|

2024 has been a good time to gain from the prior patient and effort.

The biggest gain is - Velodrome and the airdrop, Aerodrome.

Current price

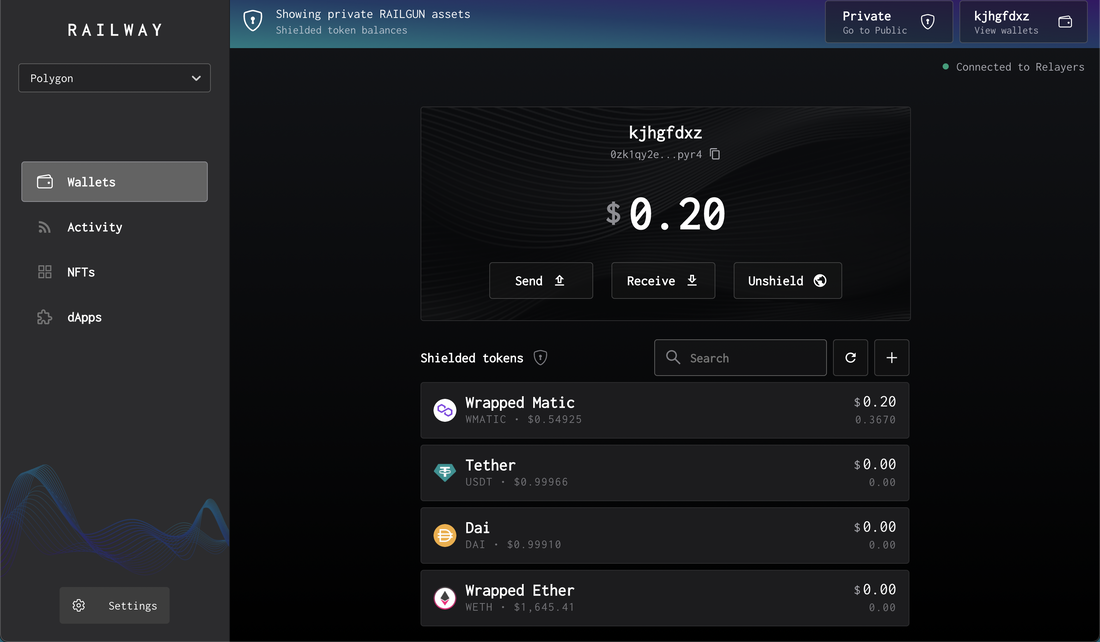

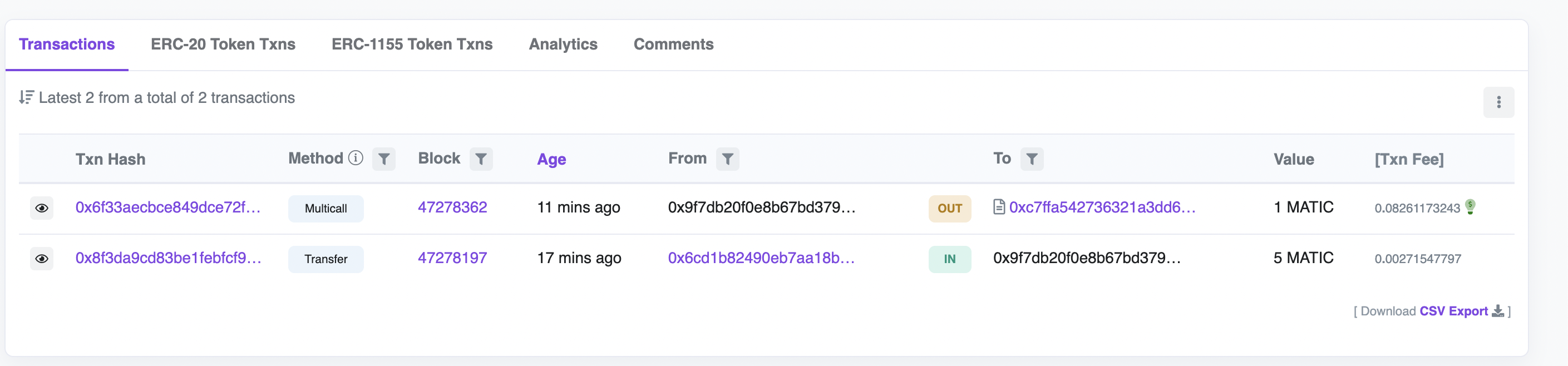

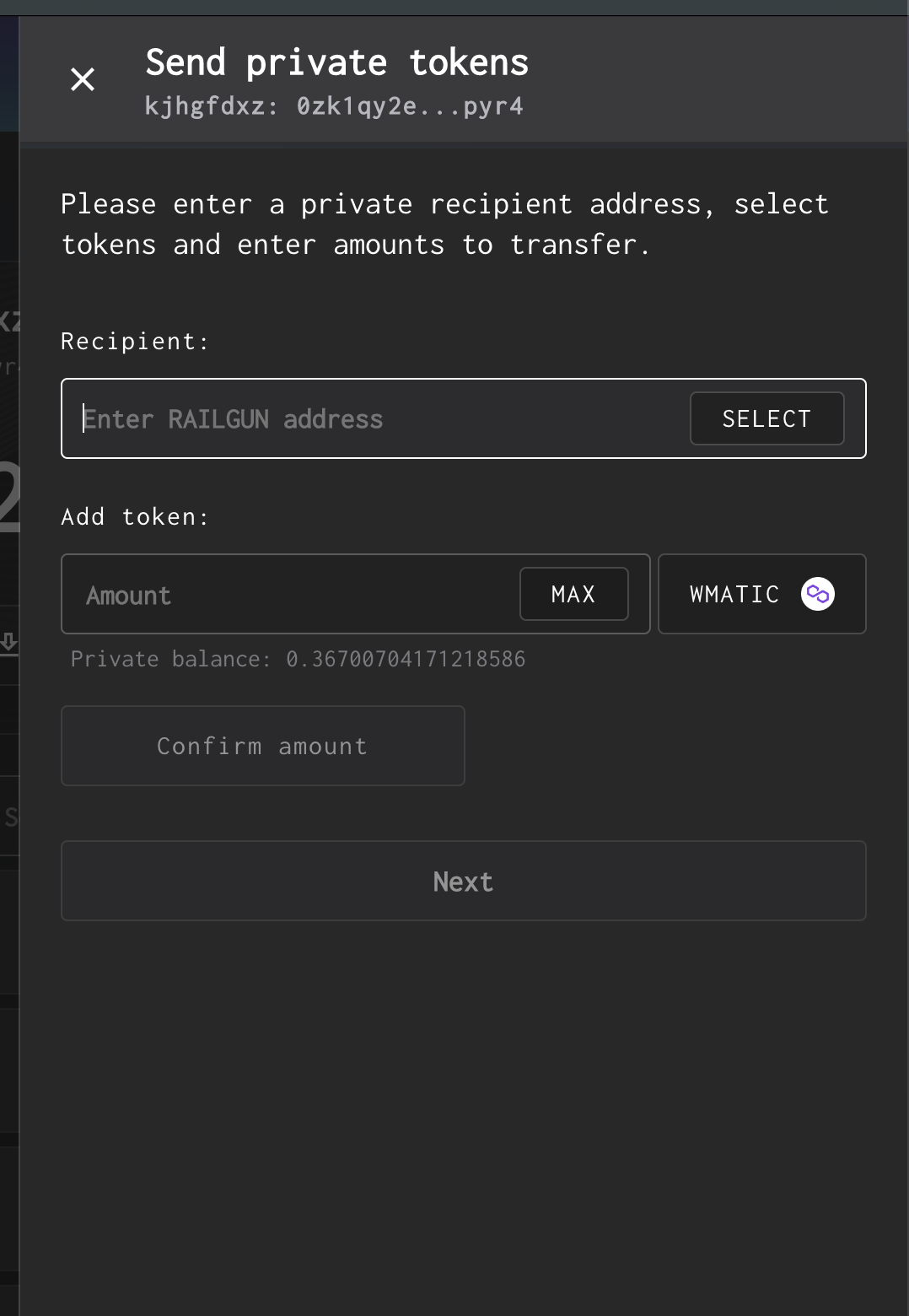

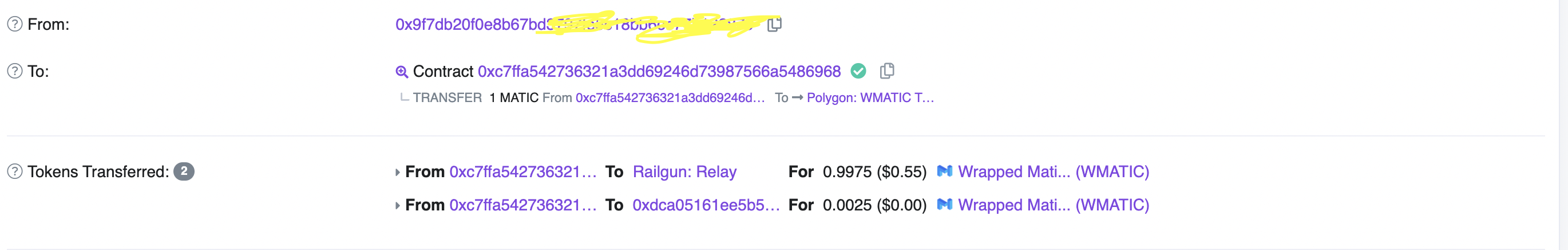

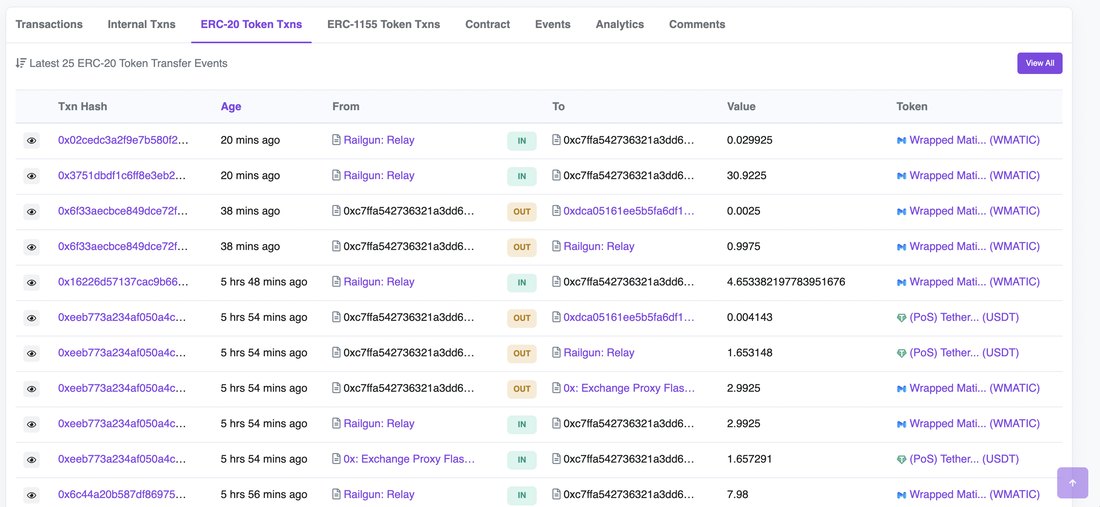

Crazy DeFi This is a thought about Railway wallet, privacy Defi Wallet with ZKproof on Ethereum, BNB, Polygon and Arbitrum. Firstly, in conclusion, it is only private when transfer between 0zk address. The security of 0zk network is the concern as no one knows if it is hacked because it is private. It is also tradable by checking the EVM 0x addresses associated with railgun contract. Website https://railgun.org/ Wallet https://www.railway.xyz/ Briefly about this is make a EVM wallet and ZK proof wallet (0x and ozk wallet which are connected as public and private), toggle between them with shield/unshield. The shielded token is not shown on explores which is on ozk address. Here is the full guide. https://help.railway.xyz/ This is what the wallet it looks like. Transactions can be seen to get to the destination of EVM address (with ZKproof address). Now the token will be shielded to be private and it goes to 0zk address. Therefore the TX between 0zk is private. This is the transaction of unshield to another wallet. You can see on the explore that it goes through this contract. https://polygonscan.com/address/0xc7ffa542736321a3dd69246d73987566a5486968 and can see it is from railgun.

