|

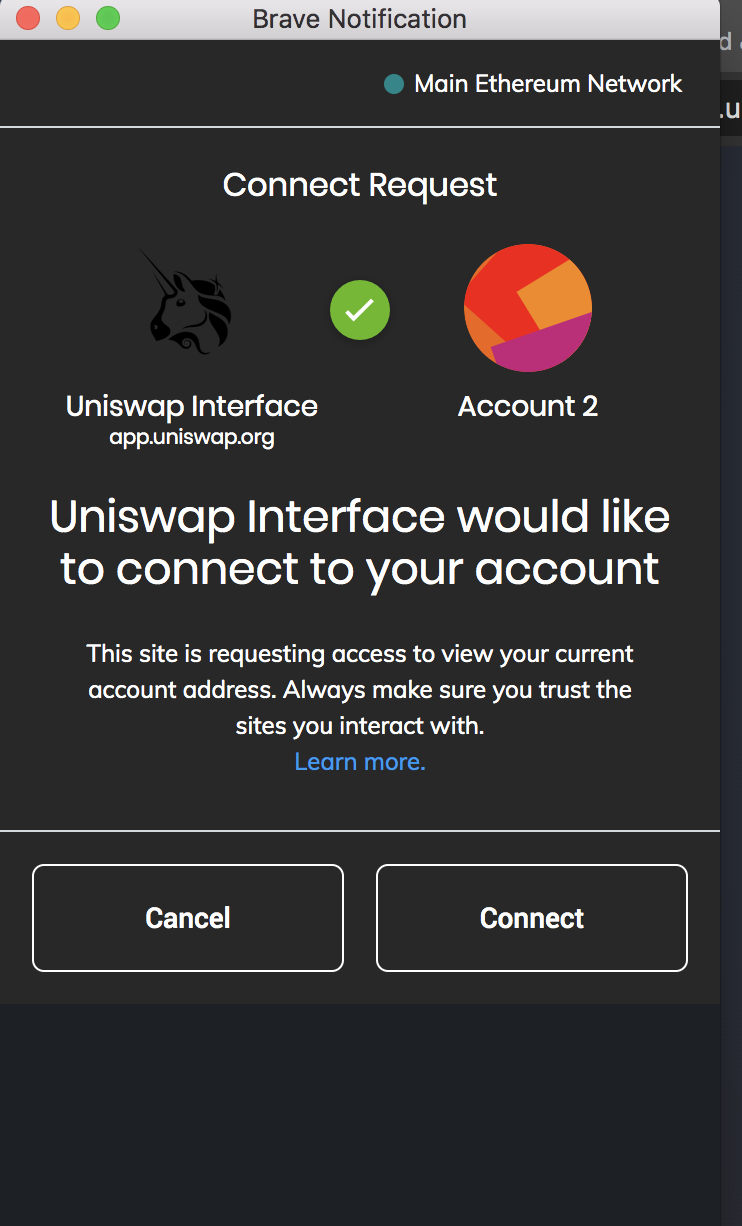

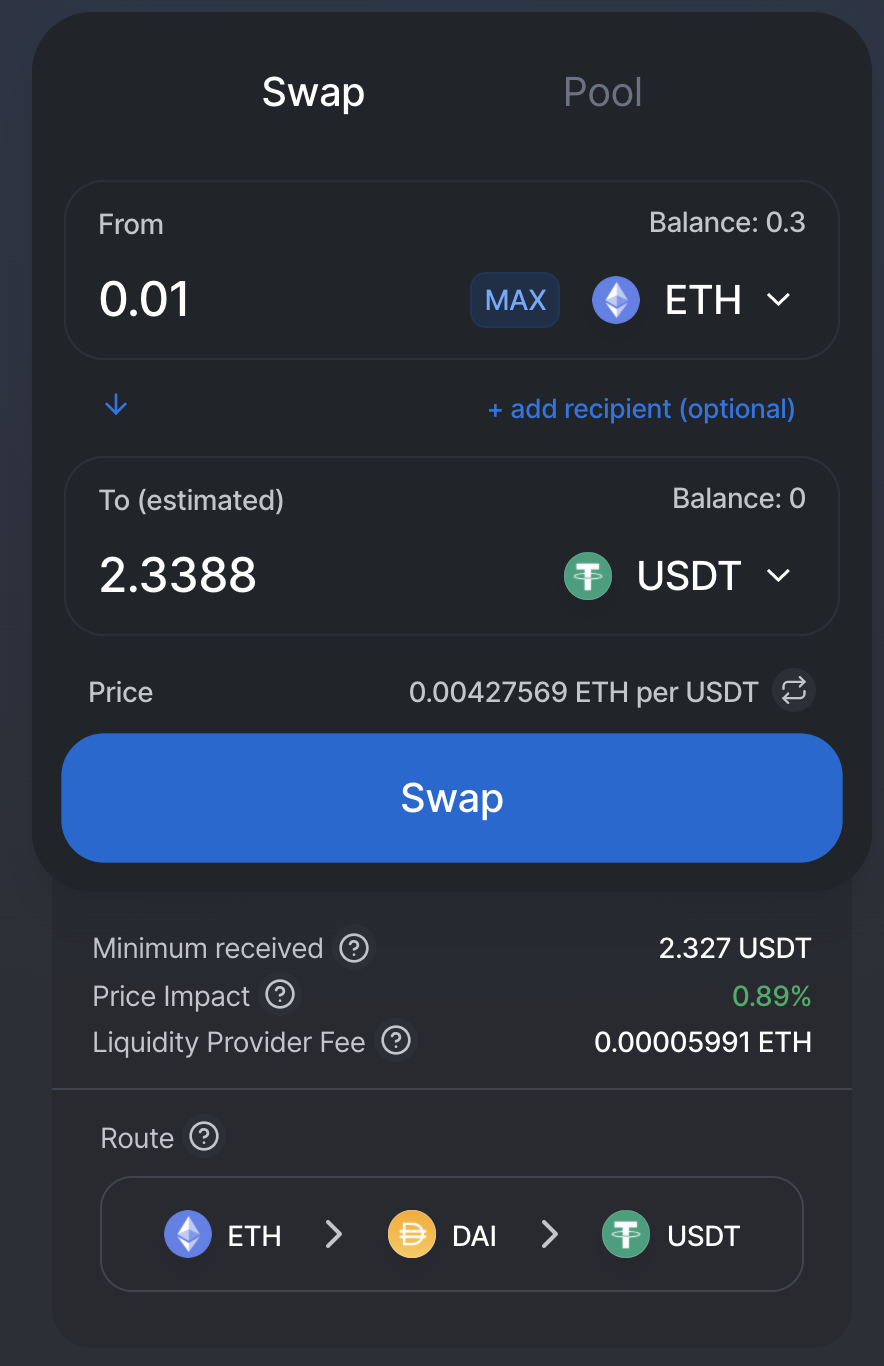

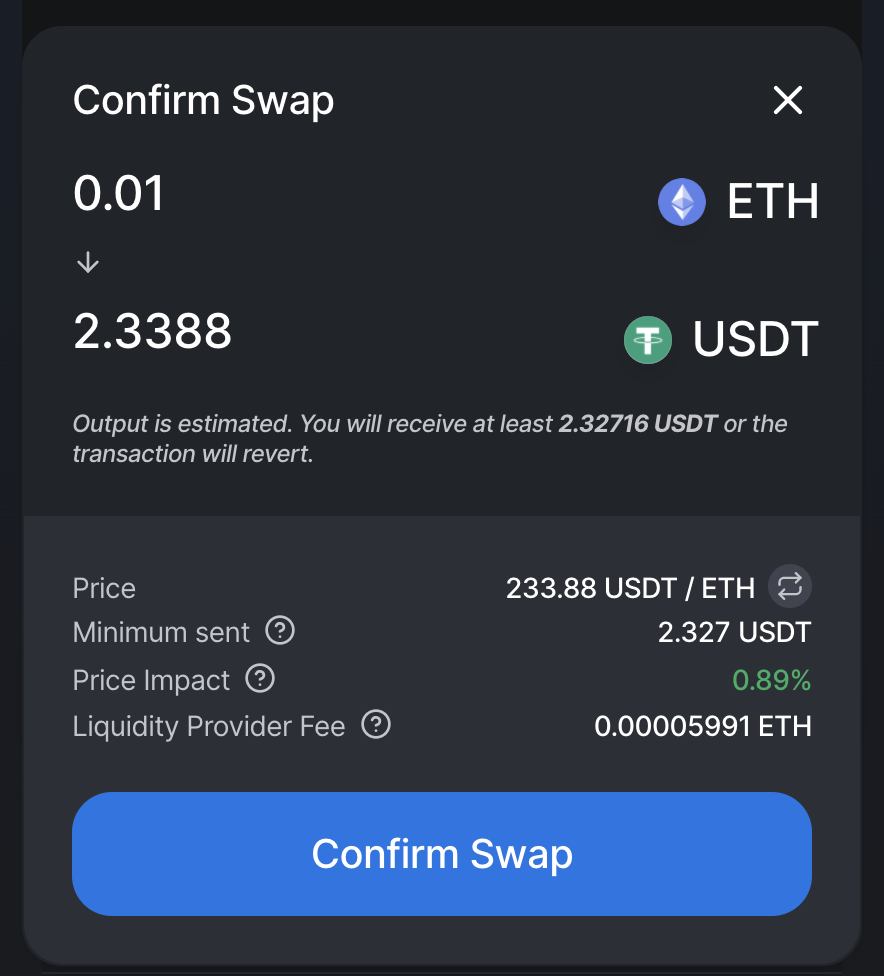

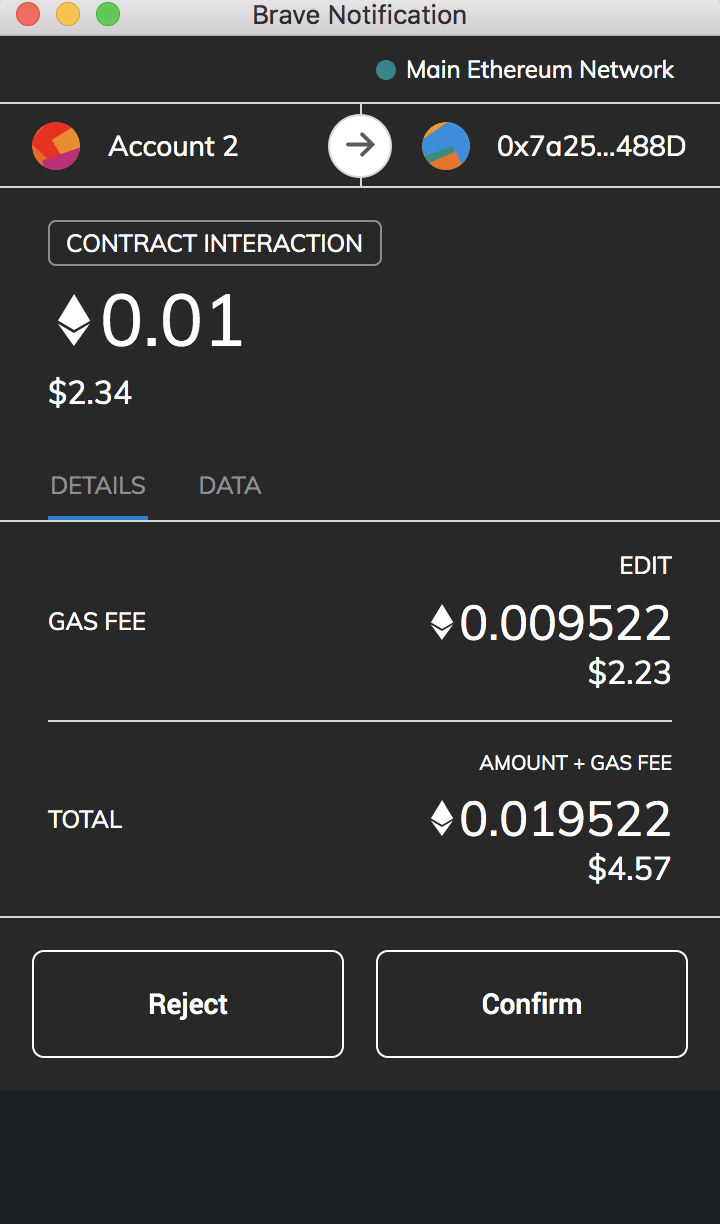

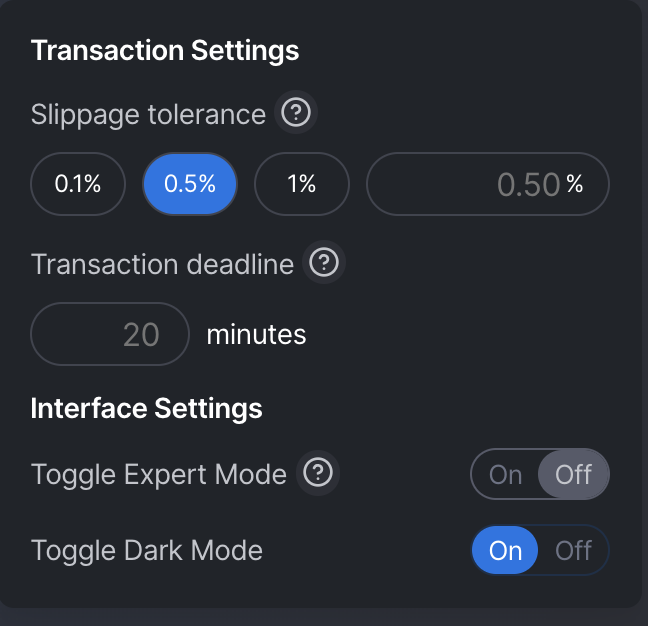

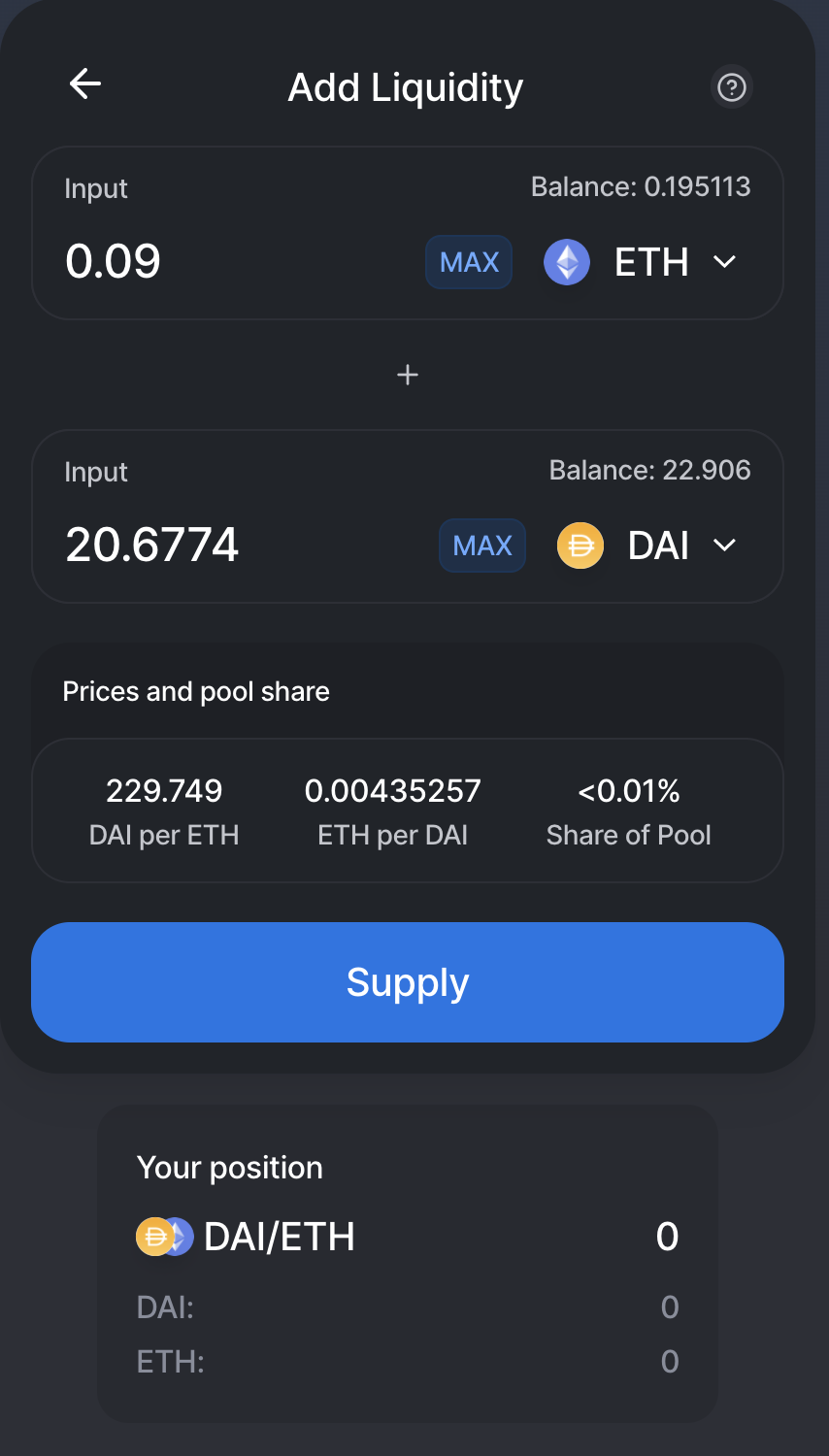

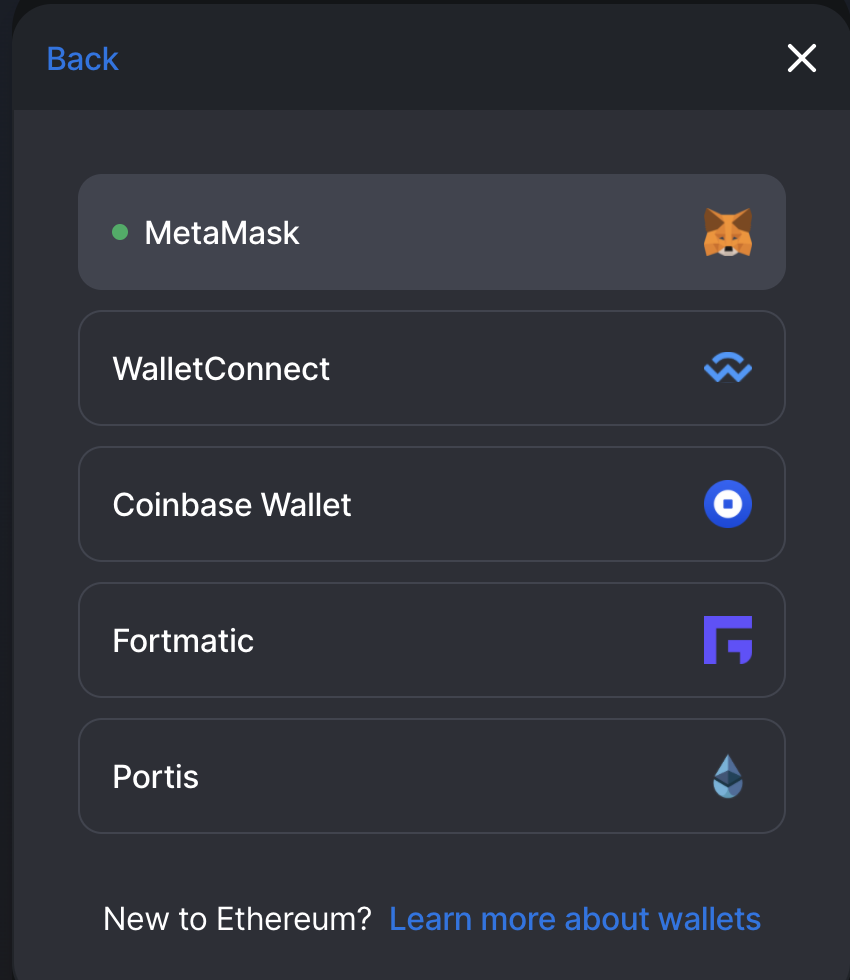

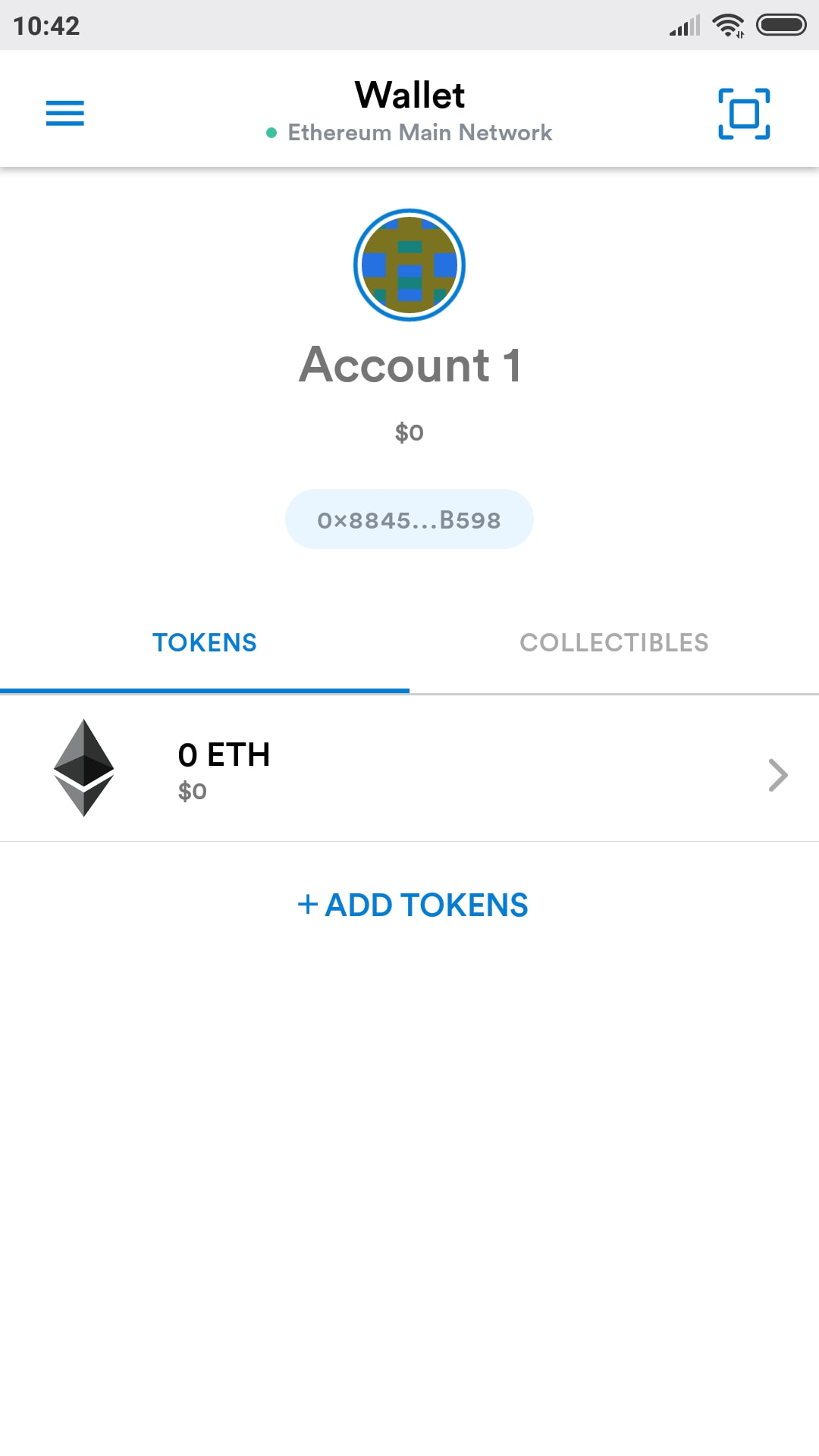

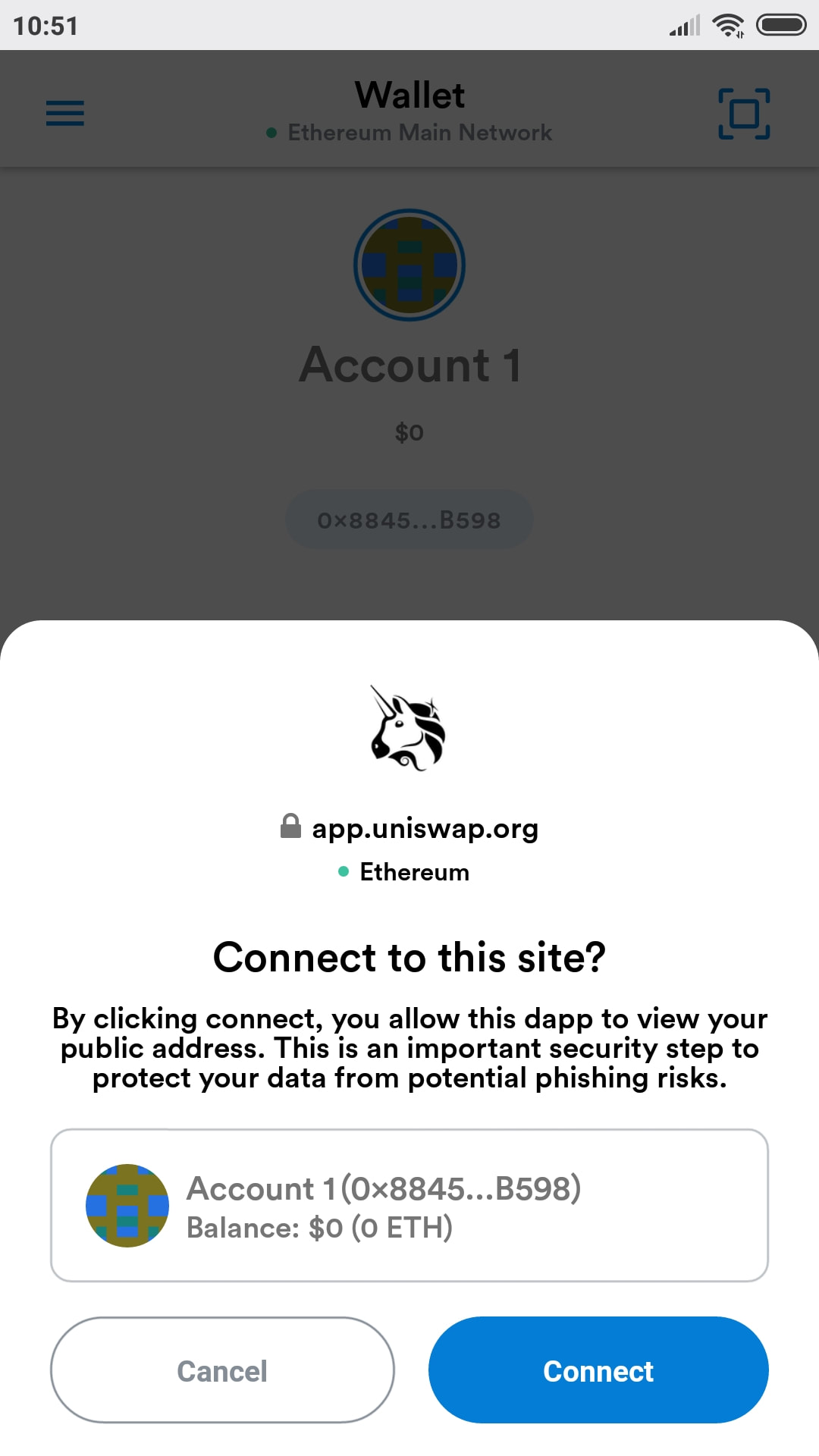

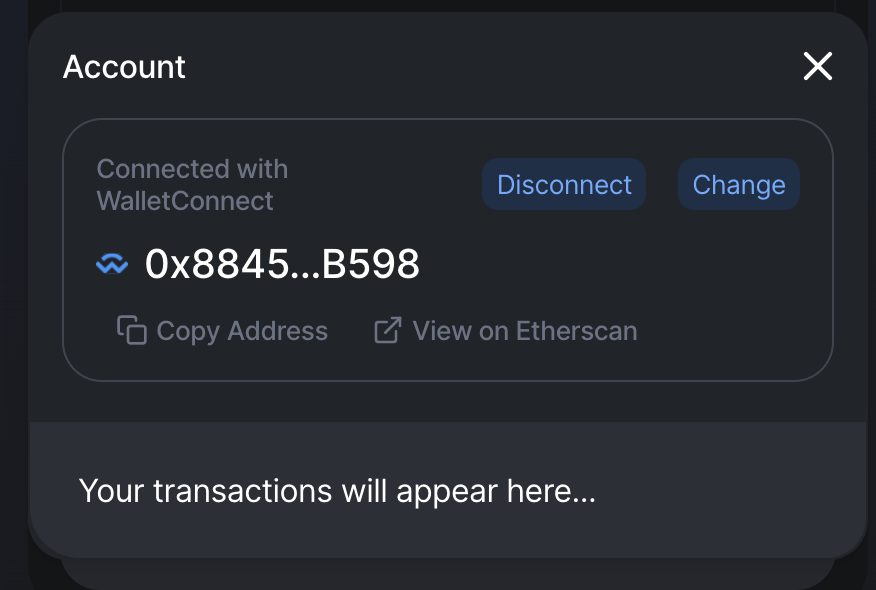

This is a brief walkthrough of Uniswap V2. 1: Go to: https://app.uniswap.org/#/swap A orange Popup window may show to allow Uniswap to connect to Metamask. 2: Click "Connect to Metamask" 3: SWAP This is like "Shapeshift". Example of Swap function below. The swap will be failed if the conversion of swap goes lower than the minimum received during the transaction time. You can pay You see the transaction detail below. You will go to metamask popup window after clicking the "Confirm swap" Yes GAS fee is $2.23 USD. I supposed to have GAS configuration boxes here with advanced GAS setting on Metamask but it does not show. Well DeFi is still a testing phase. You can see effective GAS price here. https://www.ethgasstation.info/ You can change the slippage on the setting on Uniswap. 4: POOL This is to provide liquidity into Uniswap pool to get rewarded "liquidity provider fee". You have to provide same USD amount of 2 coins. Example of ETH and DAI below. 