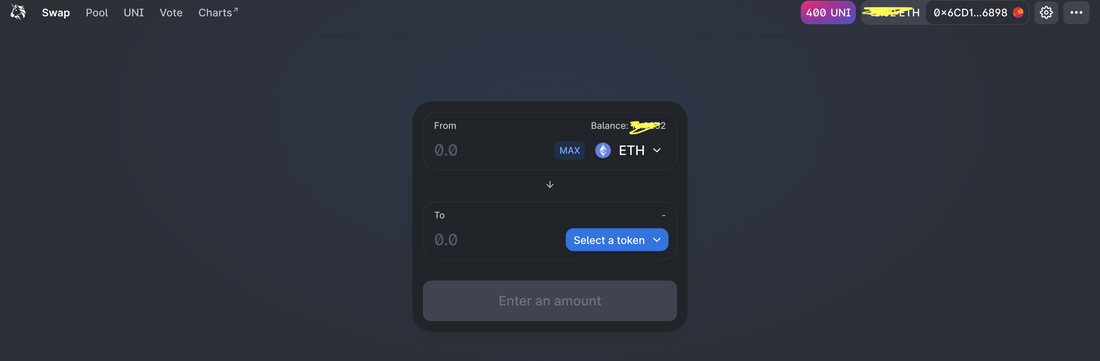

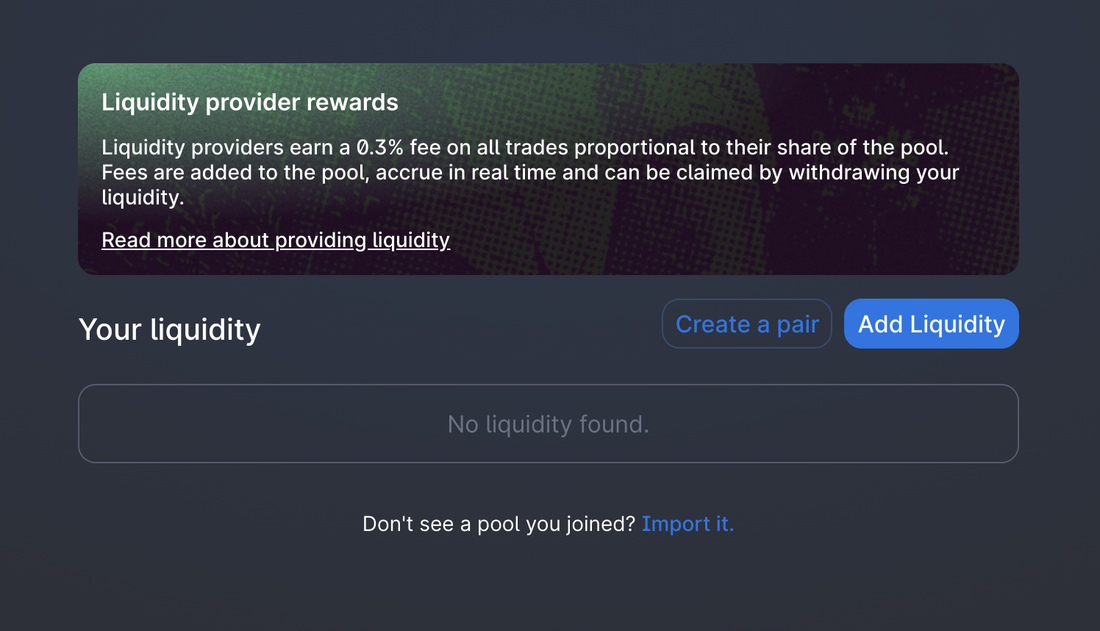

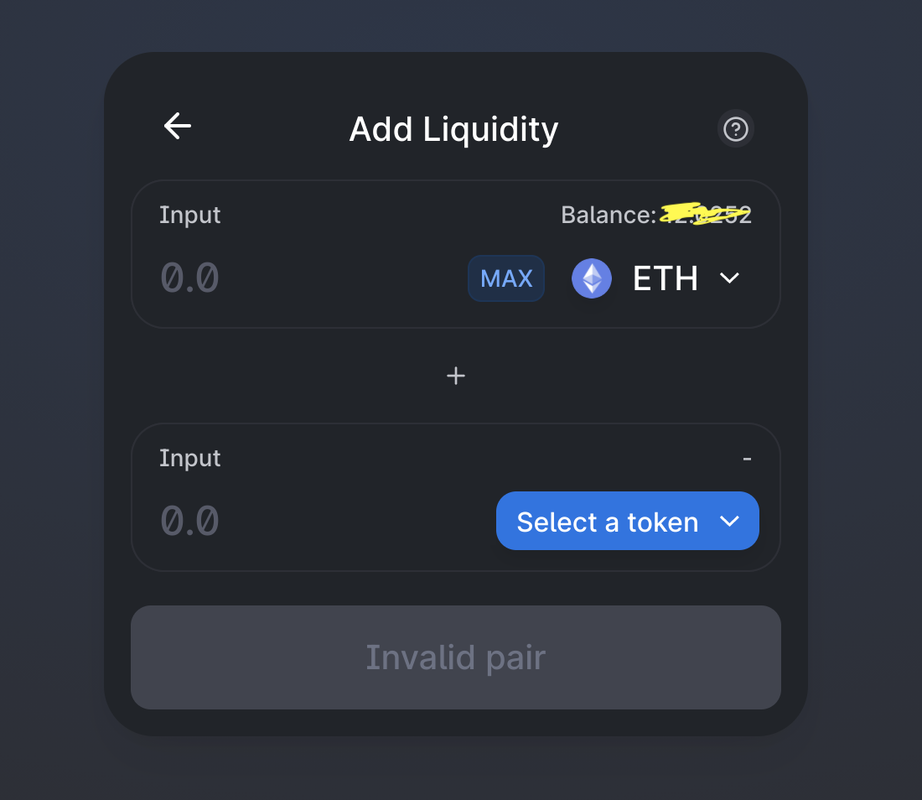

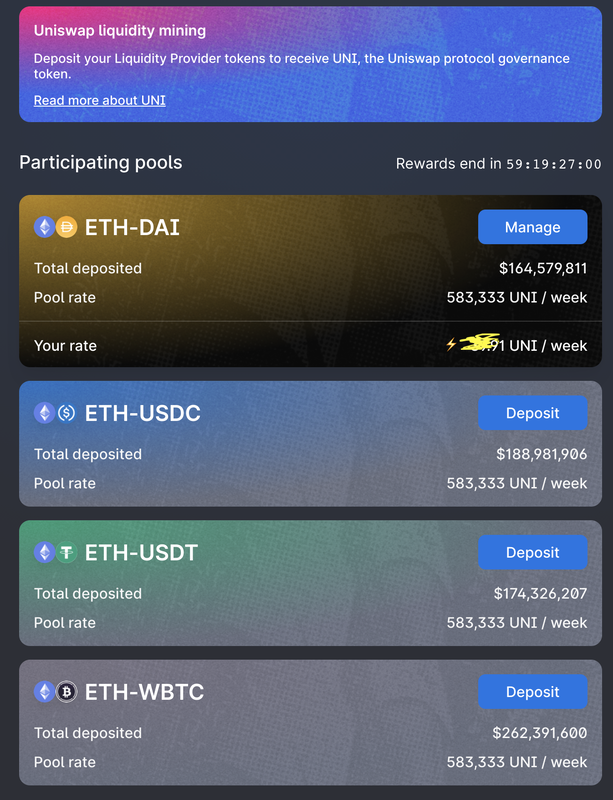

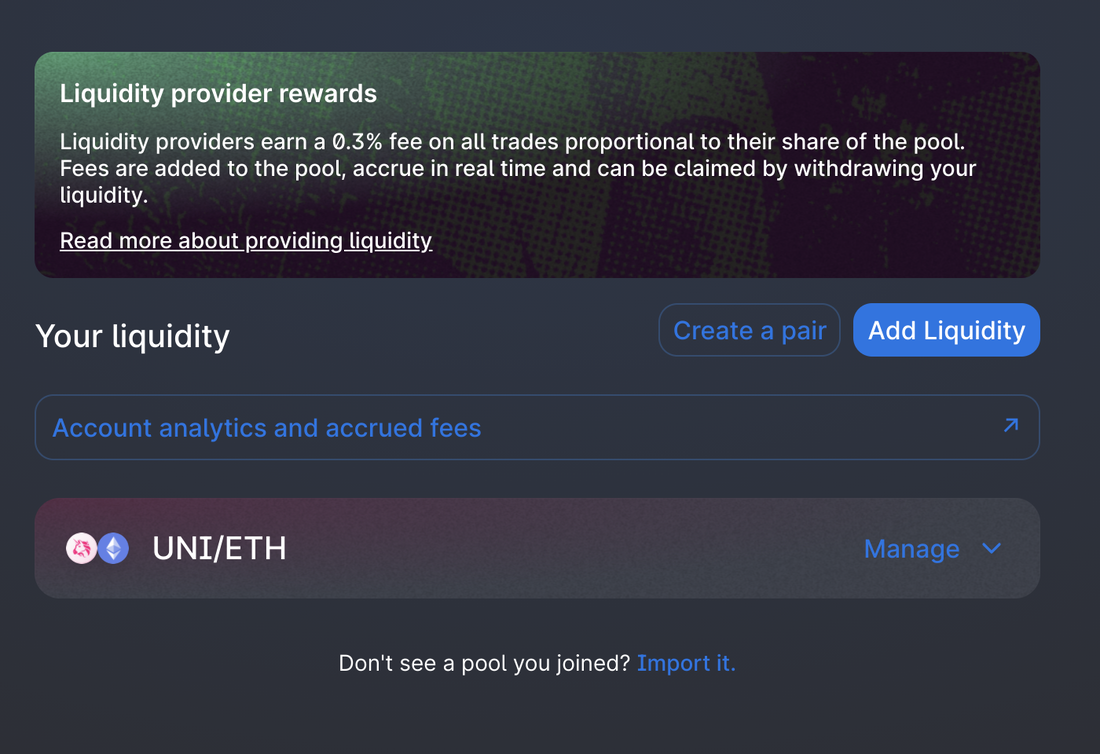

Walkthrough of Uniswap liquidity mining, how to earn UNI token. 1: Go to https://app.uniswap.org/ (Free 400 UNI is already claimed at the screenshot below) More details at: https://uniswap.org/blog/uni/ 2: Provide liquidity Go to "Pool" tab https://app.uniswap.org/#/pool Same function as before, but if you are doing this for the first time: 1: Provide 50/50 liquidity e.g. ETH/DAI 50/50 ratio with USD price Not like Balancer pool with AMM (Automated market