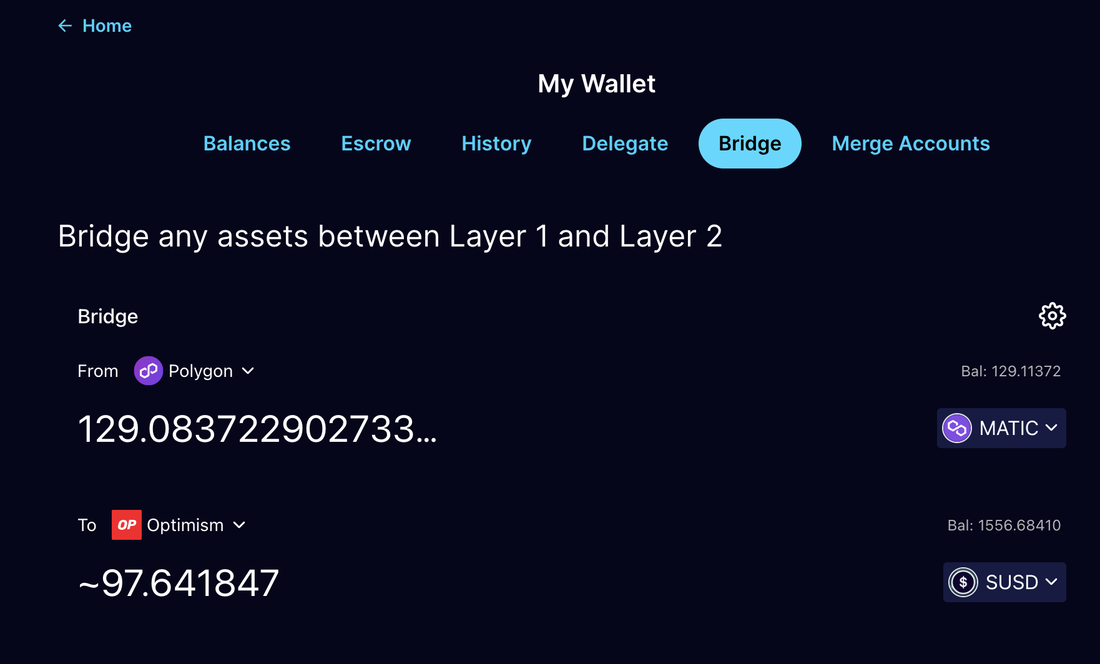

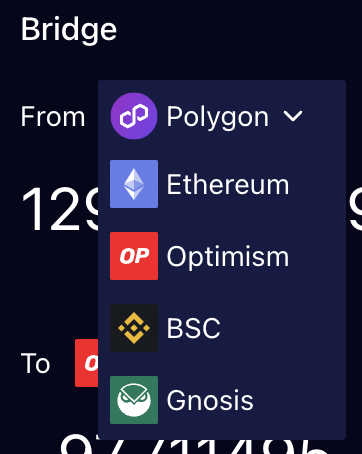

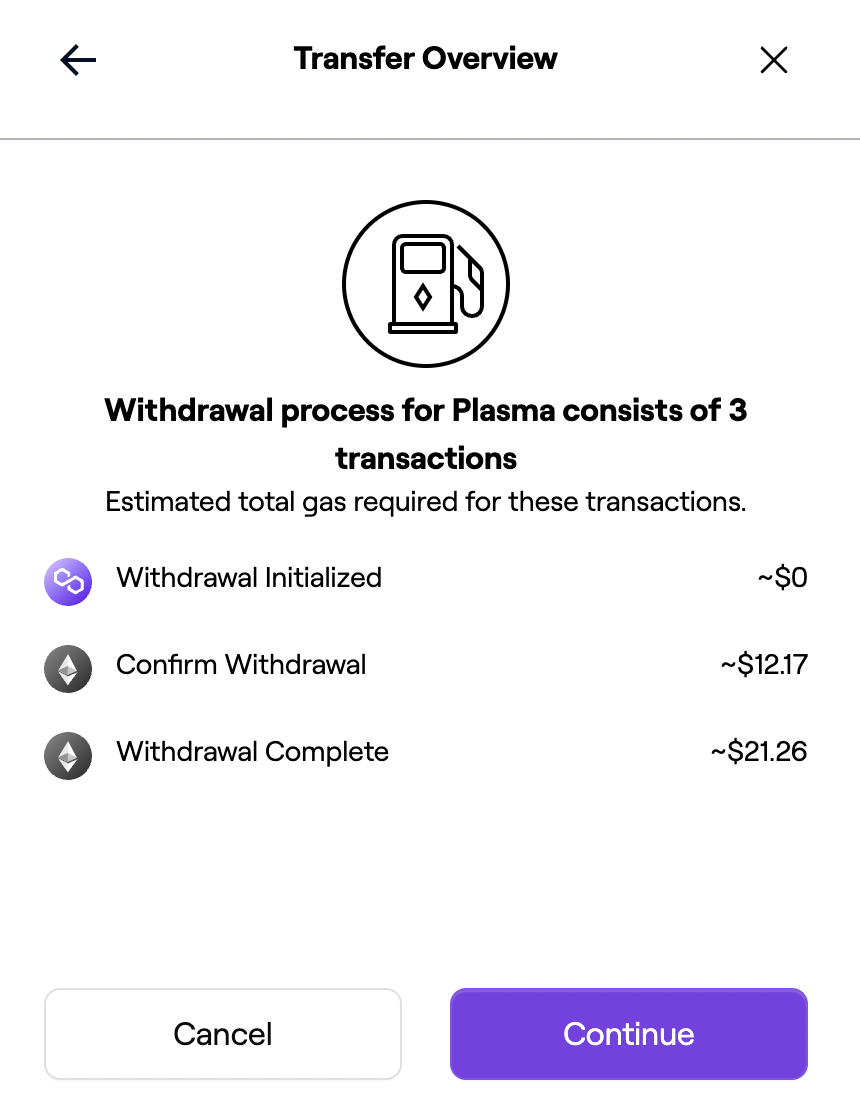

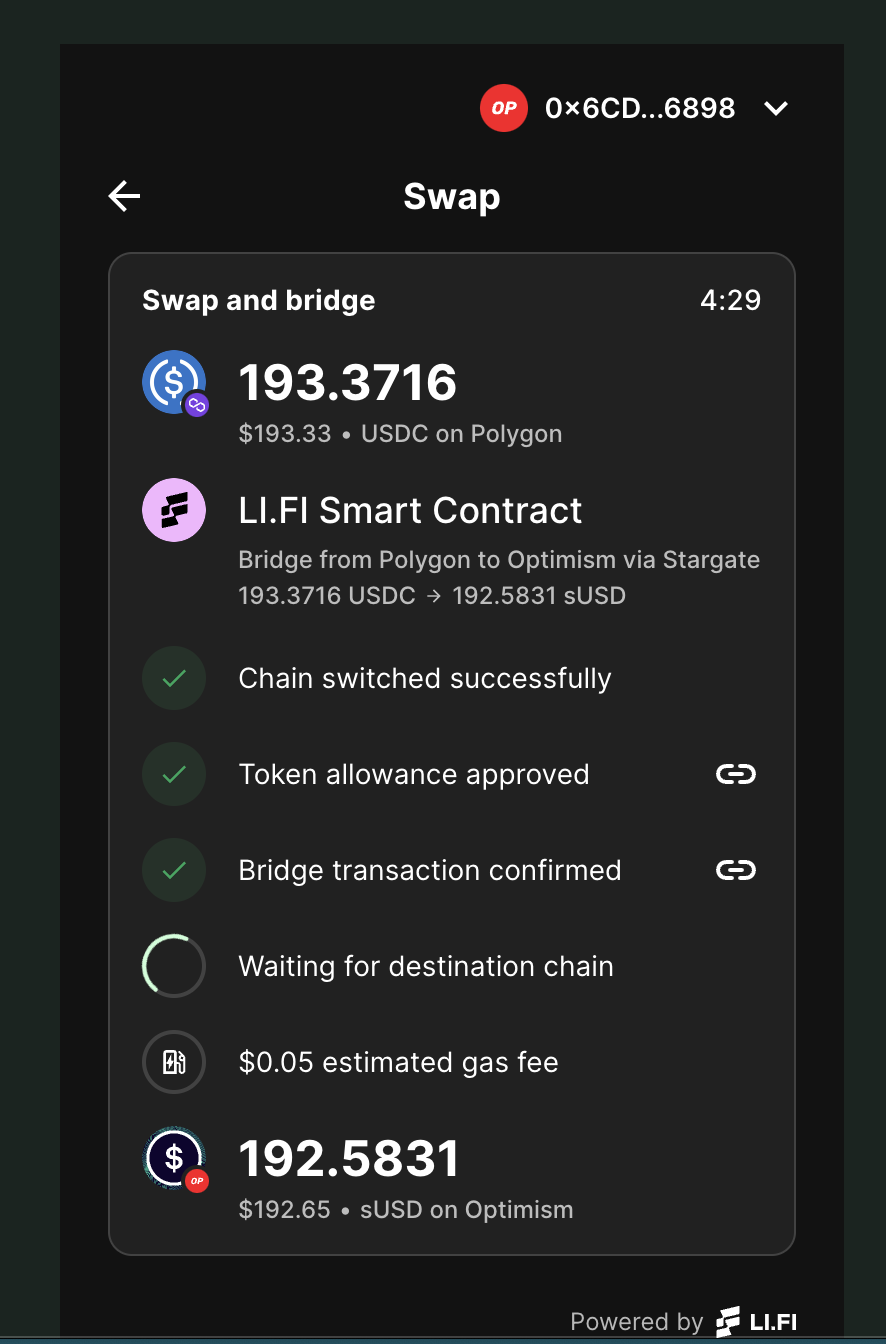

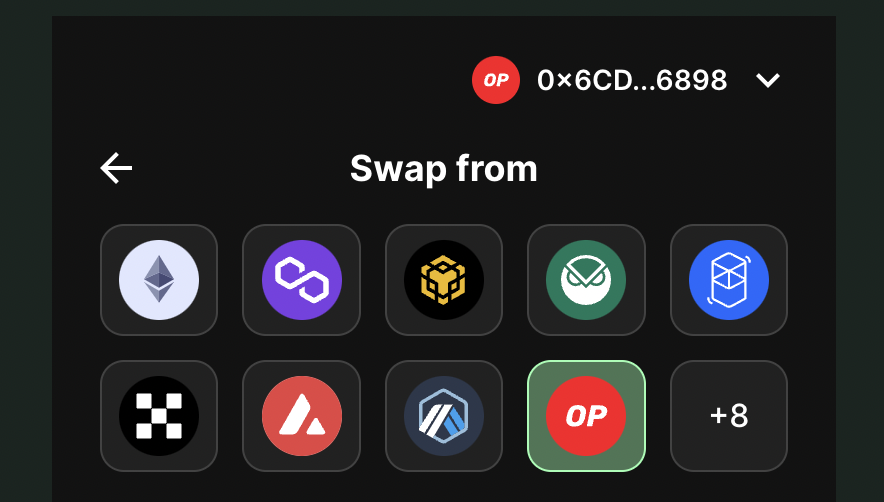

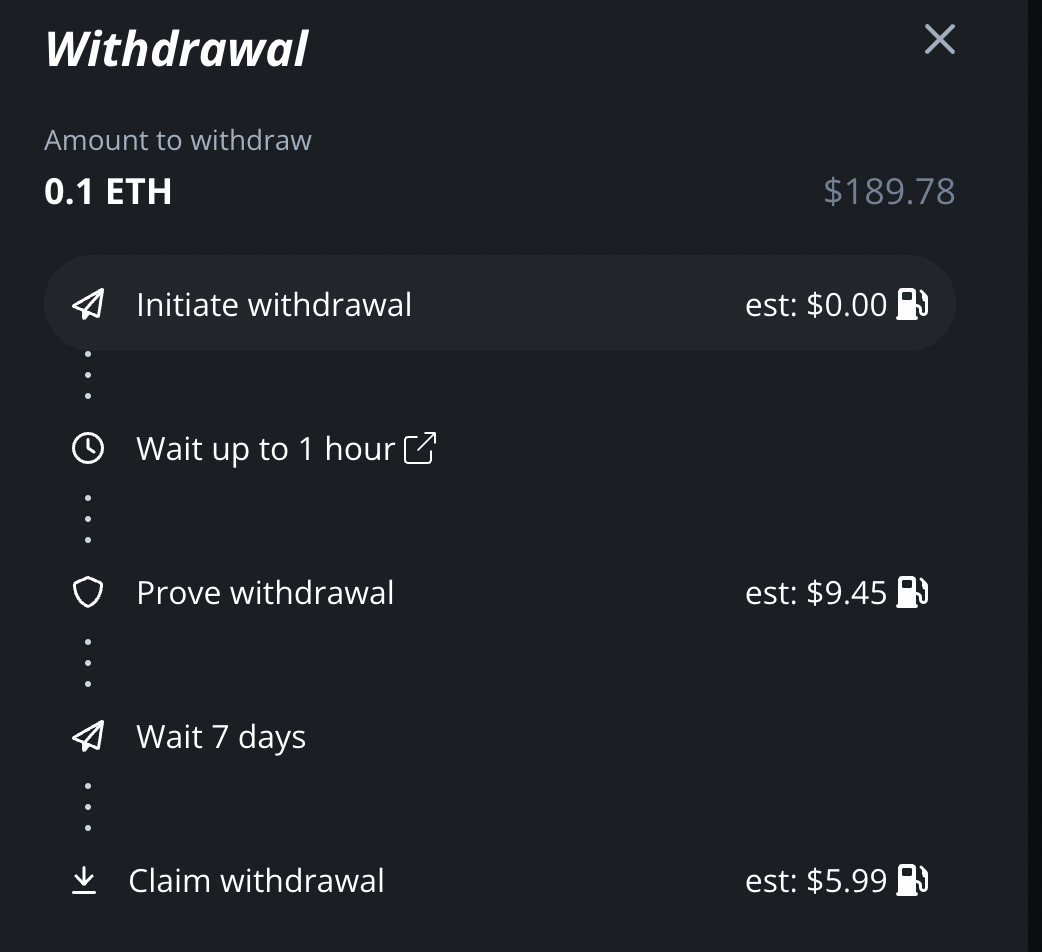

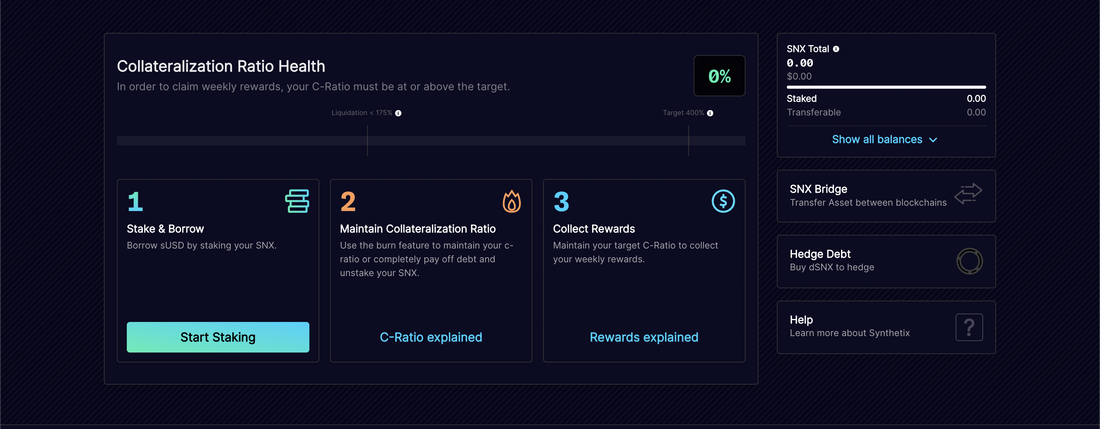

And this is the sender address. https://polygonscan.com/address/0x069eca7911c2ed34dcdaf999c44cf3cfe0610bc0 So it can be detected that transfer from this address is from railgun. Sharing crosschain bridge since multichain got a problem, the bridges talking about here are synthetix and Ironbank. There are more exists. Crosschain bridge is important because there are DeFi with many different L2s, L2 is in the mid of competition of user acquisition so that DeFi users are using multiple chains and juggling one to another. https://staking.synthetix.io/bridge https://app.ib.xyz/bridge It costs 15 - 20USD for regular crosschain (L2 back to ETH mainnet) and transferred to another L2 costs another 15-20USD. This is Synthetix bridge. from Matic on polygon to SUSD on Optimism. This includes converting and crosschain bridge. 129 Matic * 0.75USD (the price as of July 20/2023) = 97.5 USD As you can see this crosschain bridge + converting token does not affect the original value. Great. There are 5 chains for now, which is good for now. It would cost around 20USD from Matic back to Ethereum without converting the token and it estimates 3 hours to finish. This is Iron bank. Powered by Li Fi. Transferred from Polygon USDC to Optimism SUSD, that resulted 193 USD tp 192 USD. Great. It took about 15mins to complete. Ironbank offers many chains. If you transferred back from Optimism to Ethreum and it costs 15USD and it takes a week. lfg

Probably the most successful ve token is Velo as of now. https://app.velodrome.finance/ It is (3,3) vested escrow with rebasing system after Curve - OlympusDAO, Solidly - Verodrome. https://medium.com/@vedao.alt/on-velodrome-2e9d6f9b9056 It is Vested Escrow therefore you have to lock the protocol token, longer you lock and more you get voting power. Generally like this You have 100 token 4 years lock = 100 veToken power 1 year lock = 25 veToken