5: Connect to Mobile Metamask Click WalletConnect and a QR code will appear on the screen. Scan the QR code on your mobile by clicking the Square mark on the top right on the screen below. You need Metamask on your Mobile phone. I also tried on JAXX but there is no way to connect at the moment. Click connect. Done!

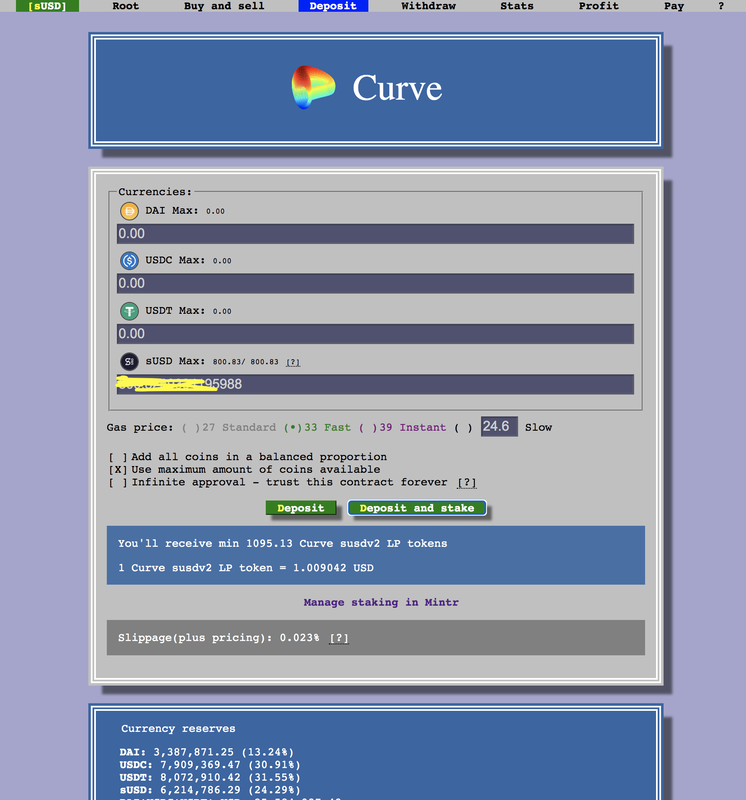

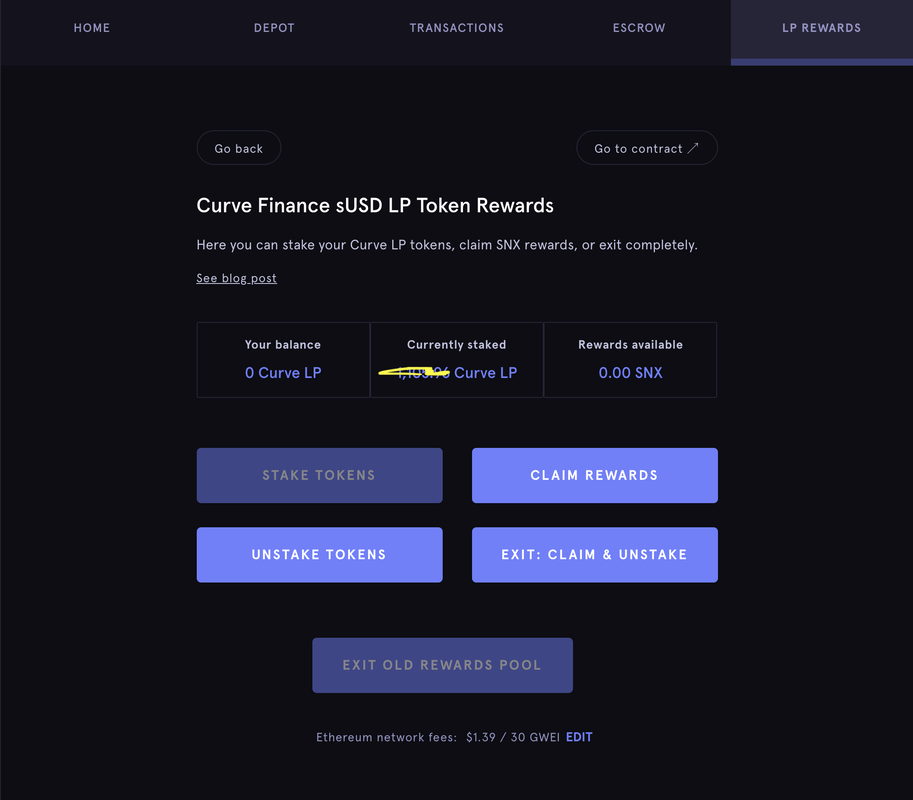

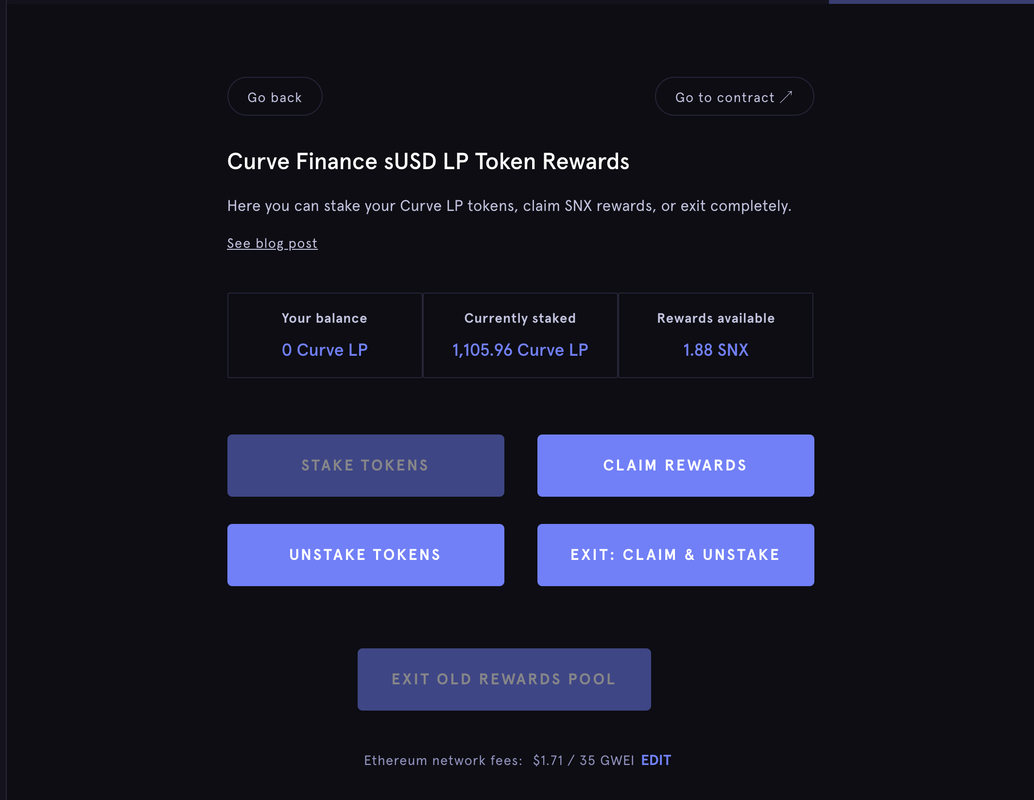

Please check previous post if you don't know anything about Synthetix. You should have sUSD if you have been staking Synthetix and sitting in your wallet doing nothing aside from Mint and Burn to adjust the collateralization ratio unless you are a trade on their platform. This is to stake sUSD via Curve 1: Go to https://beta.curve.fi/susdv2/deposit 2: Click "Deposit and stake" and accept few to several transaction on your wallet . . . Done! You can check your staking at https://mintr.synthetix.io/ And click LP REWARDS After a week of staking sUSD via Curve LP. 1105.96 USD staking 1.88 SNX reward 1.88 SNX x 2.84 (Current SNX USD price) = 5.34 USD 5.34 / 1105.96 USD staking USD x 100 = 0.48% per week as of July 2020 Finally to exit and withdraw the staking. 3: Click EXIT: CLAIM & UNSTAKE It will return your staking with "Curve LP" Therefore you will need to switch back to sUSD In order to do that:

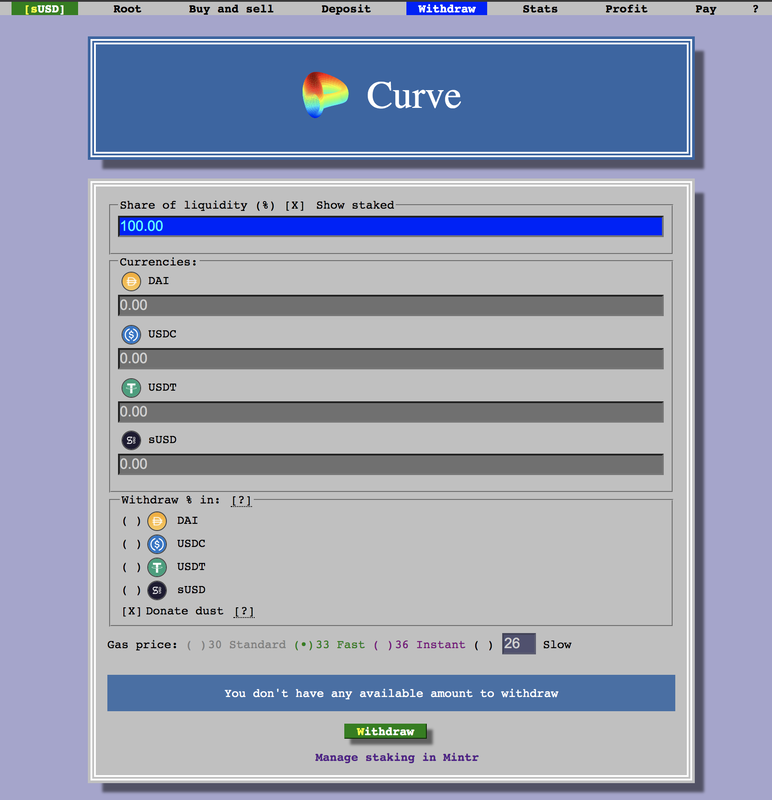

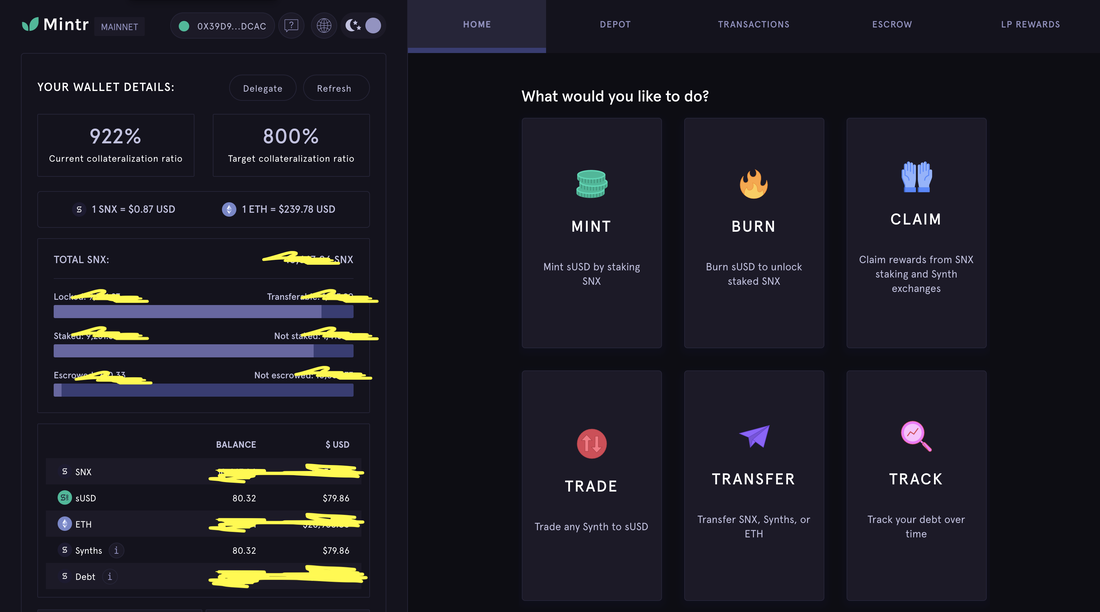

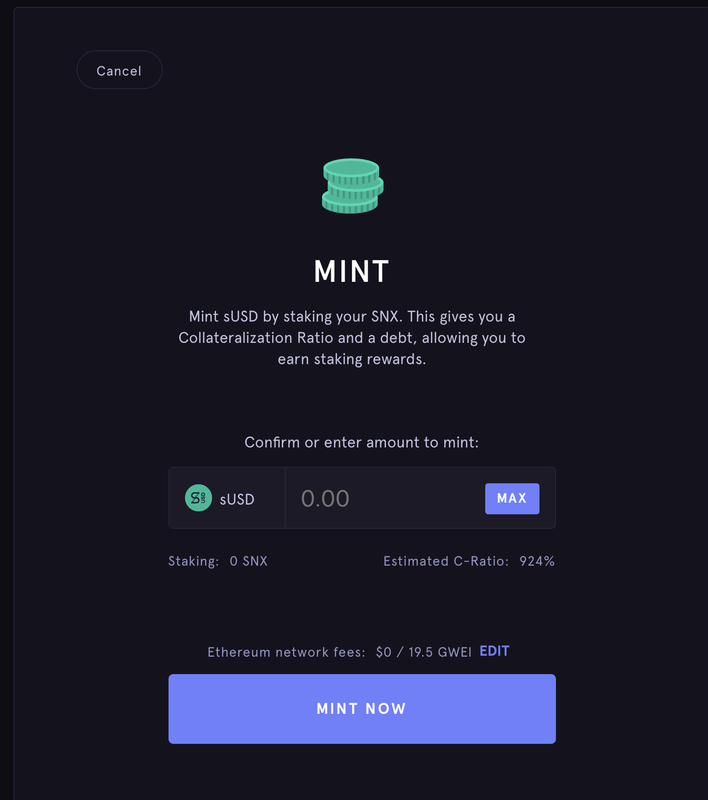

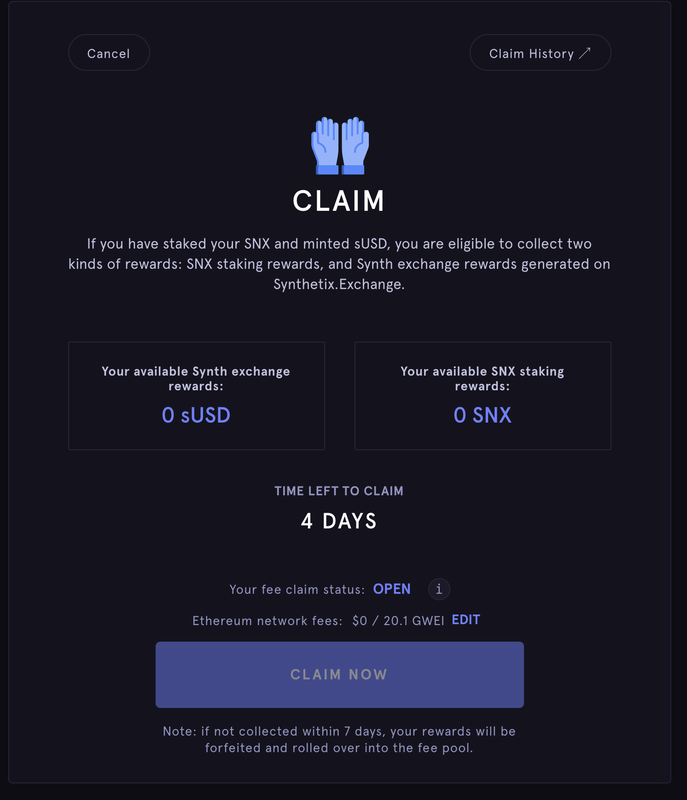

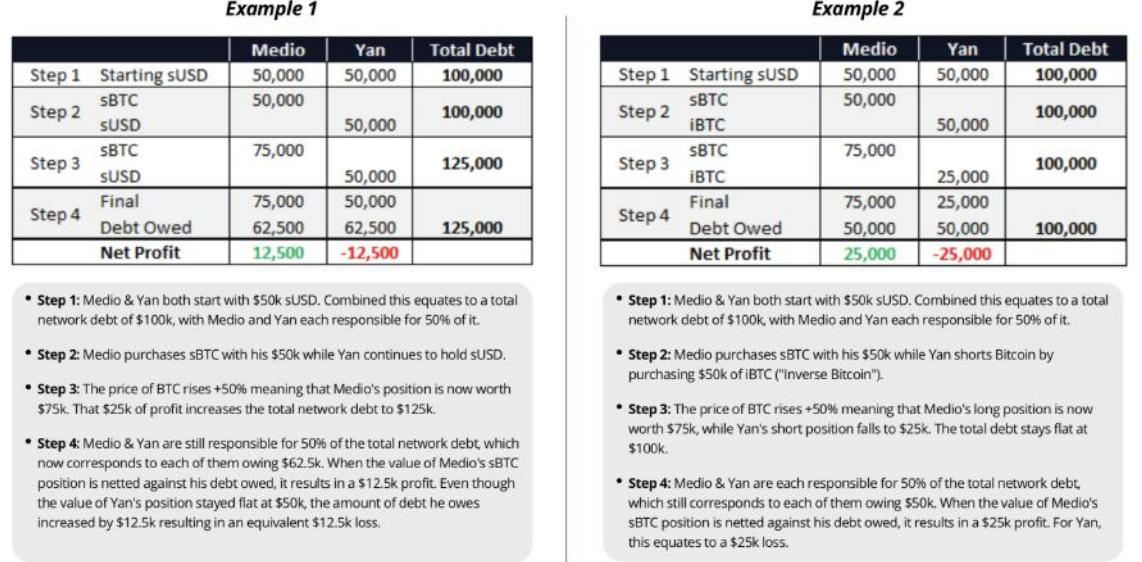

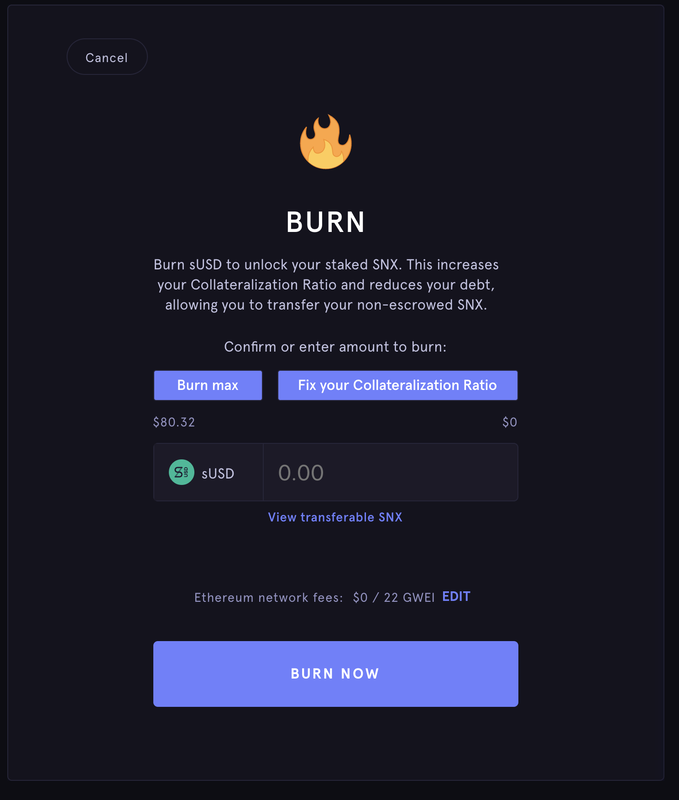

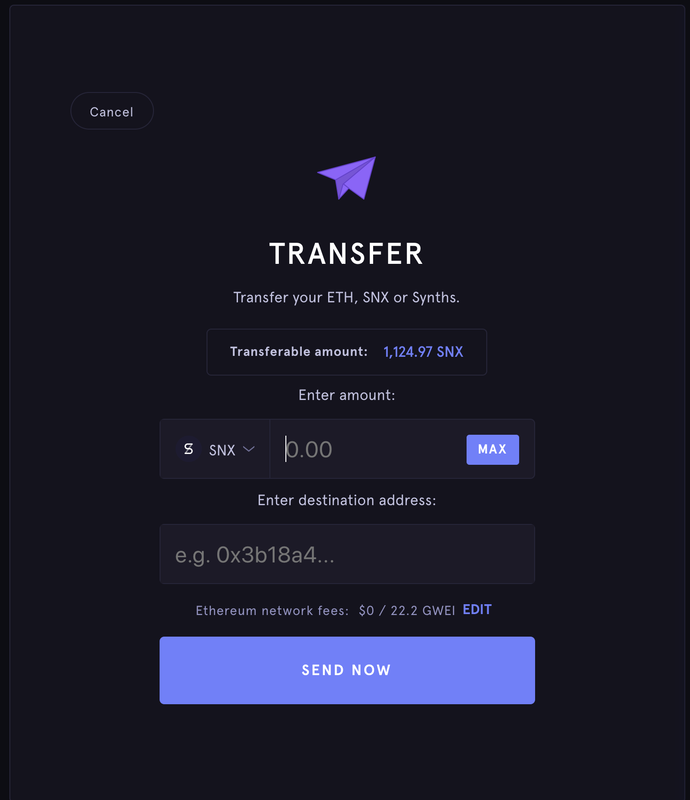

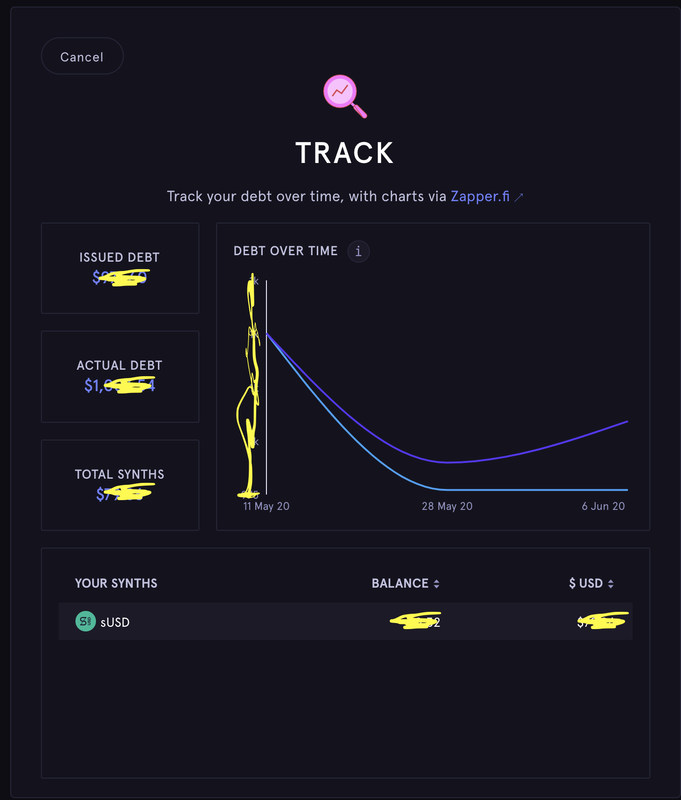

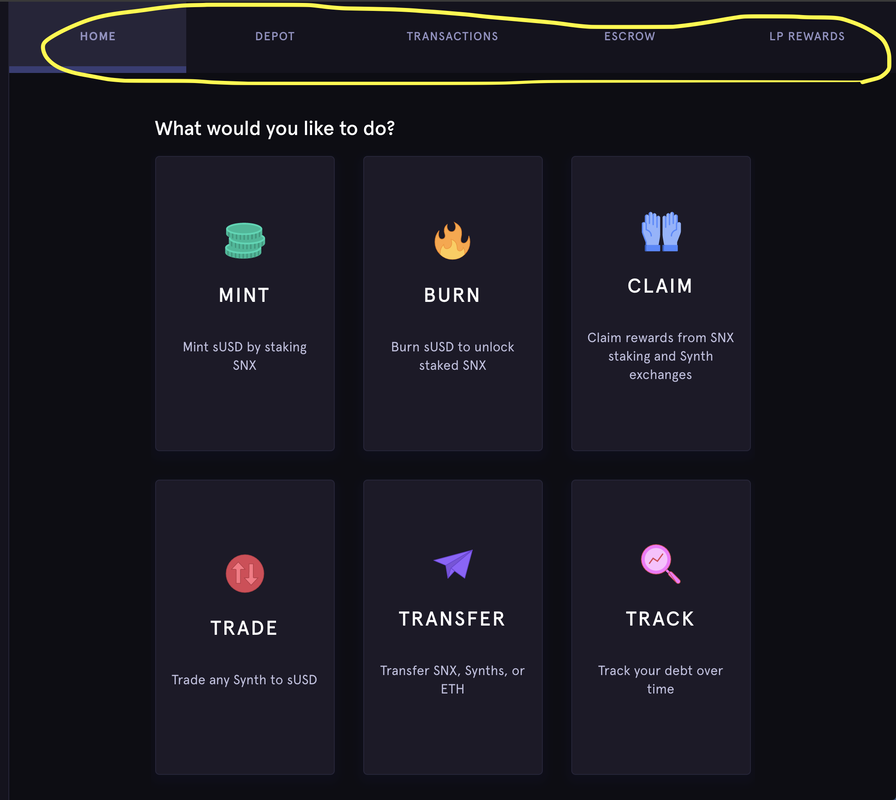

4: Go to https://beta.curve.fi/susdv2/withdraw You can see the screenshot above and click "withdraw". Popup window or your hardware wallet will as you to confirm the transaction few times same as when you staked. The top box "Share of the liquidity (%)" should be 100 if you want to withdraw all. Done! Synthetix staking and basic functions (There are "Exchange", "Mintr" and "Dashboard".) https://www.synthetix.io/ It is high staking reward, one of the highest as you can see from the link below. https://www.stakingrewards.com/asset/synthetix-network-token I am going to talk about Mintr to focus on staking for what it looks like, how it works and risk. I spent some time on this staking rewards and this is the result. 1: Go to https://mintr.synthetix.io/ And connect to your wallet with ETH and SNX. It looks like this below after connecting to your wallet. 2: Go to "MINT" And stake SNX by minting sUSD. It will be locked for 24 hours in the current rule. This adds liquidity pool of their "Synthetix" exchange and you can check at "Dashboard". Current minimum collateralization ratio is 800% (792% to be exact to claim reward) which means you mint sUSD 1/8 of staking SNX USD value. Your minted sUSD also goes to debt in other words you need to pay back the debt to unlock the staked SNX. I will explain these more later. 3: Go to "CLAIM" This is to get paid with your staking. The payout is on every Wednesday 10:00 UTC and 1 week to claim the reward. You will lose the reward if you didn't claim. ***Note that the claimed SNX is locked for a year. *** It would be necessary to forecast the market in a year. If you think it will be gone in a year and you should not be staking. Collateralization ratio needs to be higher than 800% to be able to claim. The ratio can be changed by the price of SNX as liquidity pool increase/decrease. You will need to burn sUSD to add Collateralization ratio if it is lower than 800%. This is how it works below. https://www.synthetix.io/uploads/synthetix_litepaper.pdf Liquidity pool increase = SNX and sETH price increase Liquidity pool decrease = SNX and sETH price decrease sUSD price is stable = Ratio of debt goes high/low of total liquidity. In general, it is good to have SNX or sETH when the market is going up, and hold more sUSD when the market is going down. 4: "BURN" Click "Fix your Collateralization Ratio" to be able to claim if your ratio is not enough. And also pay off all the debt by burning sUSD to unlock the staked SNX. 5: Other functions "TRADE" Not available as of June 6 2020. Go to "Exchange" instead. "TRANSFER" As it says, transfer SNX. Nothing much. "TRACK" To track your debt, minted sUSD by staking SNX Finally to talk about these tabs. "DEPOT" stands for deposit to sell your sUSD for ETH. You can do it as their exchange and also Uniswap and other DEX.