making) There was no indication during this step but you will get UNI-V2 XXX-XXX (pair) token 3: Go to "UNI" tab Deposit liquidity pool token which is given with providing the liquidity into the pool above. "UNI-V2 ETH-DAI token" in this case This is similar to Curve LP token. https://app.uniswap.org/#/uni There are currently 4 pools as of Sep 18 2020. ETH-DAI liquidity was provided above. 4: Claim, Deposit, Withdraw Claim to take the UNI rewarded token Deposit to earn more UNI Withdraw to unstake the UNI-V2 staked token and also claim UNI token 5: Remove liquidity Go to the pool you provided and remove liquidity to put the cryptos back into your wallet. Thanks! Additional

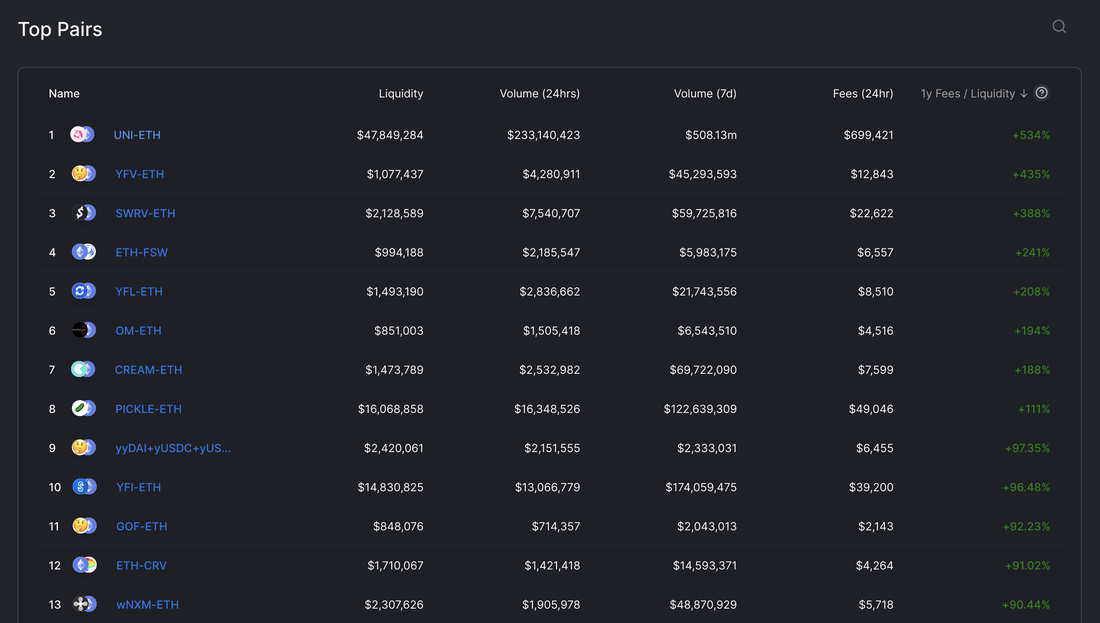

You will earn more fee with UNI and ETH by providing UNI/ETH pair than above the instruction as of Sep 19. https://uniswap.info/pairs Links to check APY for Defi projects.

Please note that high reward has high risk, be aware of loss of your funds by such as smart contract bug and impermanent loss. Yield farming https://yieldfarming.info/ https://yieldfarmingtools.com/ http://pools.vision http://www.predictions.exchange Staking https://www.stakingrewards.com/ Interest rates https://defirate.com/lend/ https://defiprime.com/defi-rates http://www.predictions.exchange/compound/None https://compound.finance/markets |