power Rebasing means you will have same share of the total token in-spite of weekly token emission. It is good to be on L2 because of cheap gas fee. You will pay about 5 - 20 USD to claim the rewards on Curve which is usually higher than the weekly rewards unless you are staking over 10k USD. The fee is less than 5 cents on Op L2. veTokens, vested escrow has started since curve. https://curve.fi/ However Curve has problem such as rewarding with their own token and rebasing as well as not able to sell. Convex was a project that be able to sell by holding CRV on behalf and give CVX token instead. Andre Cronje, the creator of Yearn and Keeper, made a Solidly with the mehcanism with OlympusDAO rebasing and vested escrow from Curve, (3,3) token. https://solidly.exchange/ Now people can sell their veToken after lock as it becomes NFT so you will have to sell as NFT. Probably the problem was he made it on Fantom, not much users there. (People say a lot of users but it is not) There are new projects which is a fork of Verodrome, such as Aerodrome on Buildonbase, Pearl on Polygon.

More to come! This is to share how I got fund back after sending it to a wrong address.

FYI It is hard to understand if you are not familiar with DeFi. Here is the story. 1: It was a Defi application which is quite open and noone helps as it is Defi, no customer support and whatsoever, even the website says do it at your own risk. That sounds tough but it is the current DeFi situation. Test in Prod by AC! 2: I sent a liquidity to a liquidity pool. (about 20,000USD) and expecting some APY. 3: After a week, I came back to the website and realized there is no "withdraw" function on their UI so checked their smart contract on Etherscan but it can only be withdrawn by the LP owner. 4: Check the contract owner and saw ENS which is identical so that I managed to find the twitter account. 5: I contacted the twitter inmail about I sent liquidity by mistake. 6: I got response and he mentioned and wondering where it is from. 7: He agreed to send back to the address which the fund came from. 8: I surely agreed as it is my address. Done This may be a simple process however; What if