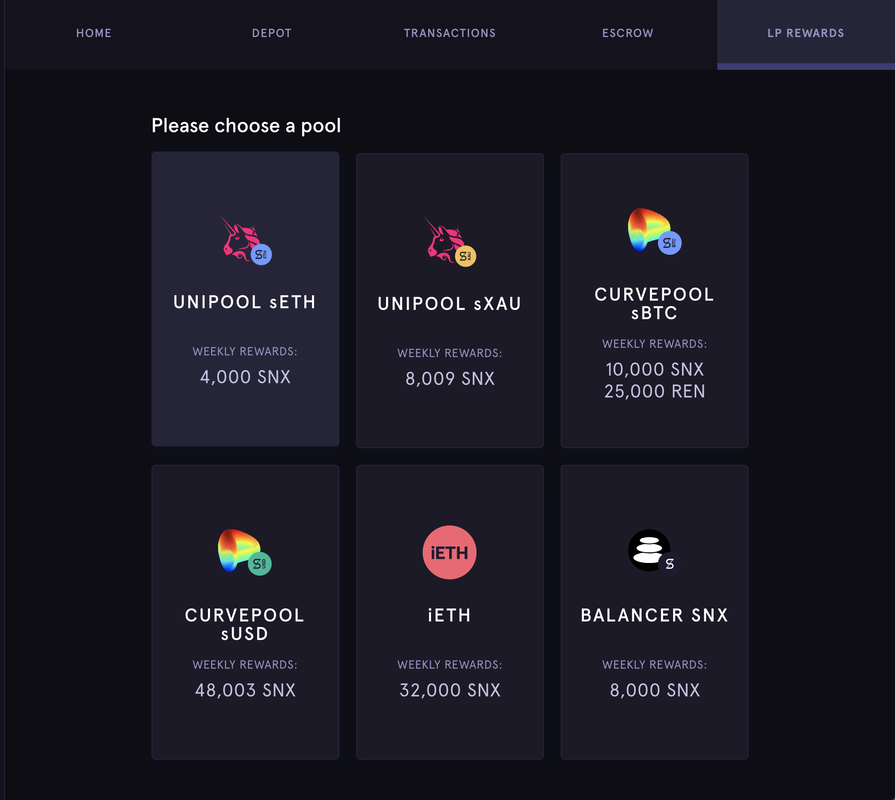

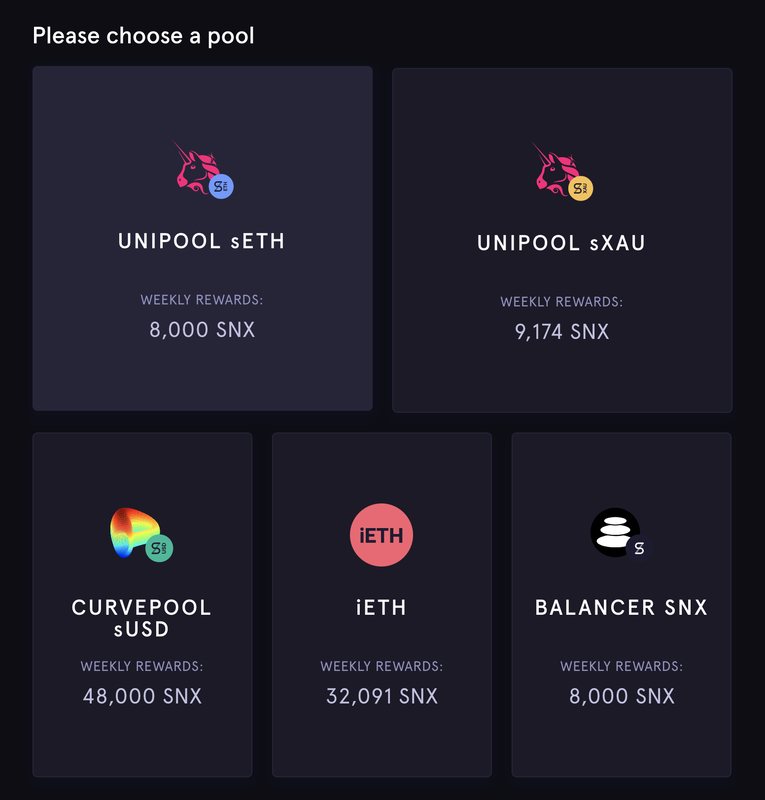

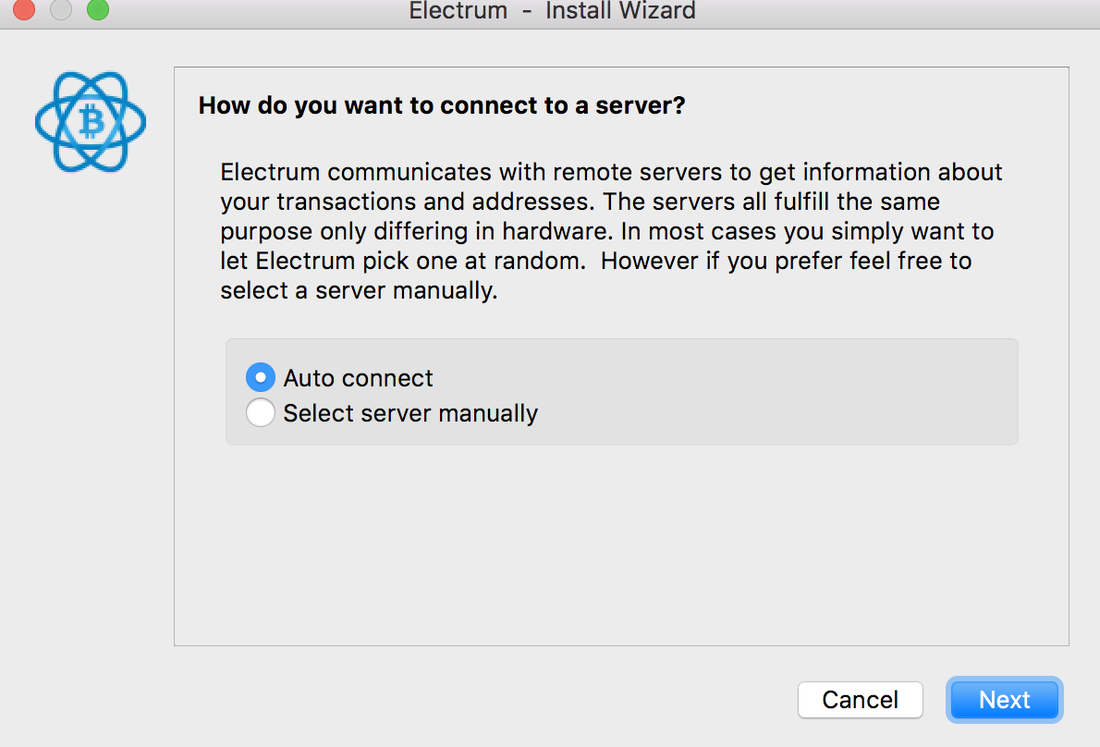

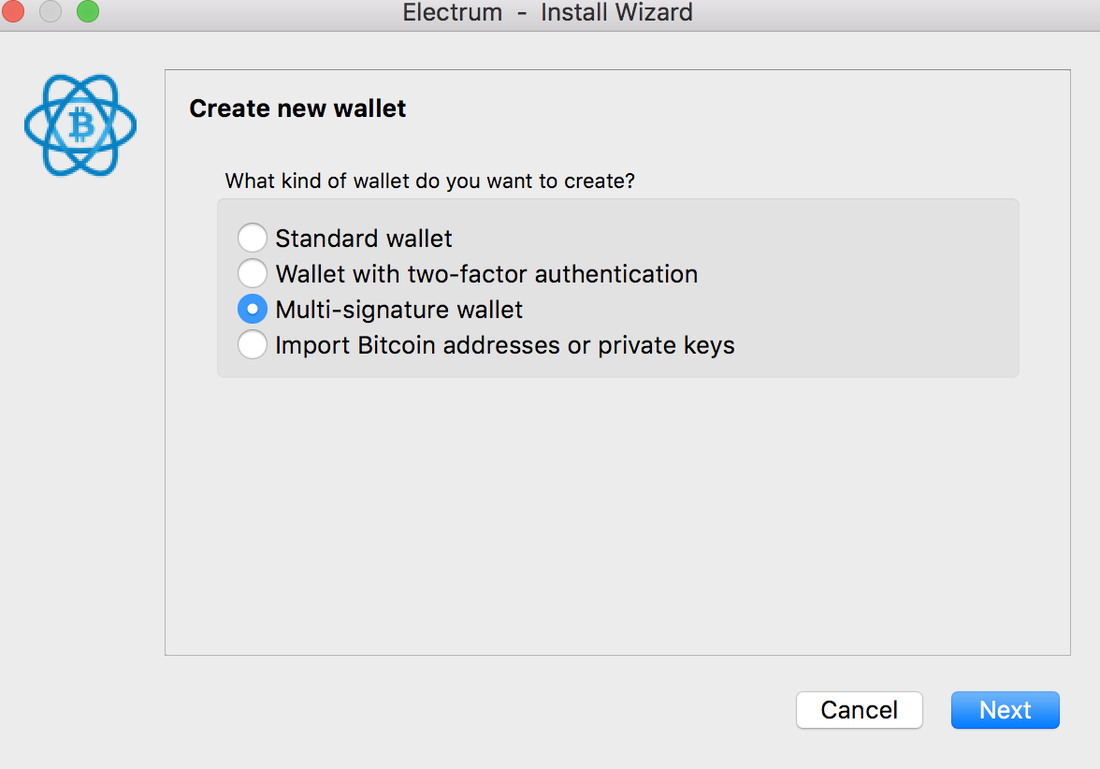

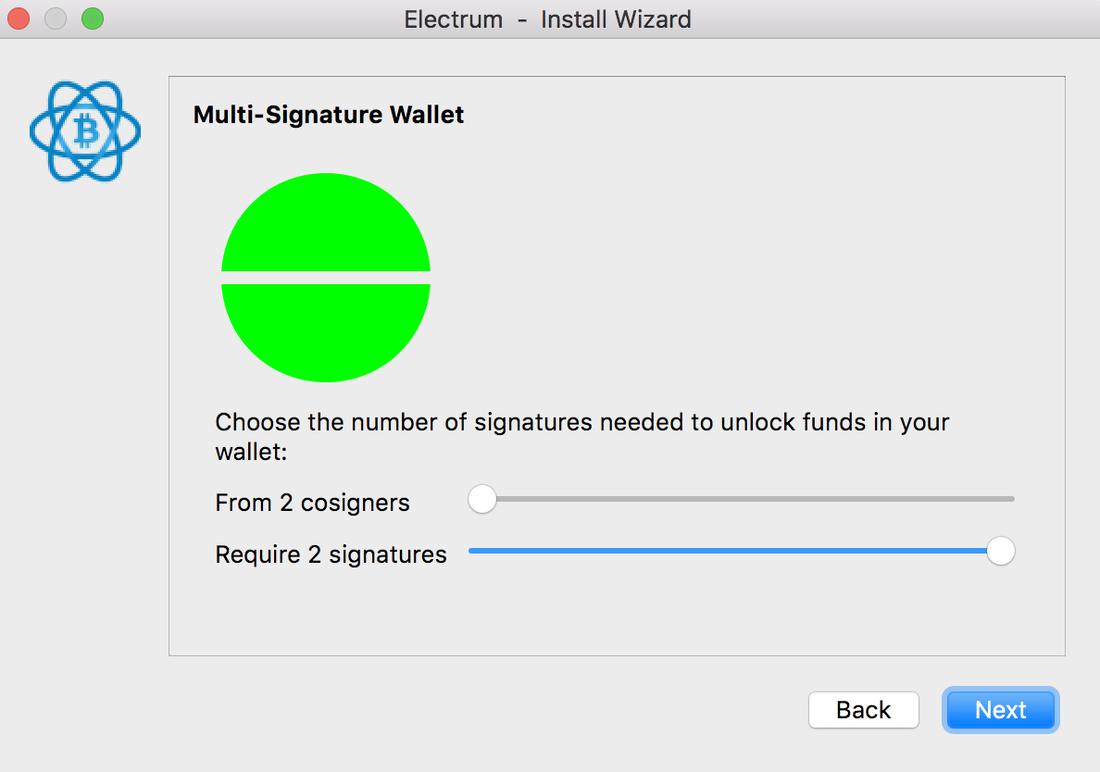

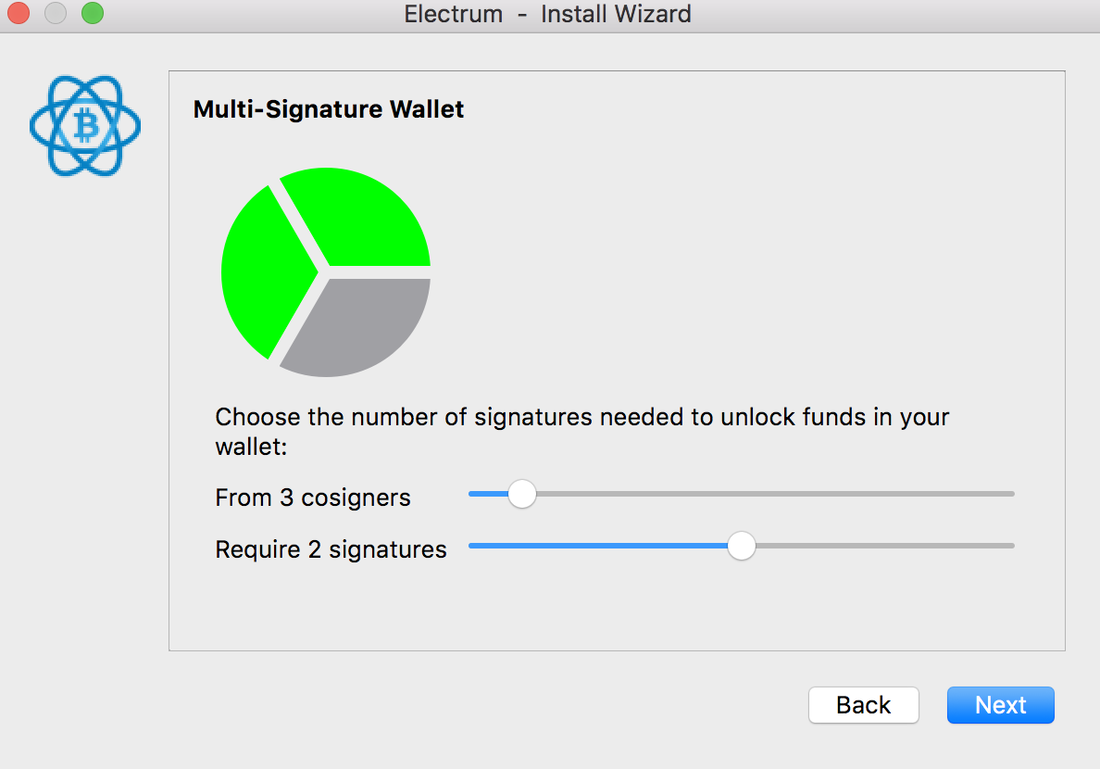

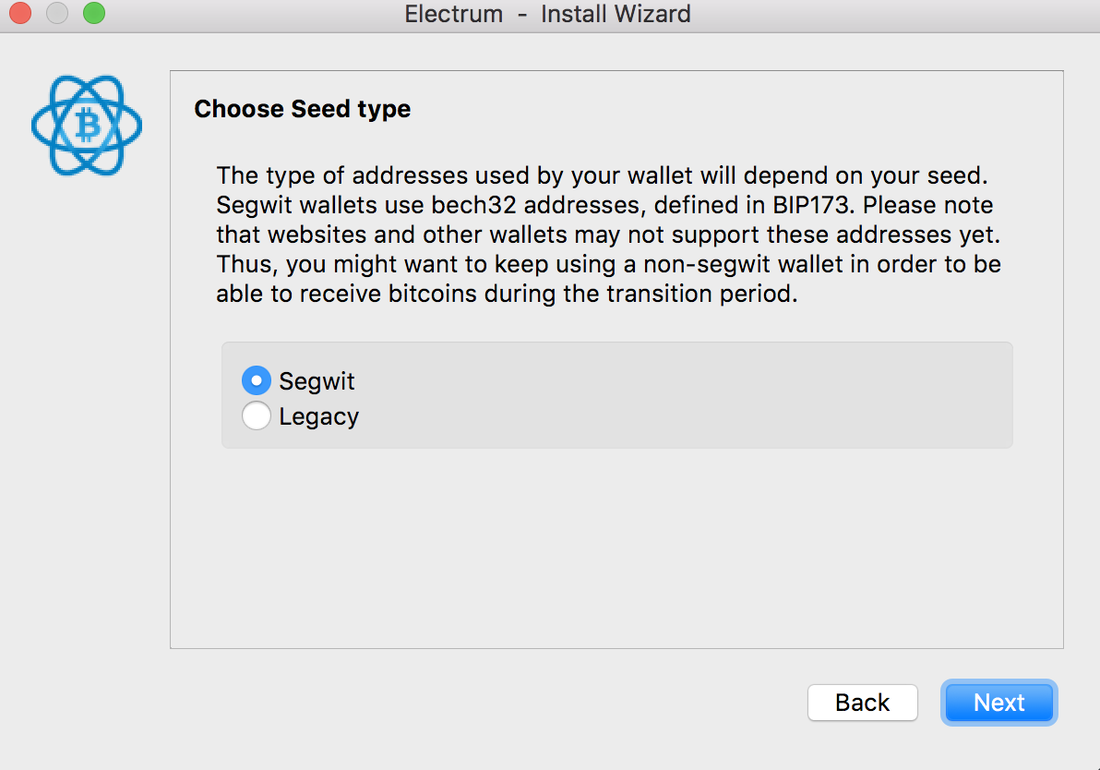

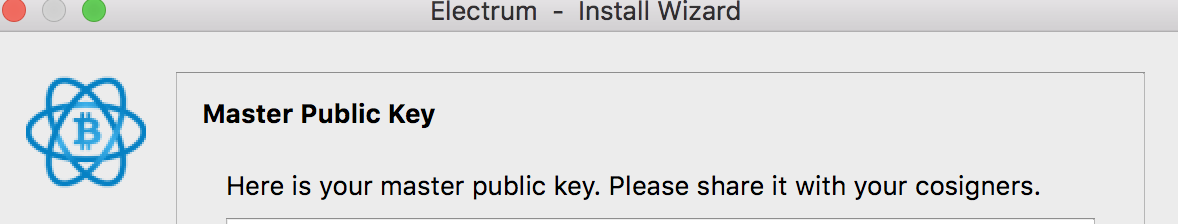

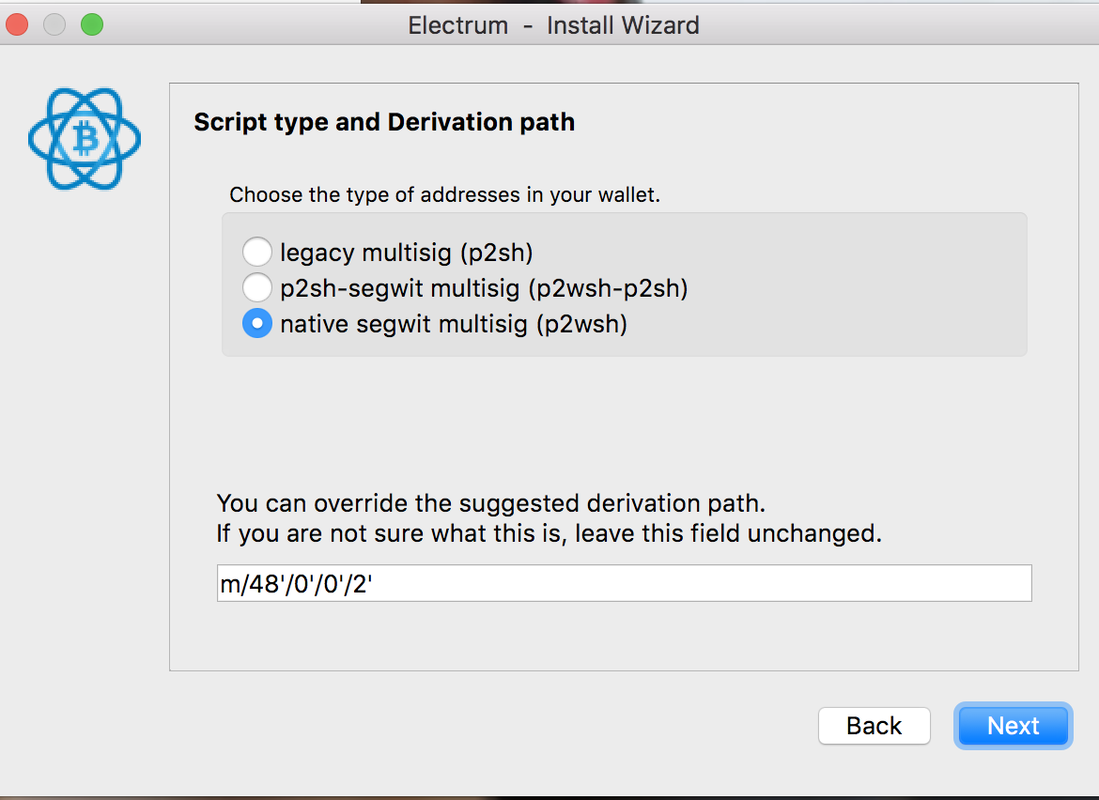

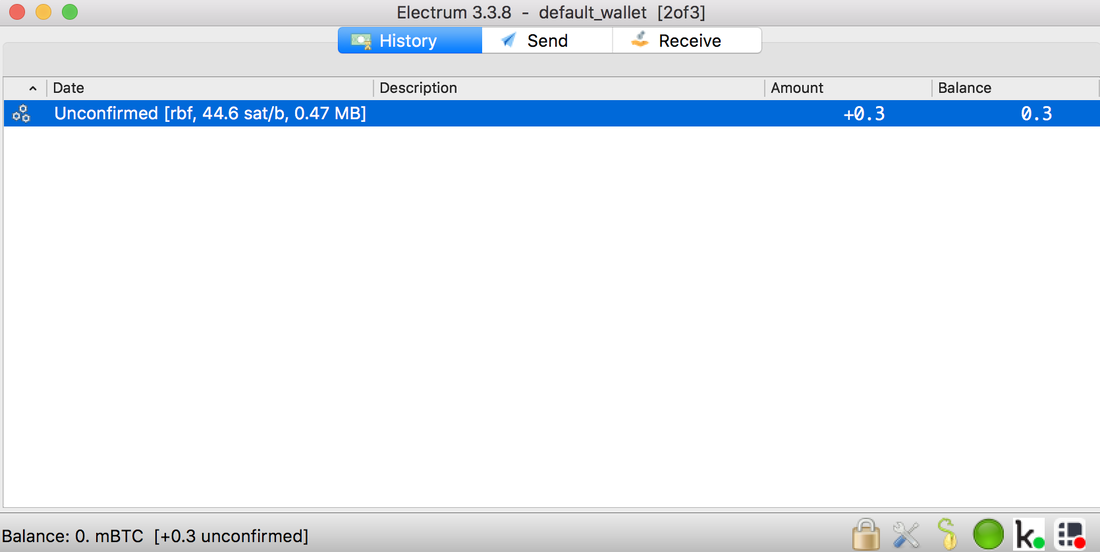

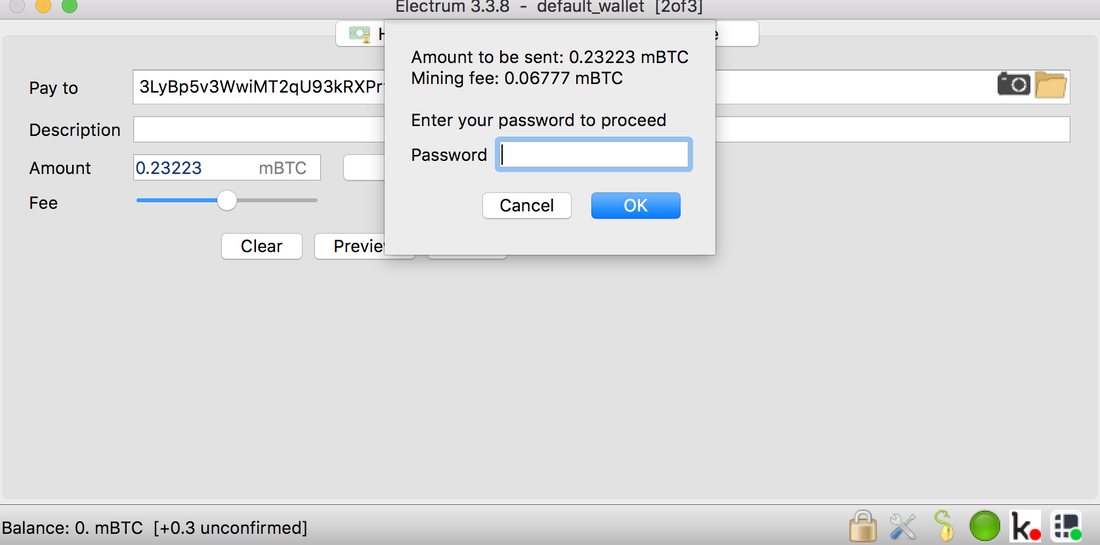

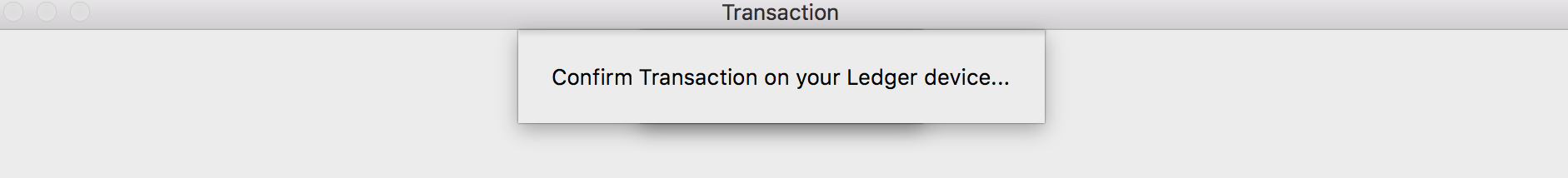

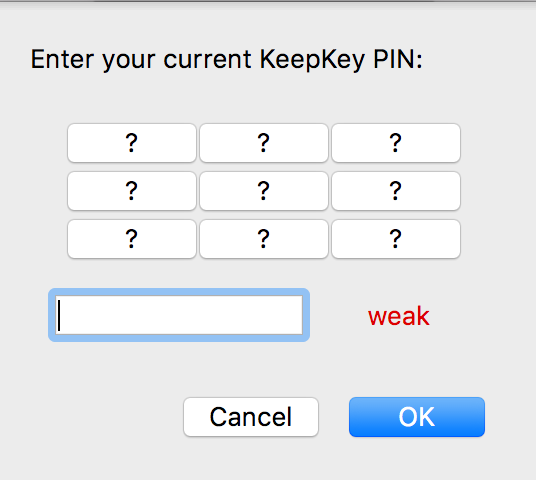

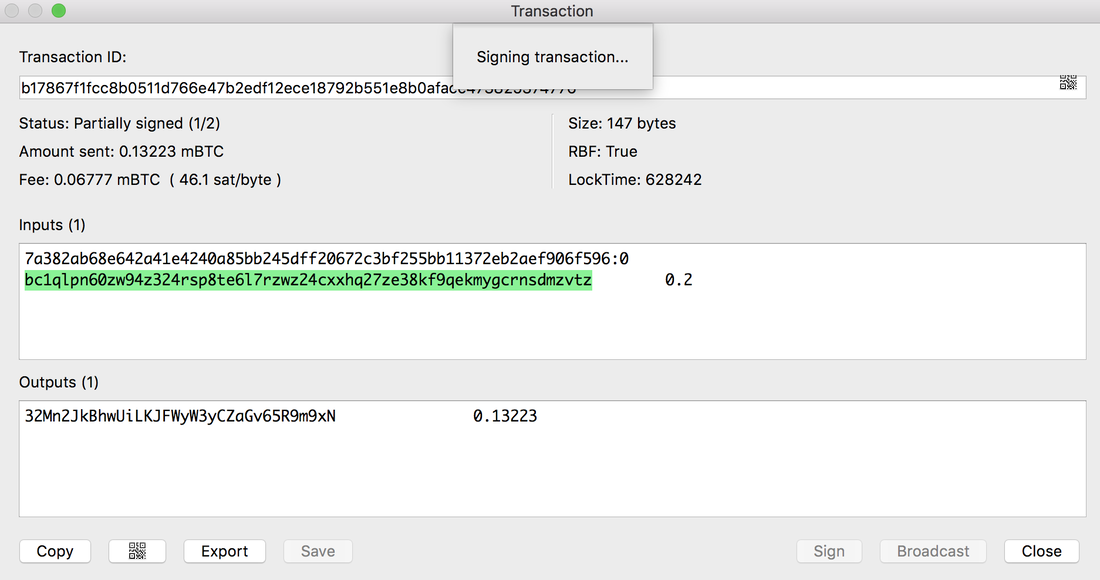

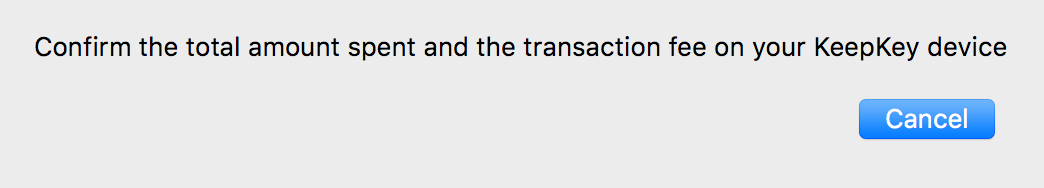

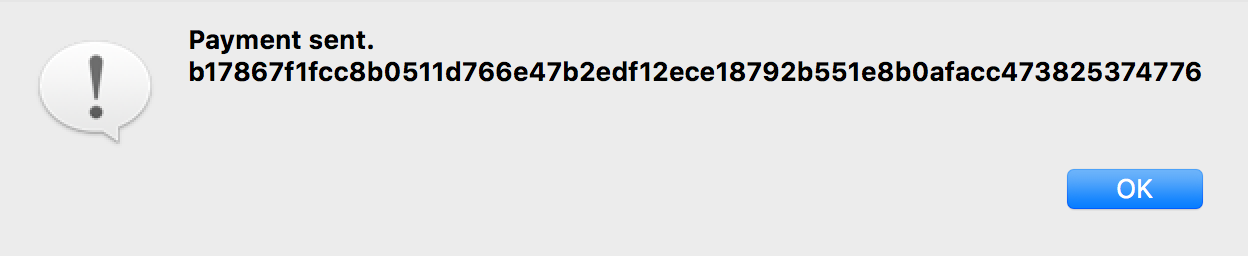

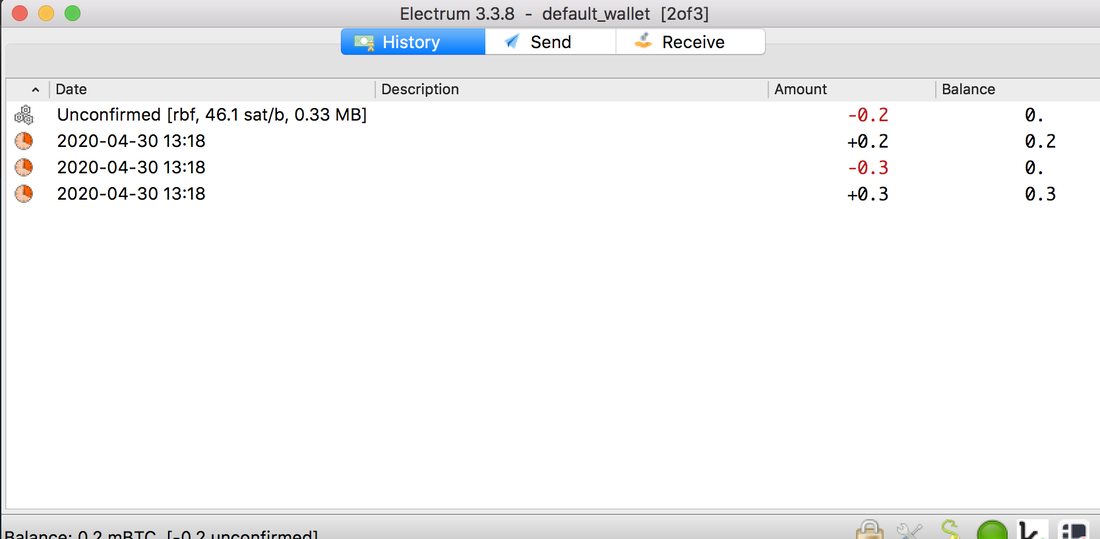

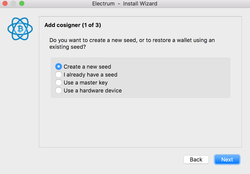

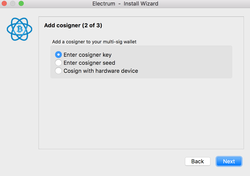

"TRANSACTIONS" shows your previous related transaction such as mint, burn, claim, depotsit and sell sUSD etc. "ESCROW" is to escrow rewards SNX therefore nothing you can do for a year. "LP REWARDS" is an interesting part that you can add liquidity to Synthetix exchange by Uniswap and other things which are more complex. The options are below. Multi signature wallet with Electrum https://electrum.org/ Download wallet from https://electrum.org/#download There is a single point of failure of using HW wallet. This tutorial is for 3 cosigner with 2 signature 3 Cosigner = Electrum wallet/ LedgerNano/ Keepkey Therefore one HW can be backup of the other. Start the app and you will see the screen below You can choose the degree of security here. Create a new seed (1: Electrum wallet co-signer)  Cosigner with hardware device (2:LedgerNano 3: KeepKey)   You will be asked for a password (If you set) for the Cosigner 1: Electrum wallet Below is if you chose Ledger to cosign  This is for Keepkey to Cosign. You should be familiar if you have used KeepKey before otherwise it looks like this below. Done!

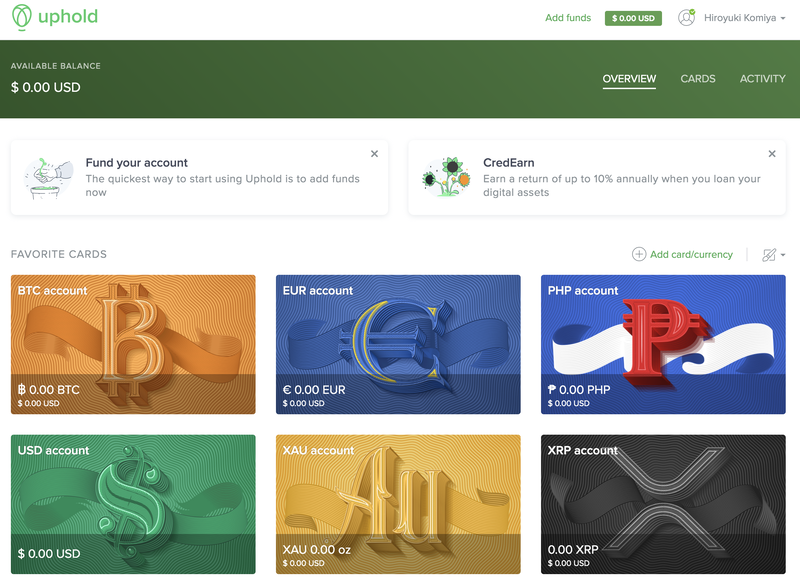

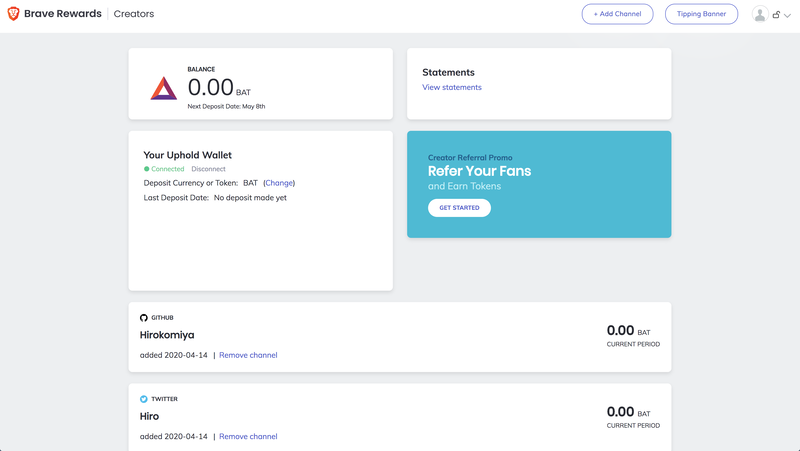

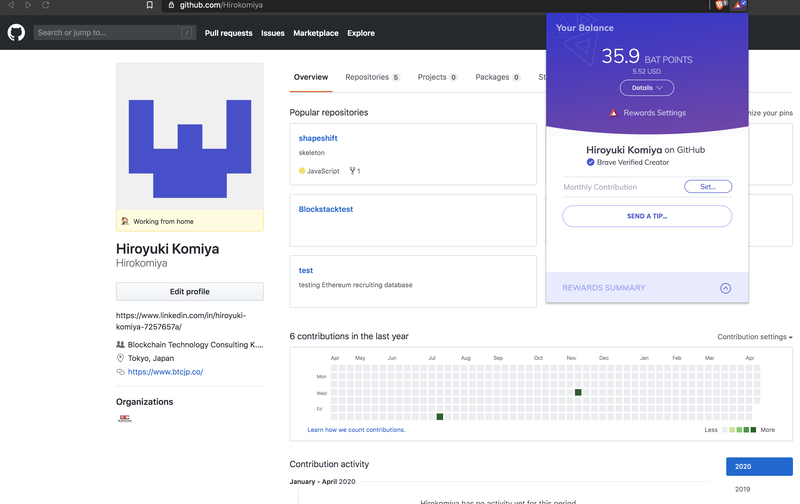

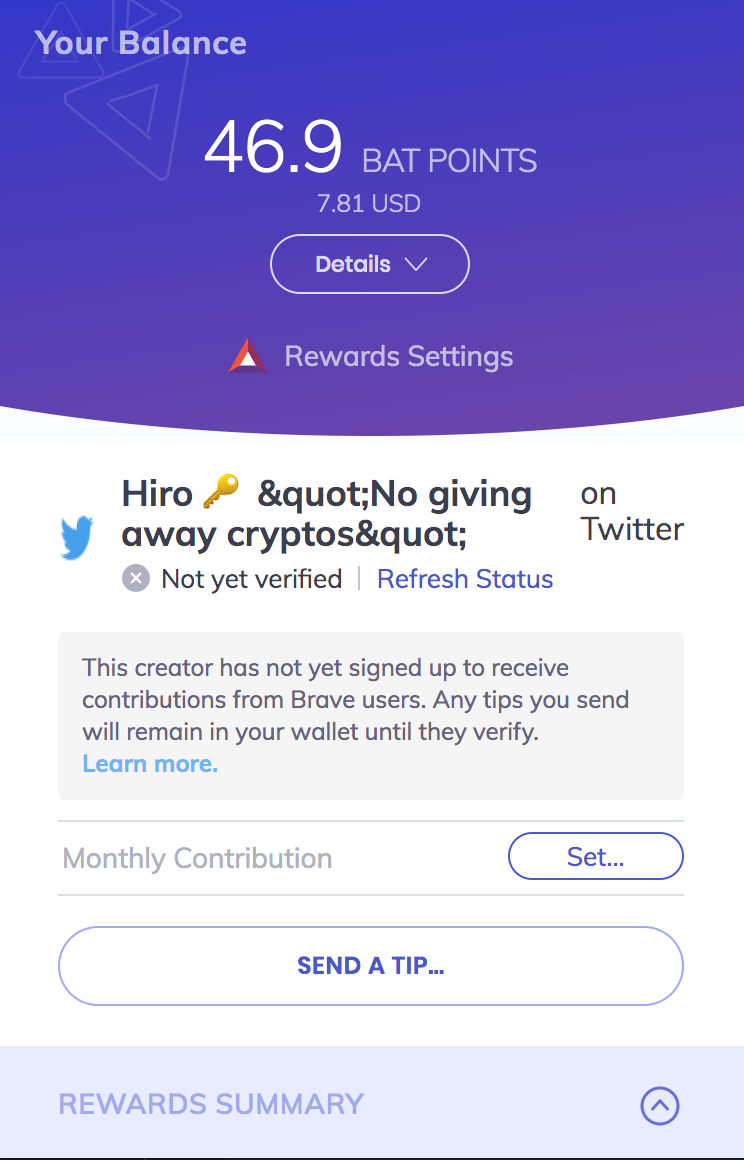

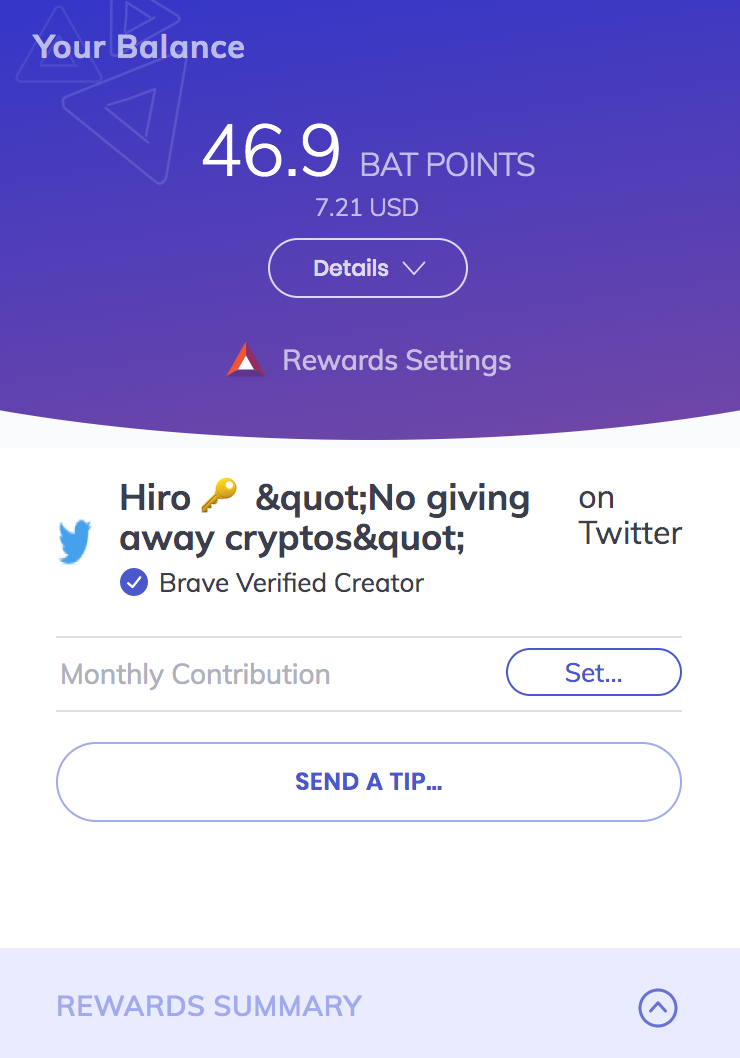

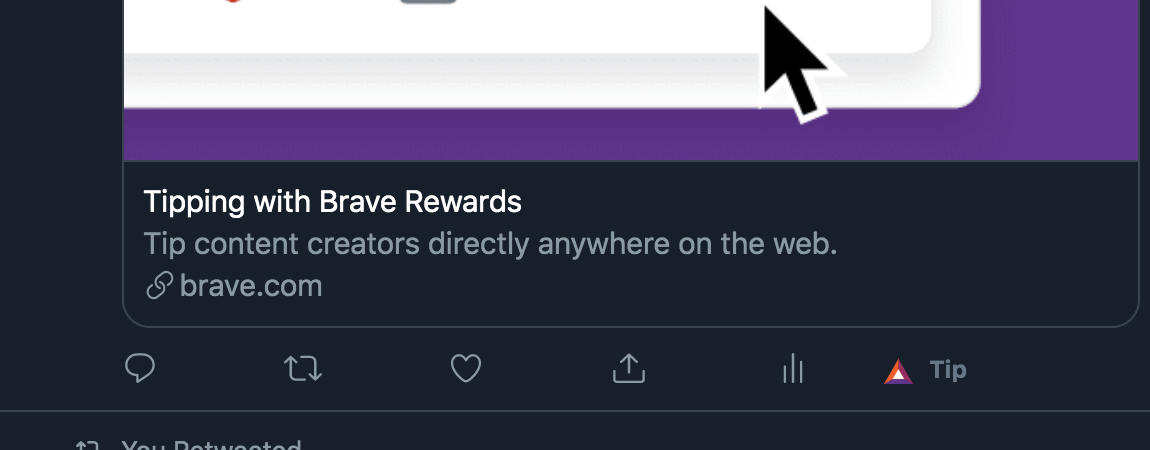

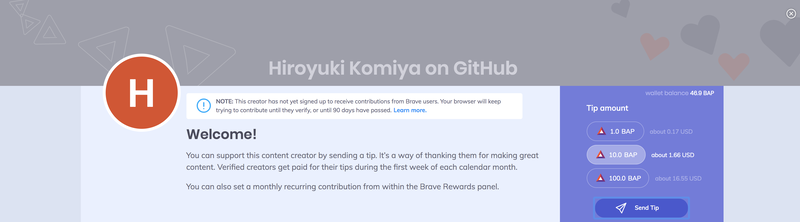

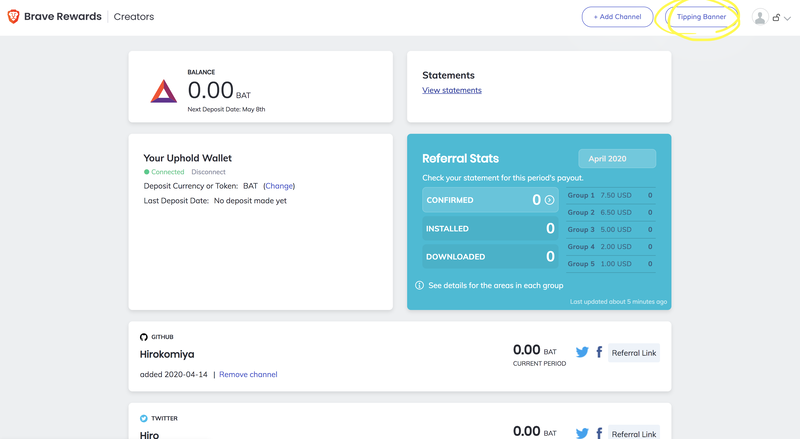

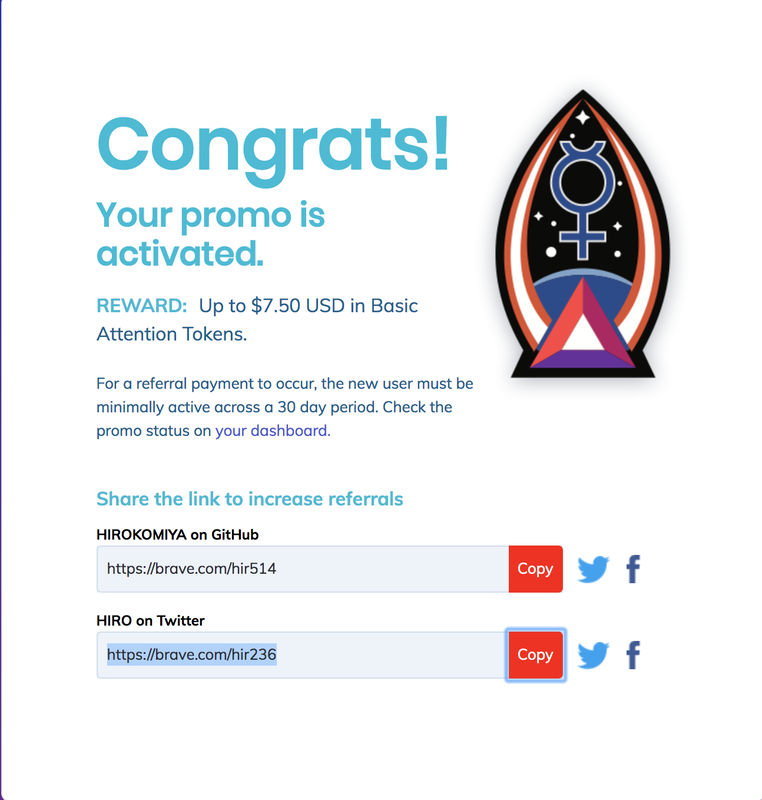

I found multisig with 2 hot wallets here. https://www.youtube.com/watch?v=QMl522DA-oo Thank you to the Youtube channel "Hodl Hodl". This is how to setup brave browser to accept tip. I assume you already have brave, if not install it. It is a great browser. https://brave.com/hir514 Yes it is affiliate link. :) If you do not want to use the link and please go to https://brave.com I will show you how to get the link along with the setting up below. 1: Setup Uphold https://uphold.com/ Go to the link and do KYC. I know we all hate KYC but you have to do what you have to do. It will look like below after setup and signin. You can do many things with uphold such as lend and earn interest and they also have credit card now. I will skip it for now. 2: Setup Brave Creator account https://creators.brave.com/ 3: Connect uphold, twitter, Github, Website, Youtube etc. All set now! It will look like this below, I already connected to uphold and added twitter and Github to accept tipping. But wait, you have to verify your account by clicking "Add Channel". You can check your status from the brave logo in the search box. Make sure you are opening the page that you are verifying. This is non-verified account below. It took me about 20 hours. How to tip 1: You can see triangle brave logo on twitter 2: For Github and other website which has no logo, and you click brave logo in the right side of search box. It should be next to brave logo. 3: If you click "SEND A TIP" and a banner will come out. You can edit the banner here. https://publishers.basicattentiontoken.org/ How to get referral code. Sign in Brave Creator https://creators.brave.com/ or go to https://publishers.basicattentiontoken.org/ You can see in the screenshot above which is blue part says "Referral stats". I have done so that it looks like this now but you can click and get the referral code. 4: Send me a tip here!

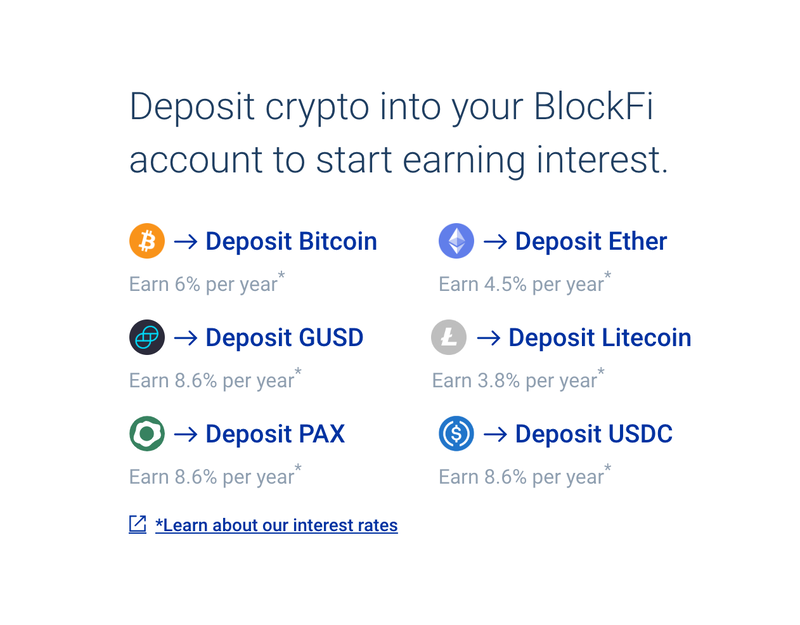

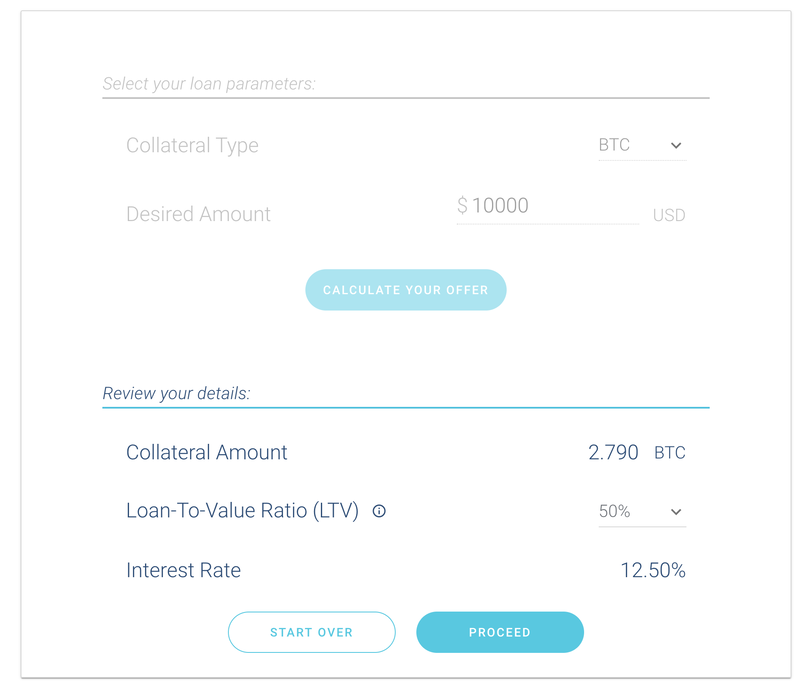

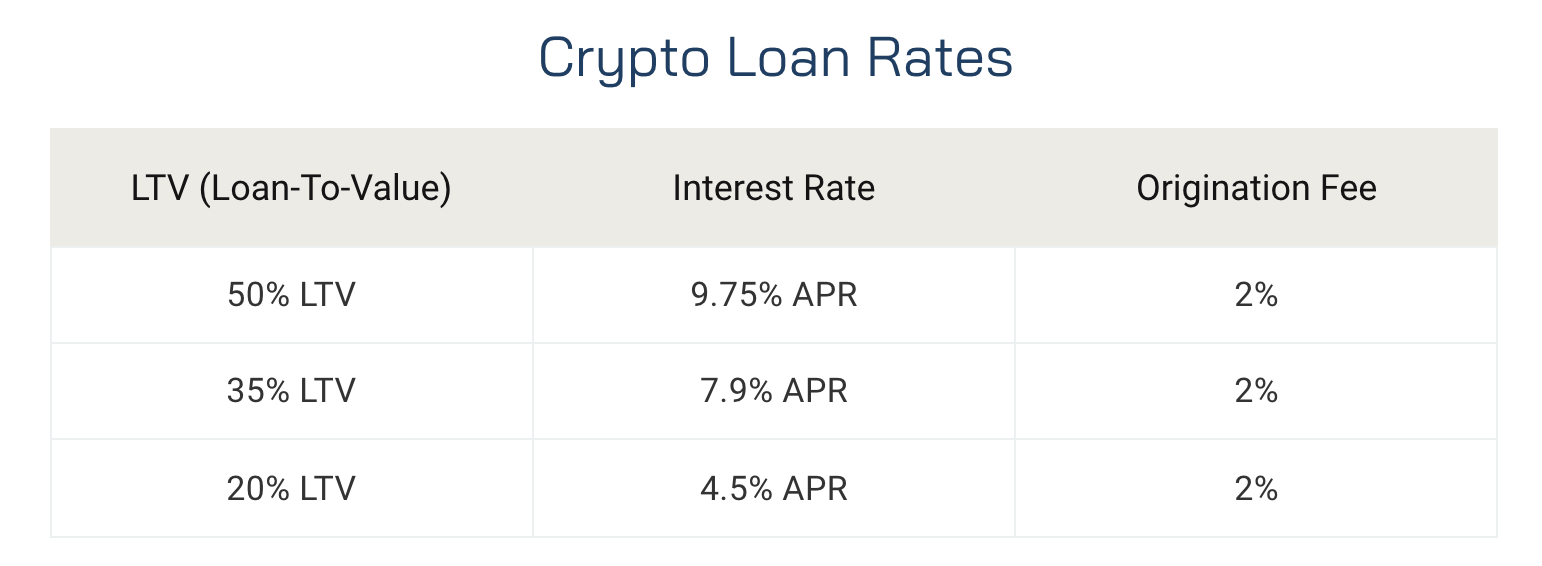

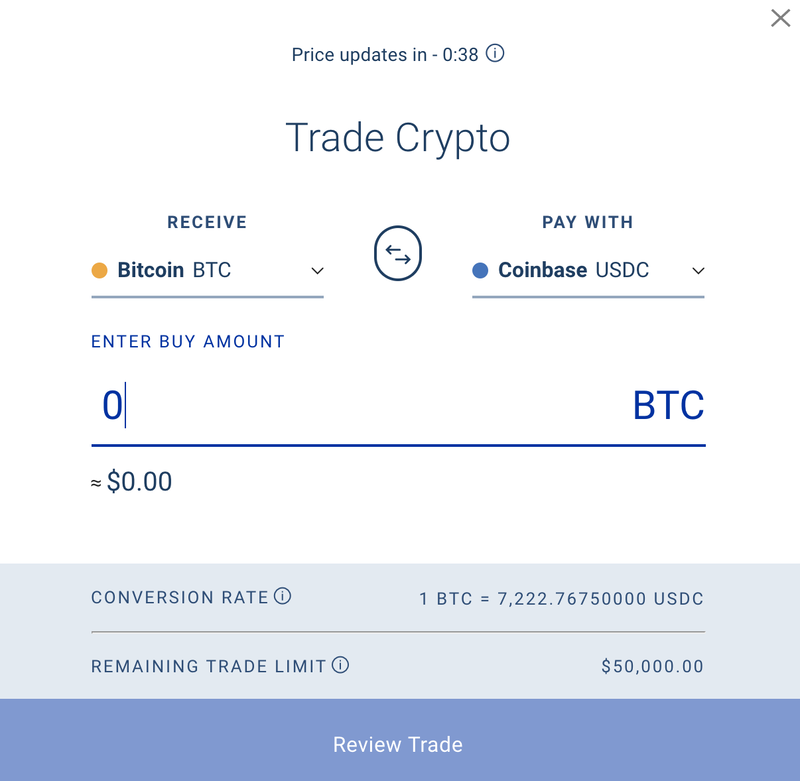

https://twitter.com/hiroyuki_komiya https://github.com/Hirokomiya It seems nicer than pasting my ETH or BTC address ;) Website https://app.blockfi.com/ First you will be asked KYC including DOB, address, photo verification to be able to use any function. 1: Deposit/Withdrawal (earn interest rate) BTC 6% interest rate per annual upto 5BTC, 3.2% for 5 < For more detail https://blockfi.com/rates 2: Loan function https://blockfi.com/crypto-loans/ Collateral = BTC LTV (Loan To Value) 50% = 12.5% per year LTV 35% = 10.44% LTV 20% = 6.73% 3: Trade function https://blockfi.com/trading/ I always have a doubt using 3rd party app for deposit since the case of exchange/ 3rd party app hack.