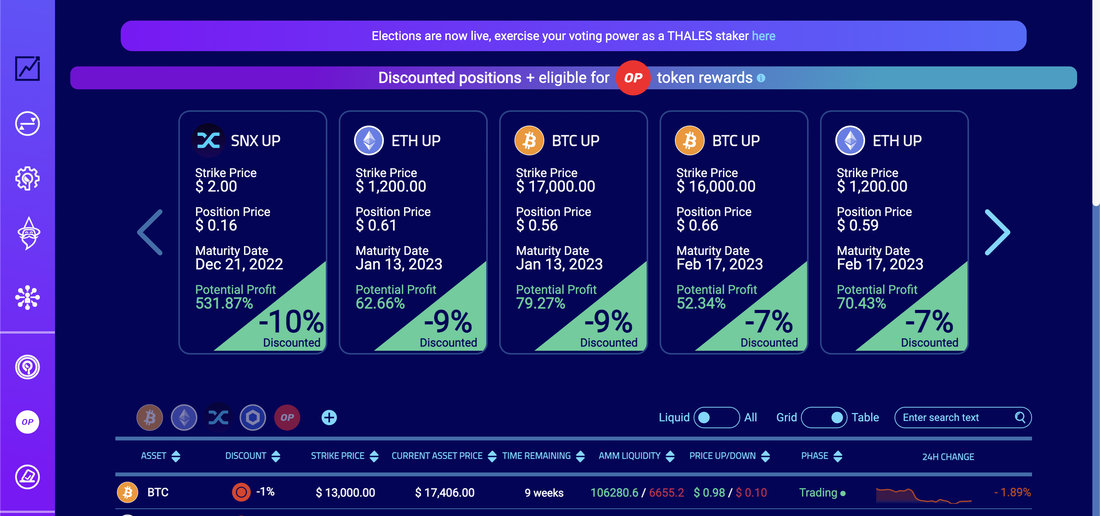

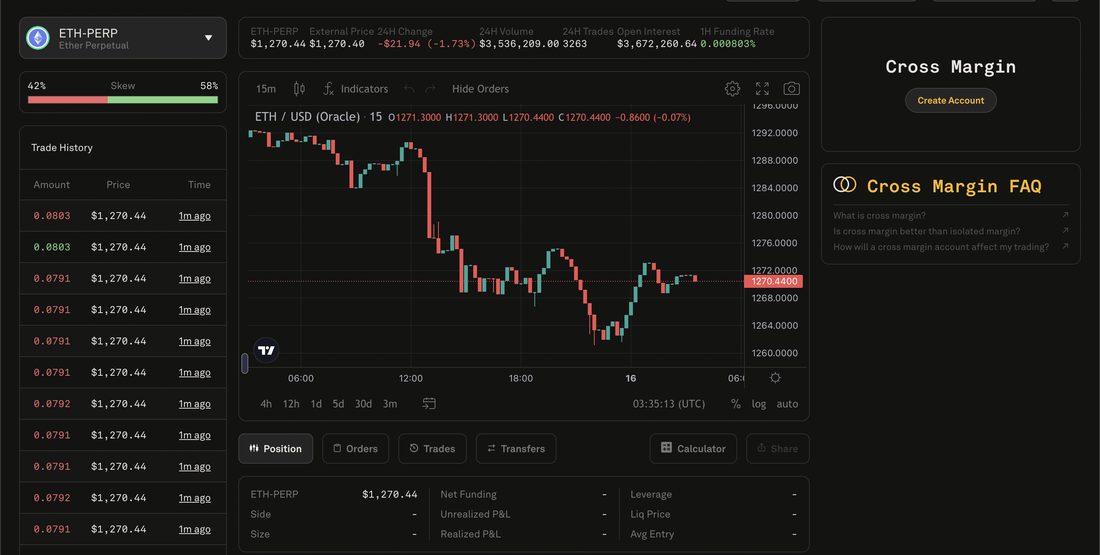

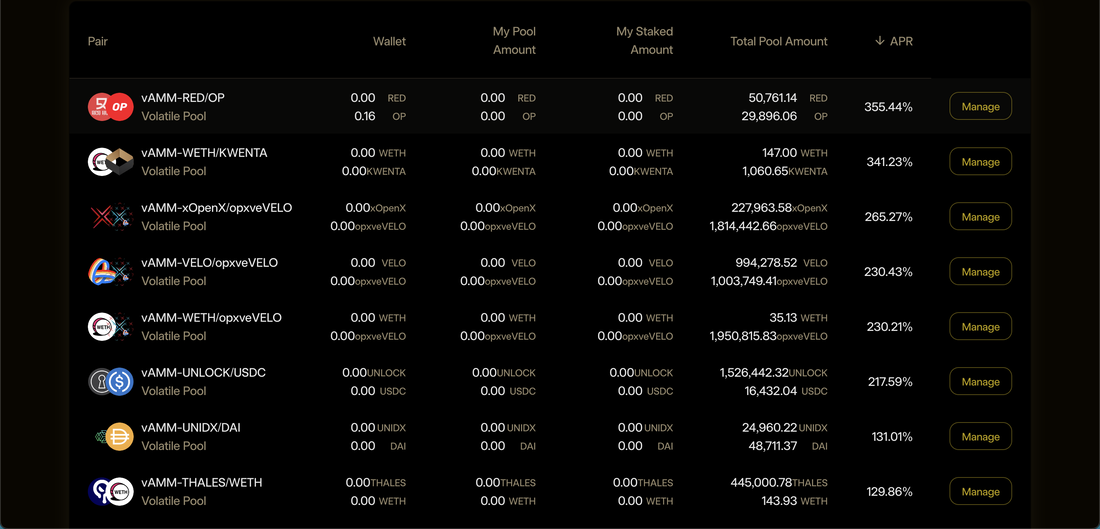

There is no such thing DeFi lawyer or decenterized court. Therefore it is a self-regulation. I think so far the players in DeFi are nice, they act right if it makes sense. Layer 2 DeFi economy on Optimism. Op token started with big airdrop. https://www.optimism.io/ They are incentivizing heavily for optimism network users. List of Dapps are here; https://www.optimism.io/apps/all Rewarding the early users, great! Here is to share the current rewards status. Main project on optimism is Synthetix and there are number of projects on top of it such as Thales (Option, Betting market) and Kwenta (Dex). Reward rates

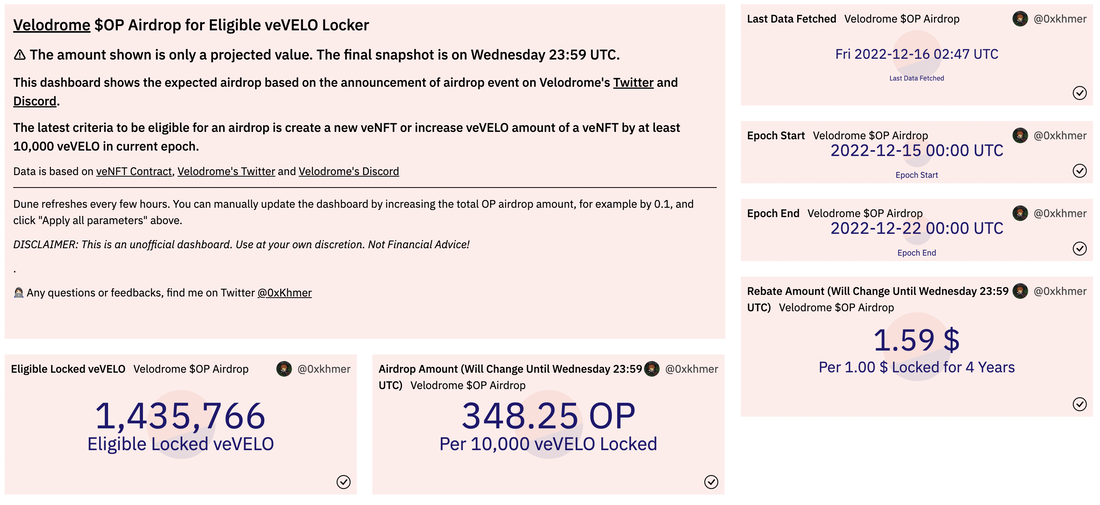

Velodrome has been the juicy platform. https://app.velodrome.finance/ Velodrome is the fork of Solidly, https://solidly.exchange/ Andre Crojnes project, yes, good. It is like Curve with upto 4 years lock to get 1:1 vested escrow. And on Velodrome, you can sell the VeToken which is NFT, like what Andre did on Solidly. What Convex has done was to convert crv to cvxcrv to be able to trade because vecrv is not able to transfer and boost the reward. And YFI is the strategy aggregator. Velodrome is currently having massive support from OP incentive. Your initial investment of VeVELO can instantly get back by OP token. https://dune.com/0xkhmer/velodrome-airdrop LP staking and the fair reward system has been the key issue for DeFi, it is being said that Uniswap V3 isn't great to liquidity provider but there is a project called arrakis to incentivize the LP on Thales and Kwenta.