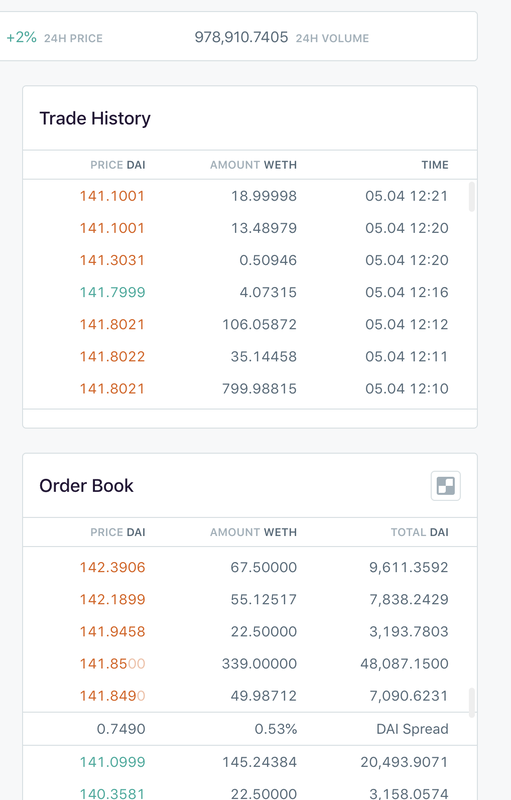

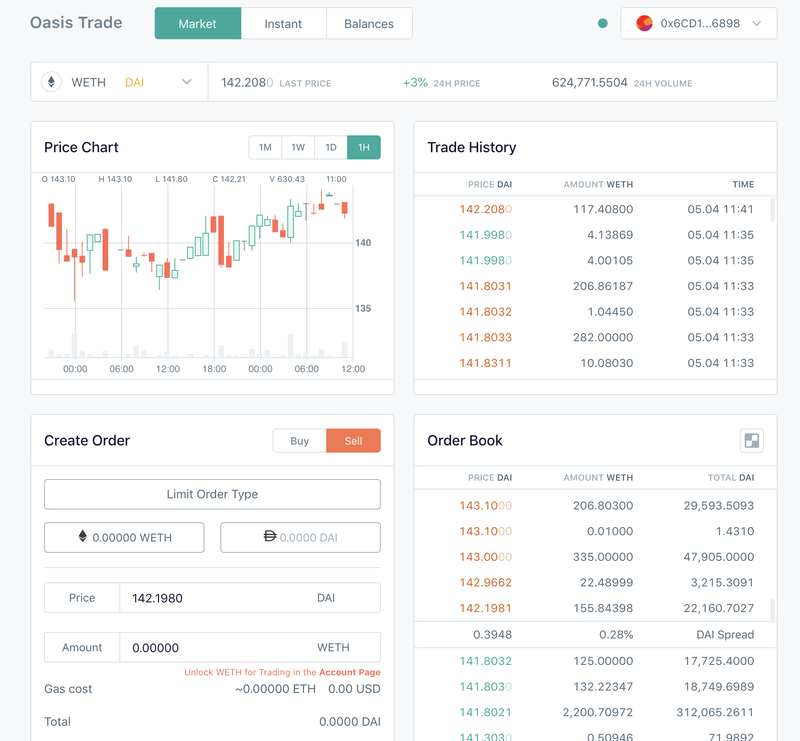

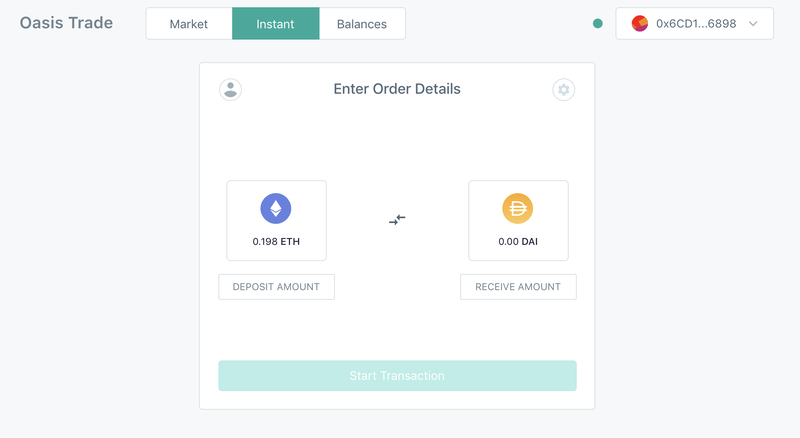

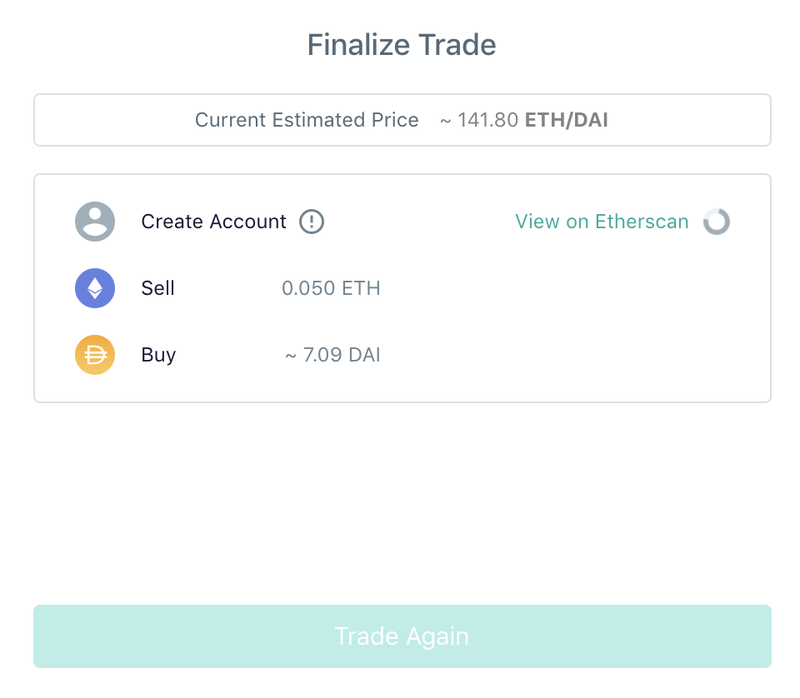

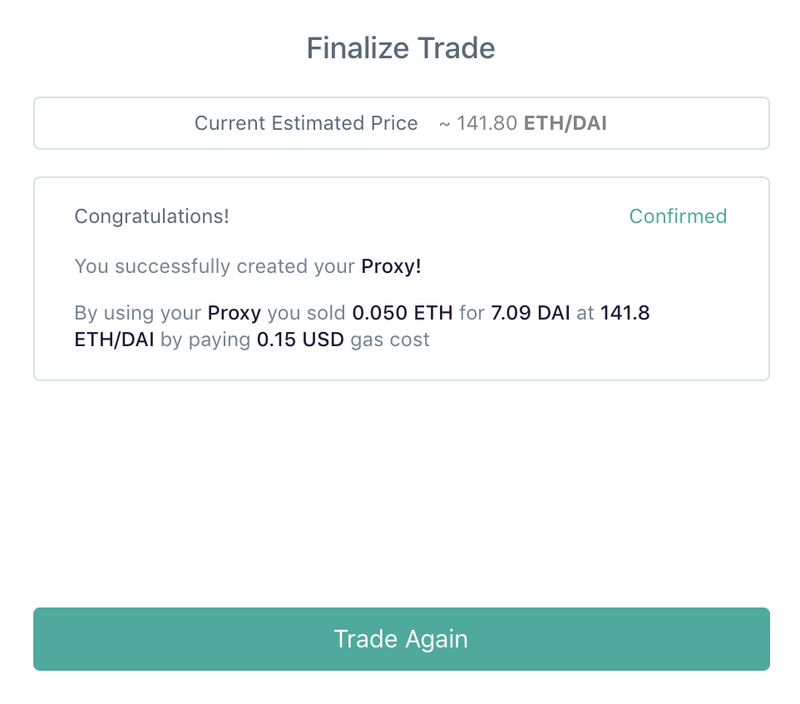

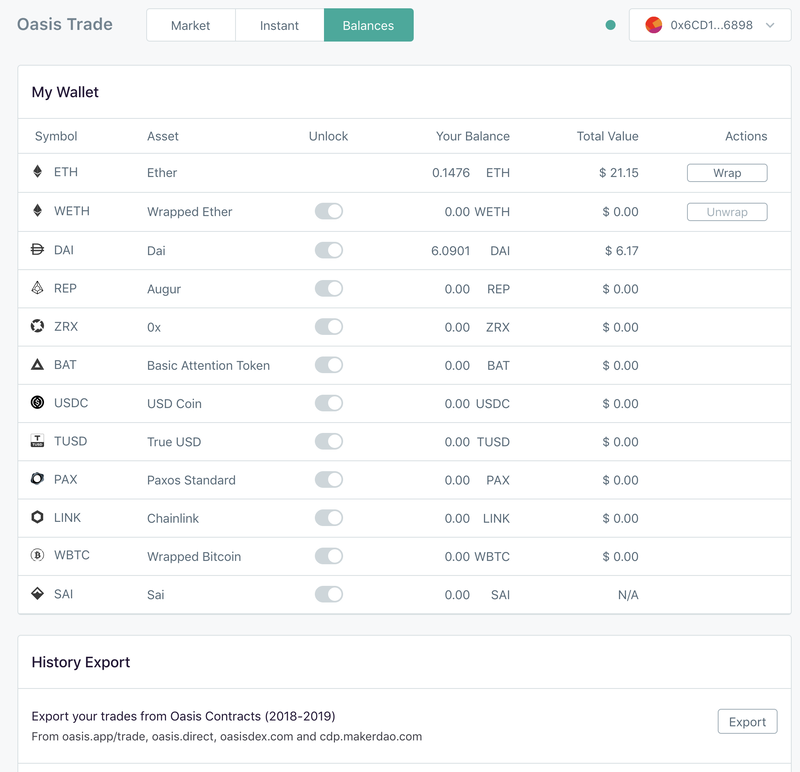

Good thing about BlockFi is relatively high interest rate. 6% BTC, 4.5% ETH which is higher than MakerOasis DAI saving rate (0% now but 6 - 8 in regular case). Maximum collateral amount is 50% e.g. 1000USD collateral to borrow 500USD but with high interest rate. it can go as low as 20% collateral. This can be used to obtain small amount of DAI without going to exchanges such as Binance, Bittrex etc. 24h Trading volume as of April 5 2020 is about 1m USD with WETH and DAI pair. There is no trading volumes for other crypto asset. If you are wondering how to gat WETH (Wrapped ETH), it is at the end of this post. 1: Go to https://oasis.app/trade/market The screenshot is "Market" tab 2: Connect to Metamask Ledger and Trezor option looks like coming soon. "Instant" tab I bought DAI here "Balance" tab