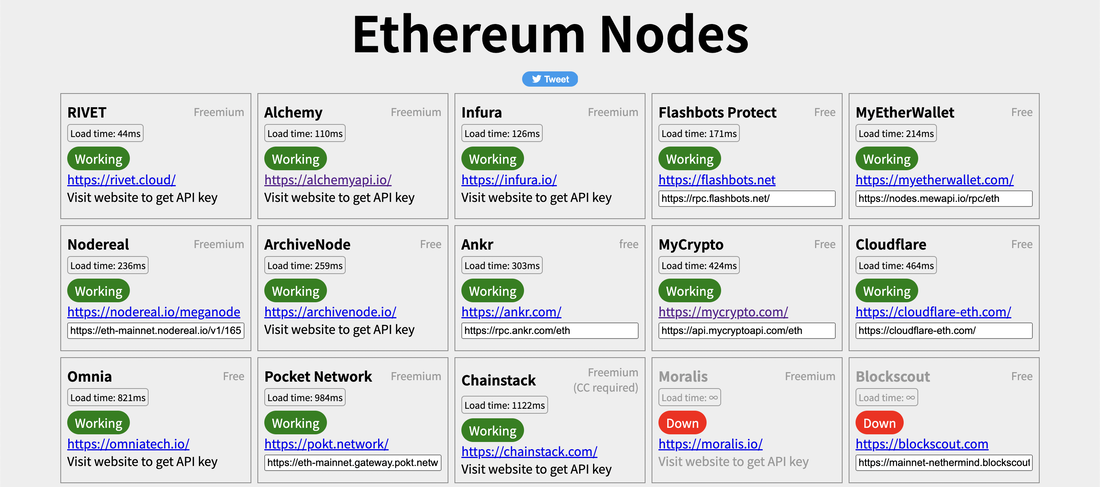

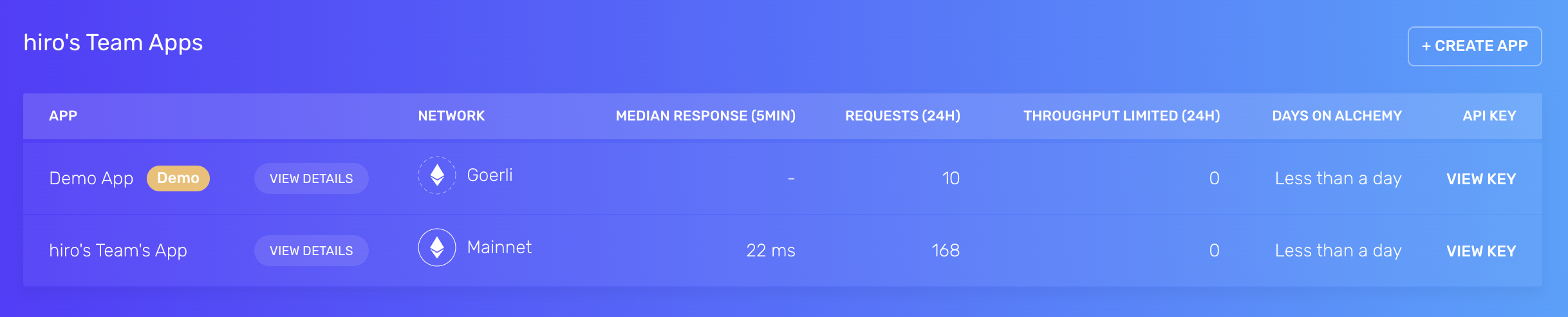

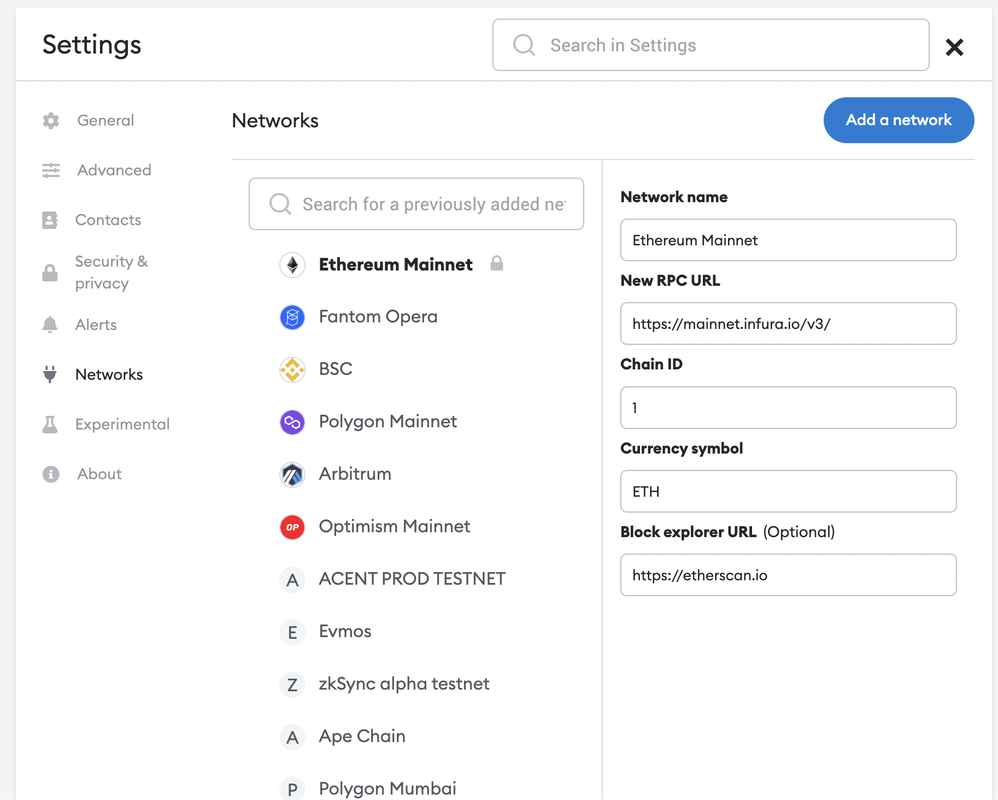

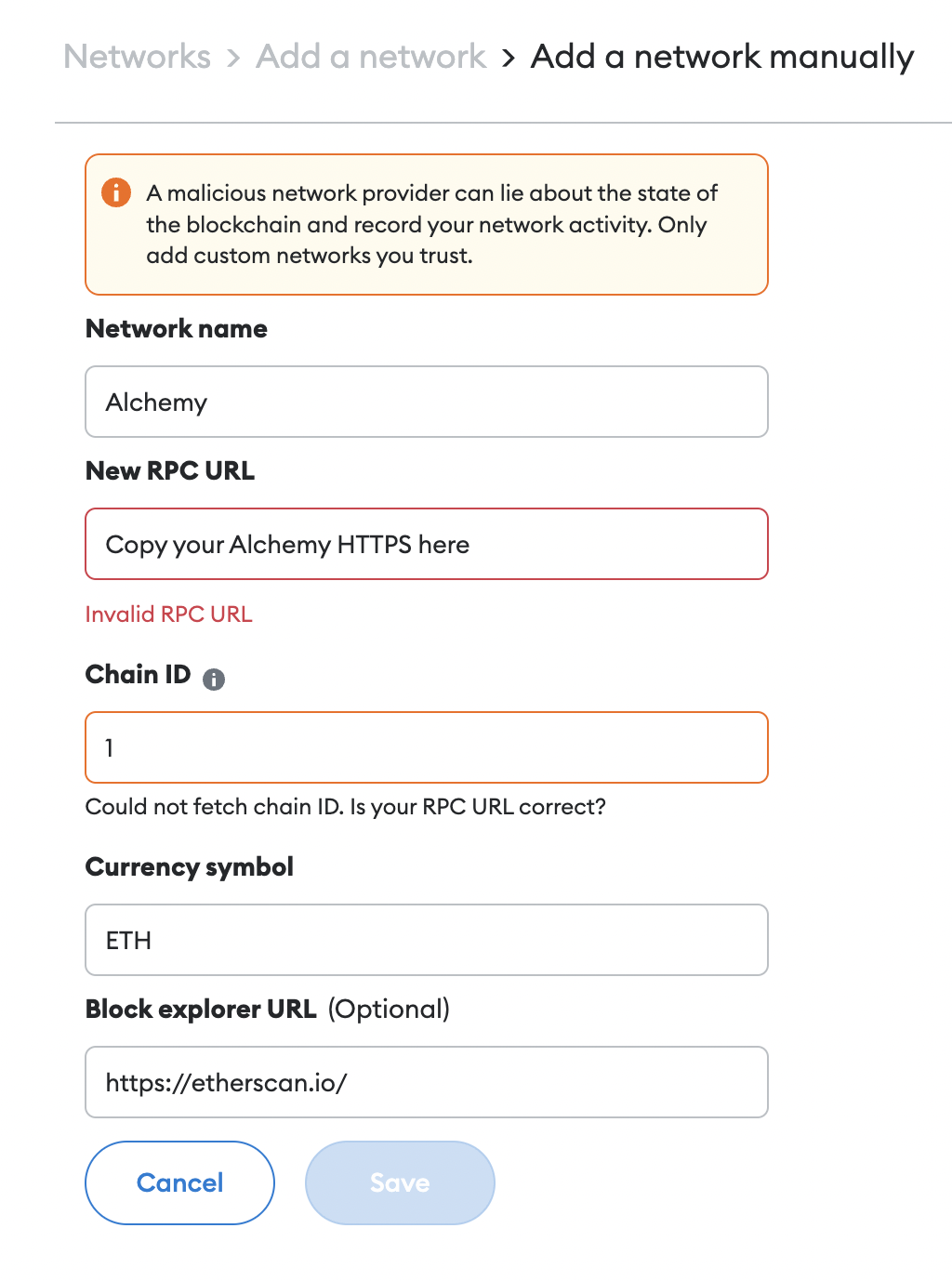

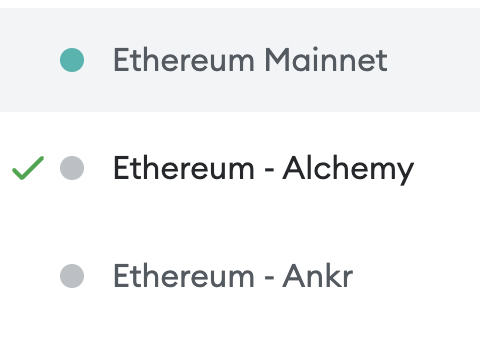

Velodrome's incentive system with bribe and the reward goes to voters seems working and the op incentive is huge for new comers. almost zero risk to start (you can get instant profit as well). Let's see what wins. This is for the answer to ConsenSys announcement that they will collect the IP address every transaction with using Infura RPC which is by default on Metamask Ethereum Mainnet. List of RPCs https://ethereumnodes.com/ I am using Alchemy for this tutorial. https://www.alchemy.com/ 1: Signup with email address 2: Login Alchemy will give you a API Key for the access. 3: Click view key and look for HTTPS and copy. 4: Go to Metamask setting - Network As you can see default mainnet is set with infura.io 5: Add a network Done! I put the network name as Ethereum - Alchemy Bonus

6: Ankr https://rpc.ankr.com/eth You can add Ankr with already provided RPC above. No need to sign in anything. Now you should have 3 Ethereum mainnet lol Just sharing something to see crypto market sentiment which is the price of SBD (Steem Dollars). No explaining about the token but if you are in crypto during 2017 and you know. 1 SBD supposed to be 1 USD but; Bull market = 1 SBD above 1 USD and up trend Bear market = SBD down trend and 1SBD => 1 USD is a bottom sign It is surprising accurate so far. It looks getting closer to 1 SBD = 1 USD which is a starting of bottom sign and expect years of side way, it was 2 years of side way 2018 - 2020.

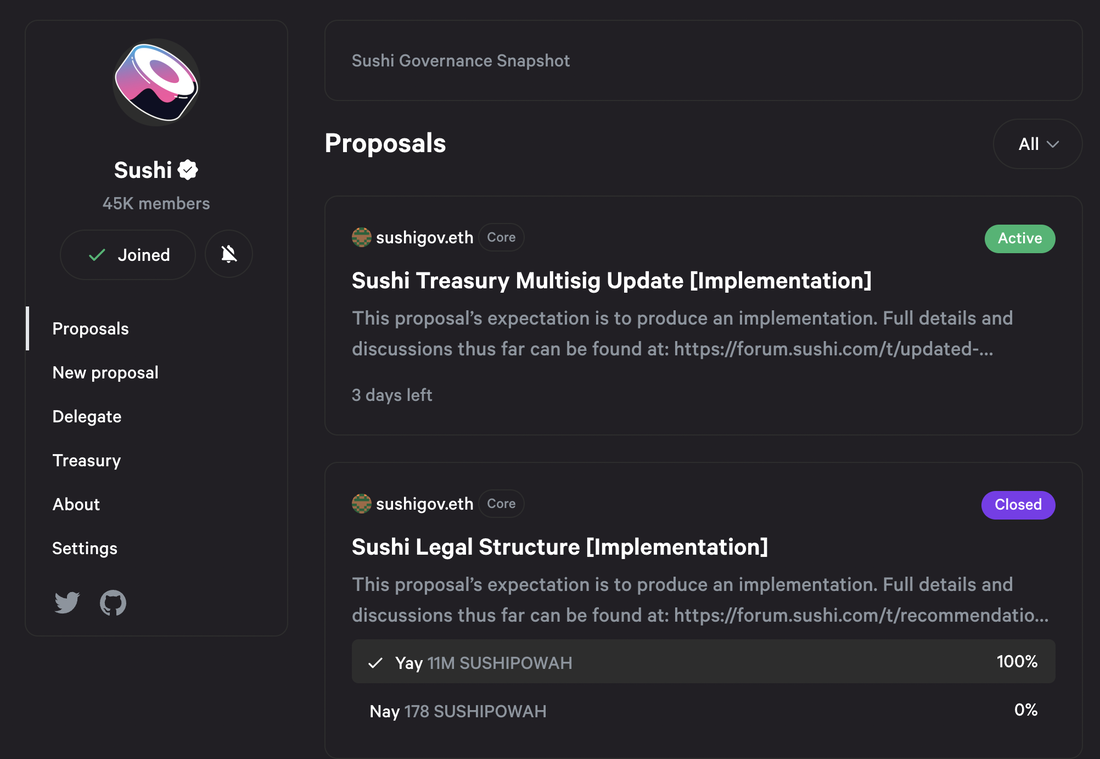

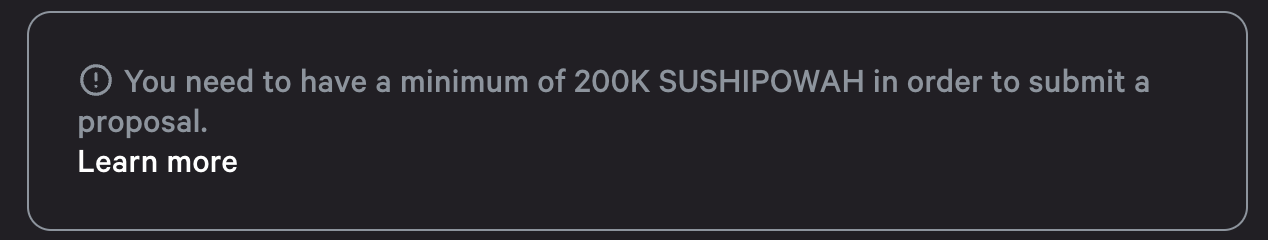

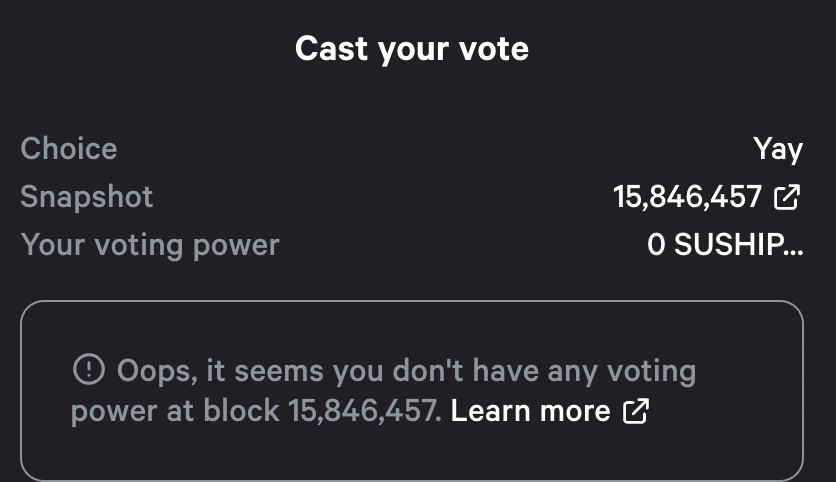

Let's see if this still works. DAO experiences here, Anyone can join DAO in DeFi world if you hold minimum token requirement to

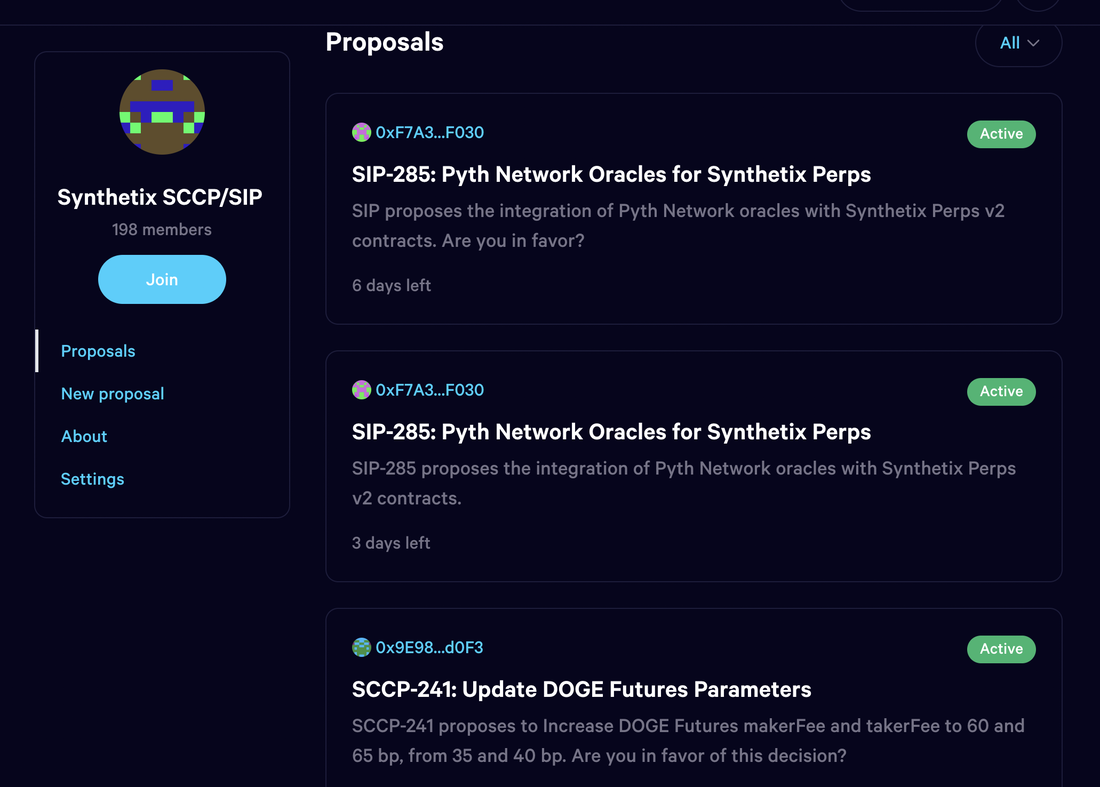

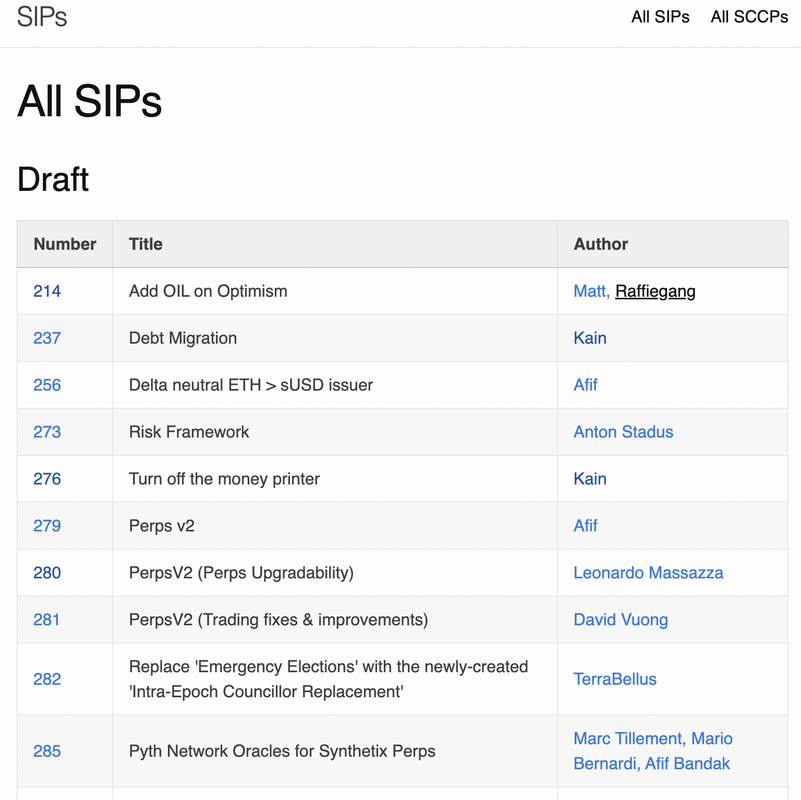

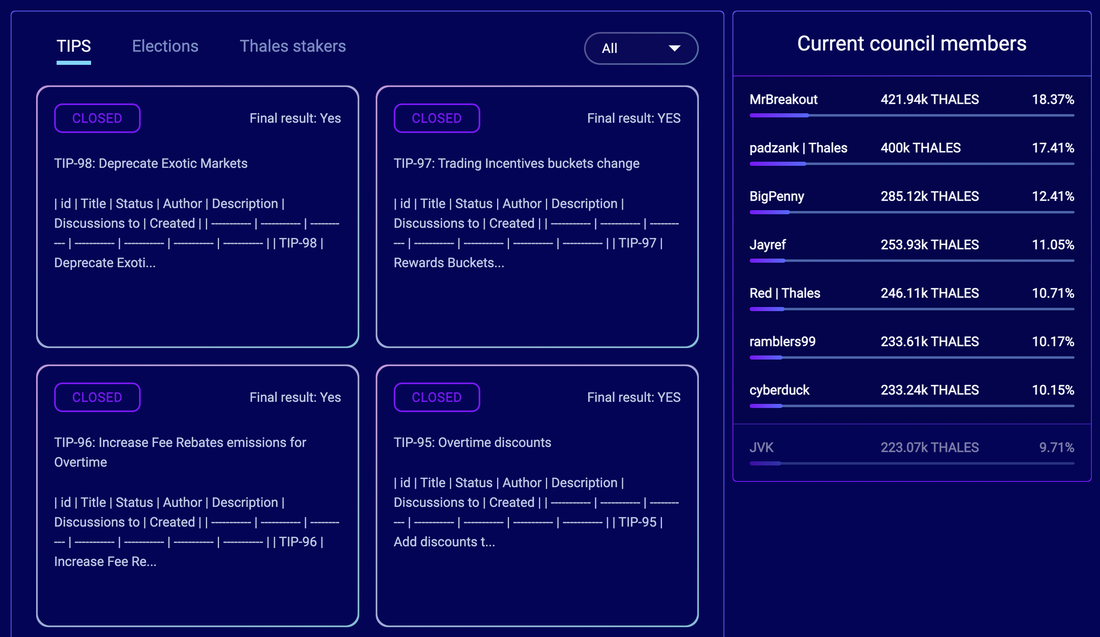

Sushi https://snapshot.org/#/sushigov.eth Synthetix https://governance.synthetix.io/ for nominate and vote council members https://gov.synthetix.io/#/ for vote https://sips.synthetix.io/all-sip/ for review progress SIPs Council members get 2000 SNX per month. Thales https://thalesmarket.io/governance Article about councils https://thalesmarket.medium.com/thales-council-nominations-are-live-8ad3578192de Council members get 1000 THALES per month. MZDAO https://www.mzdao.jp/ Community driven DAO project. 500 JPY per month to join. DeFi DAO: It is hard to tell if it is working through my experience but more public than traditional companies for sure. Anyone can join but not easy to understand what people are talking about if you are not in the industry. Votes tend to go to make the big voters/holders profitable, yes fair enough. But doing too much cause losing trust and drives the value of the group/ token low. same philosophy as Bitcoin.

MZDAO: It just started, I will share my thoughts later. It's idea to share company success with members not owners. This is my experience of NFT games which I played past year that includes;

There are 5 games here in this article (I played more though) and they are all fun. Making money is totally a side business in my opinion. I think most of players play because it is fun. 1 Axie Infinity https://axieinfinity.com/

2 Gods Unchained https://godsunchained.com/

3 Sandbox https://www.sandbox.game/en/

4 Illuvinum https://www.illuvium.io/

5 CryptoKnights

https://cryptoknights.games/

|