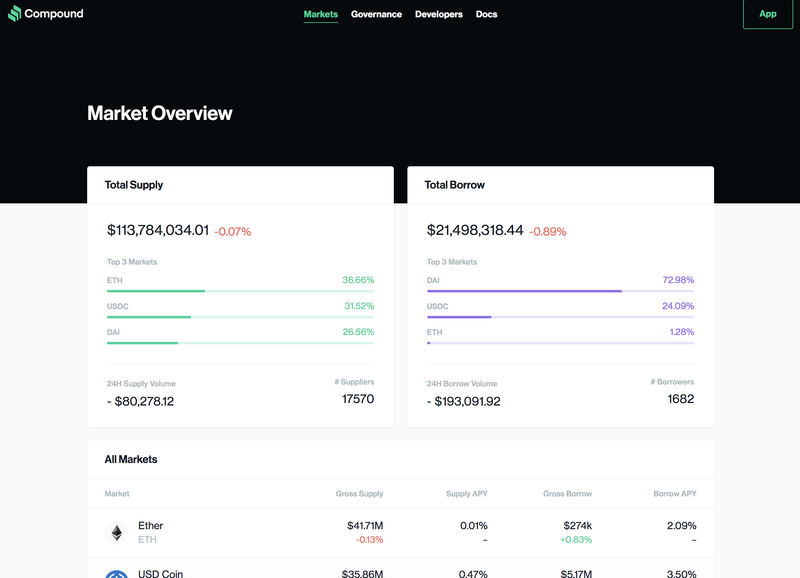

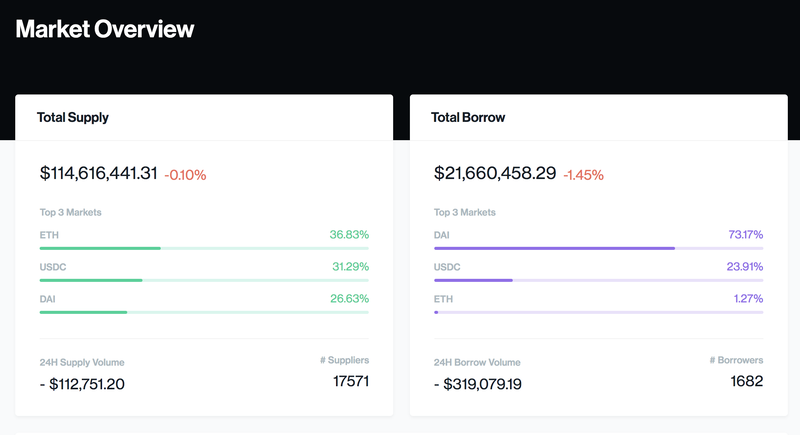

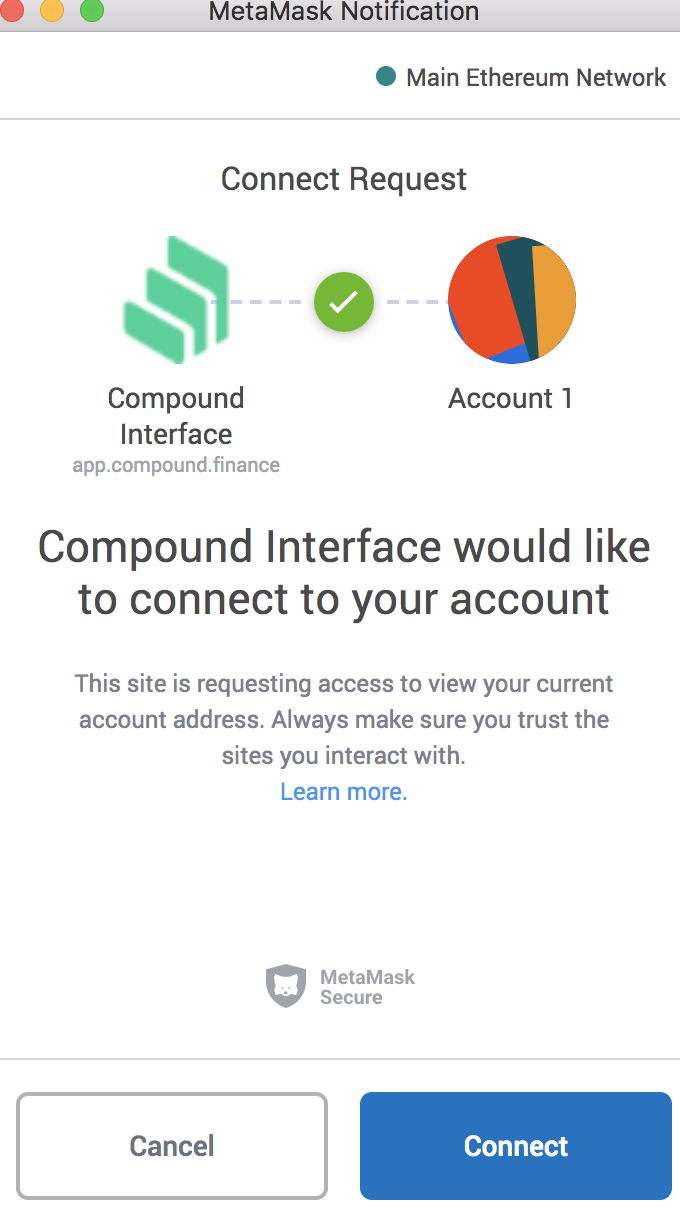

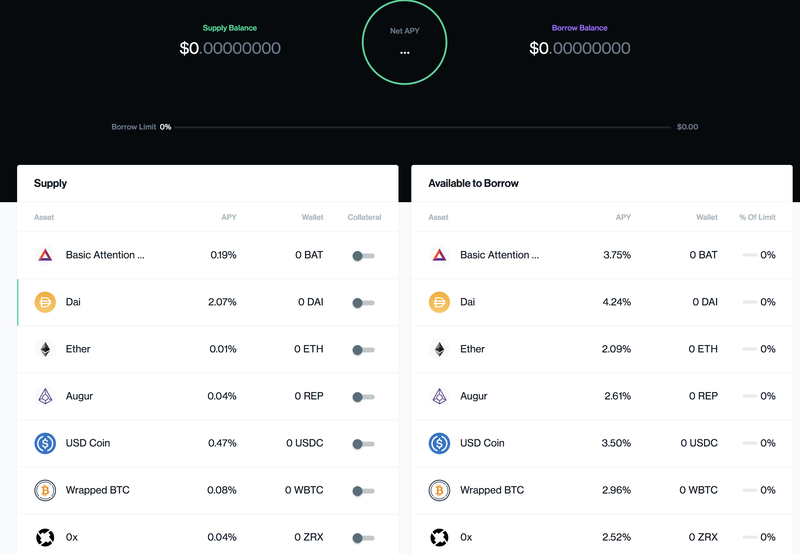

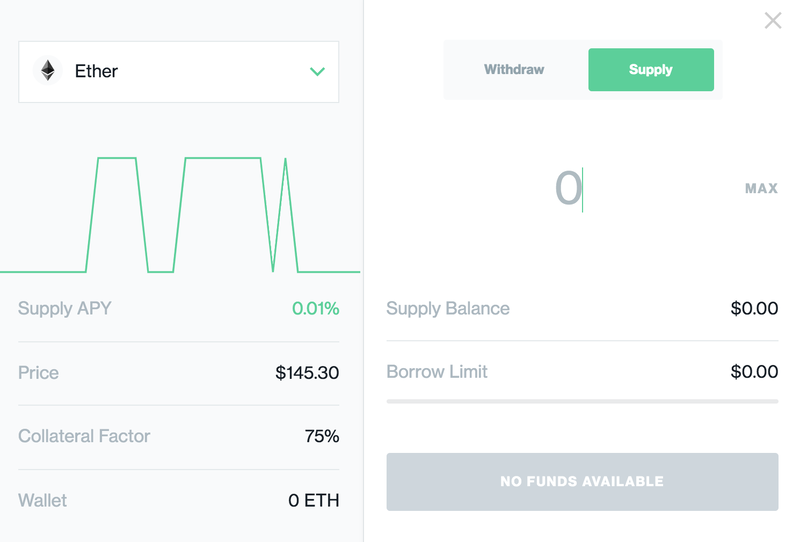

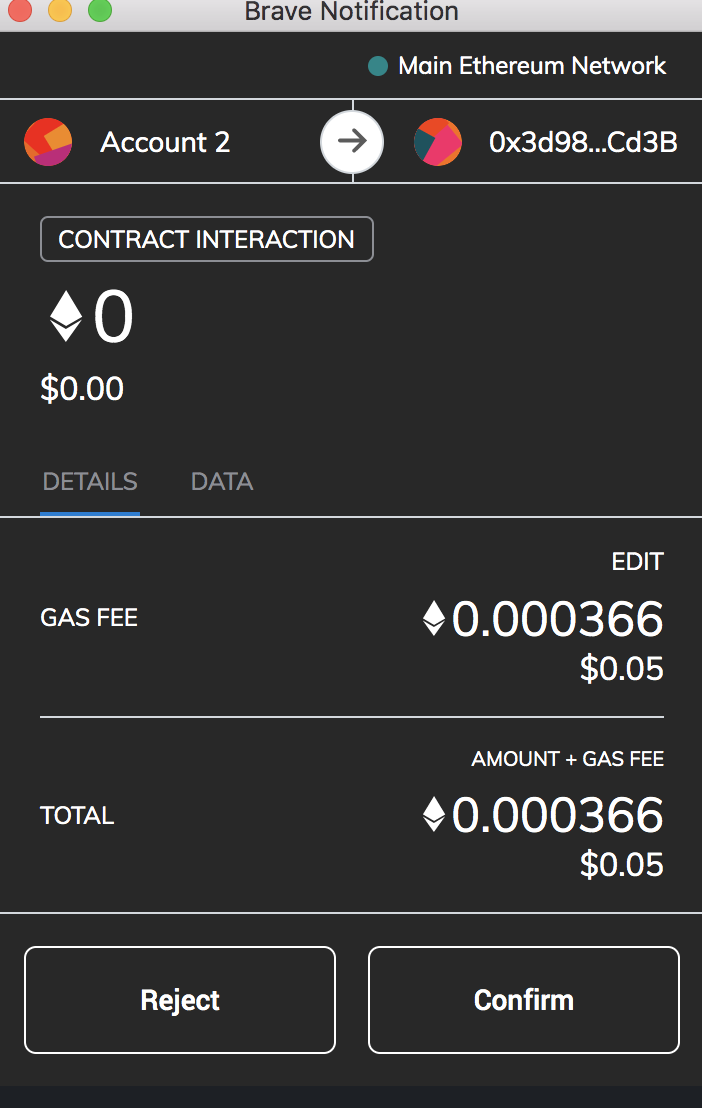

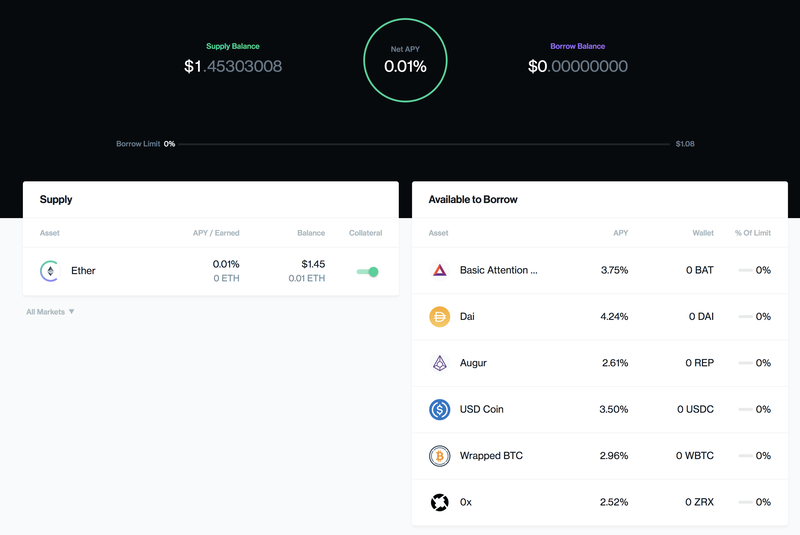

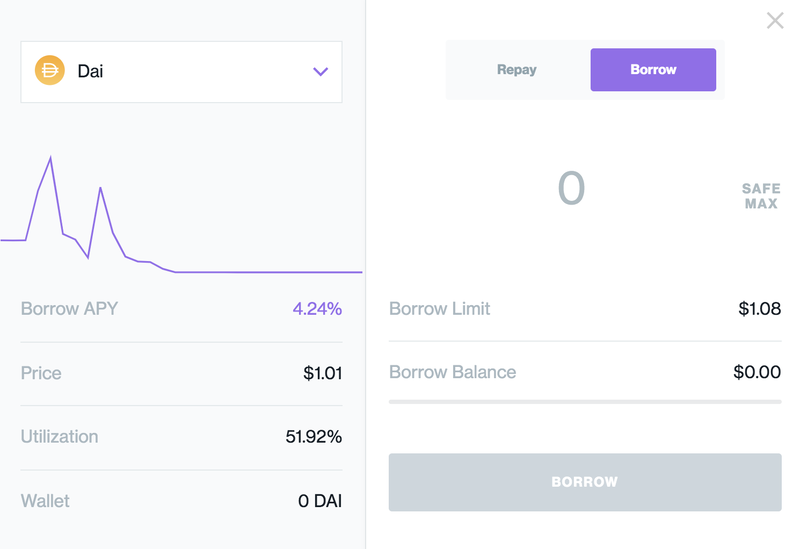

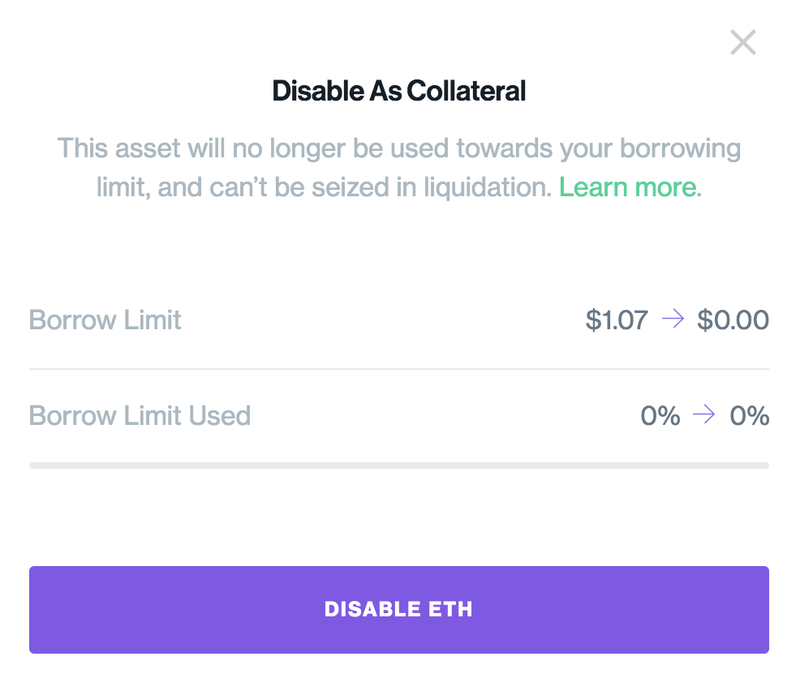

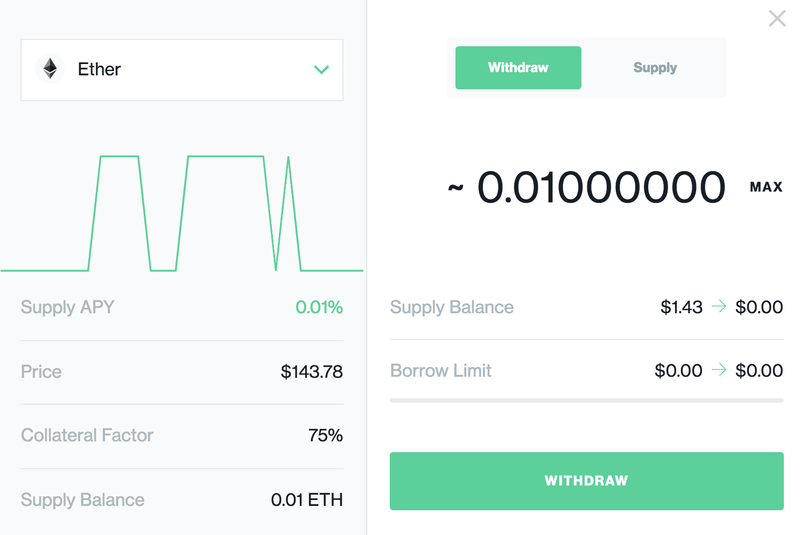

You can convert ETH => WETH here just pressing "Wrap". There is also "Export" to save your trading history so that you can work on your tax. Compound, Ethereum platform DeFi application: Compound is a platform to earn interest and borrow cryptocurrencies. This is a walkthrough of what it loos like to use. Compound website https://compound.finance/ Current market size screenshot as of April 5 2020, 114m USD total supply, is not big. Earn interest by locking ETH (or other asset you choose) as collateral 1: Go to https://app.compound.finance/ 2: Connect to your wallet I am using Metamask for this walkthrough. Current market asset and APY (Annual Percentage Yield) below, 0.01% interest by collaterizing ETH.. Not much. 2.07% for DAI 3: Click Ether to deposit Collateral factor: Percentage of asset collateral price that you can borrow e.g. 1000 USD ETH collateral = you can borrow 750 USD of asset. It is different each crypto asset. e.g. Augur = 40% For more info: https://medium.com/compound-finance/faq-1a2636713b69 Metamask or your connected device will ask you to confirm the transaction. The screen it looks like this now. Yes I deposited only a little. That's it. I can earn 0.01% of annual interest now. Additionally, this is what it looks like to borrow. Click Dai in the "Available to borrow" and you will se below. APY is 4.24%. I have disabled as collateral at the end of this tutorial and withdrew to Metamask.

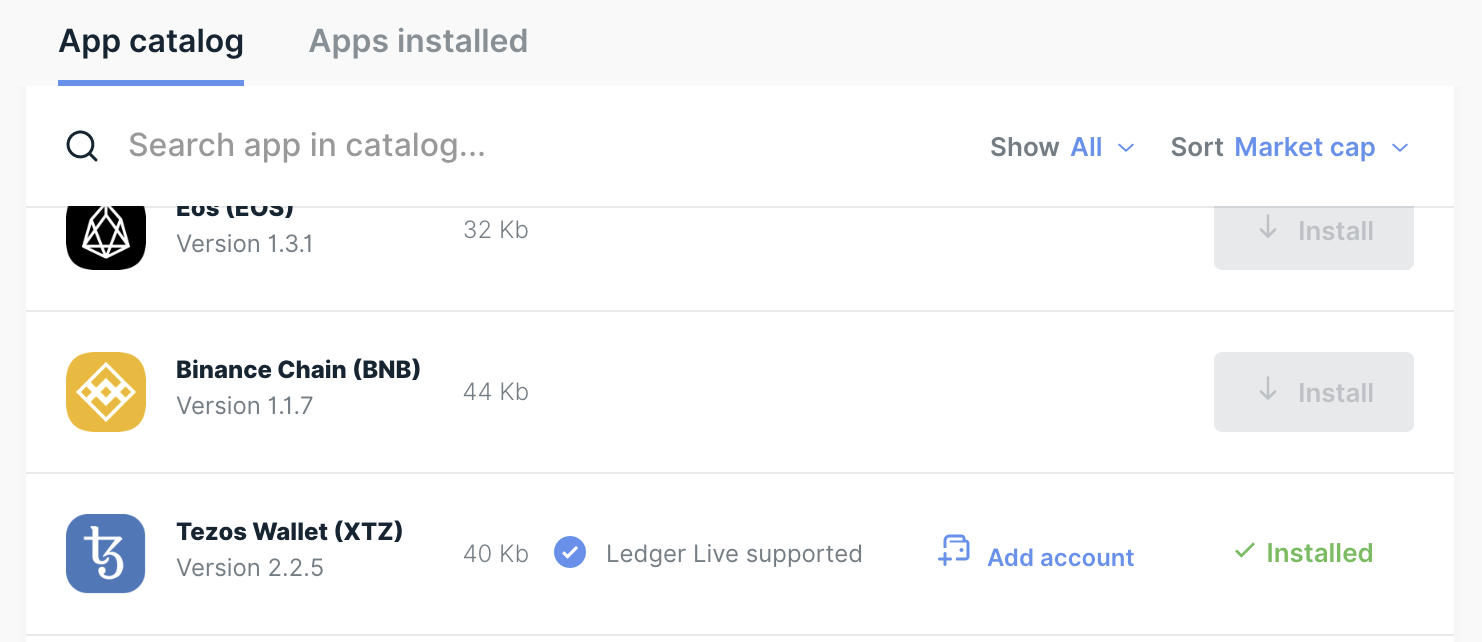

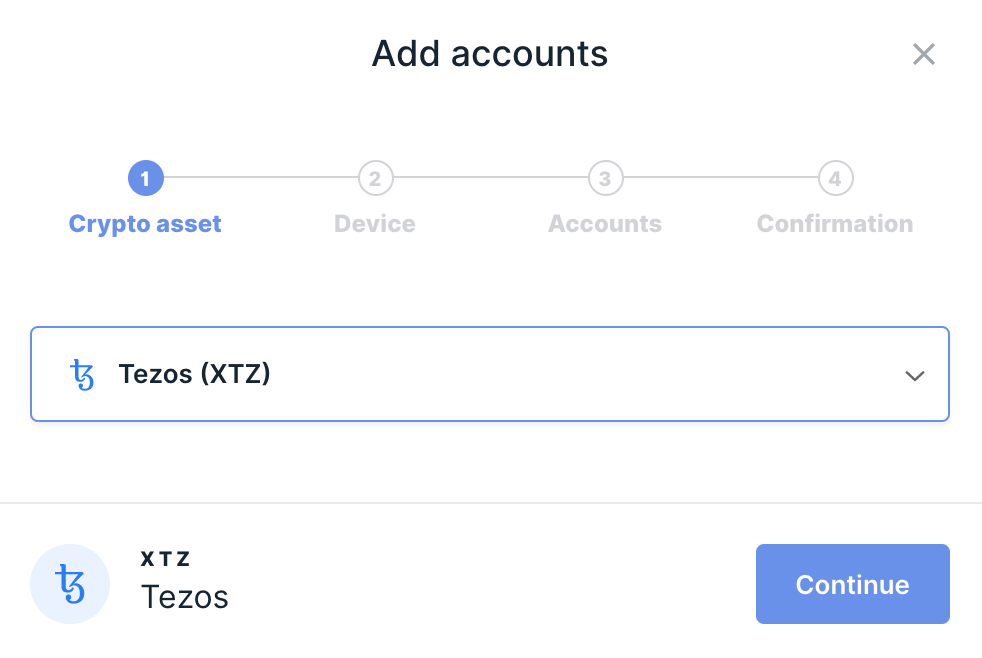

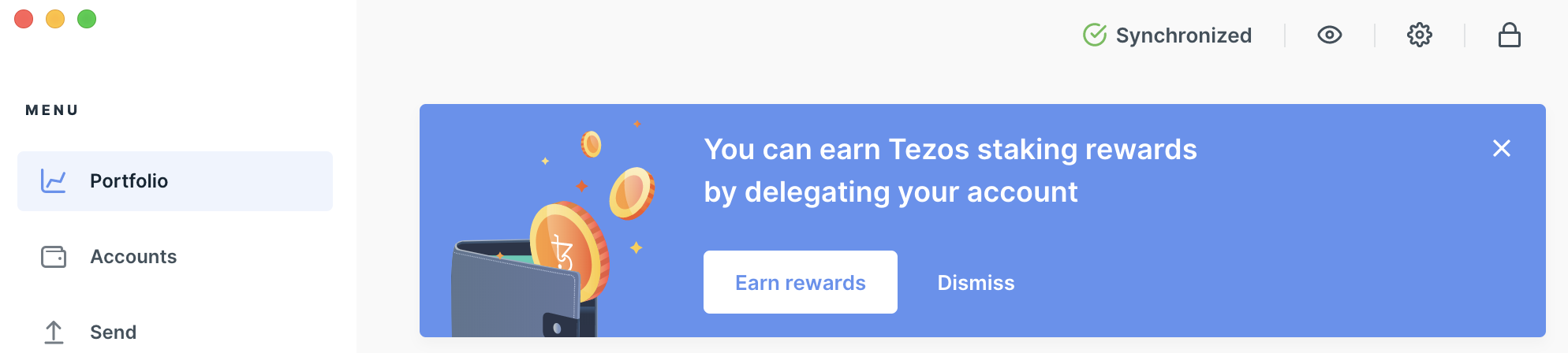

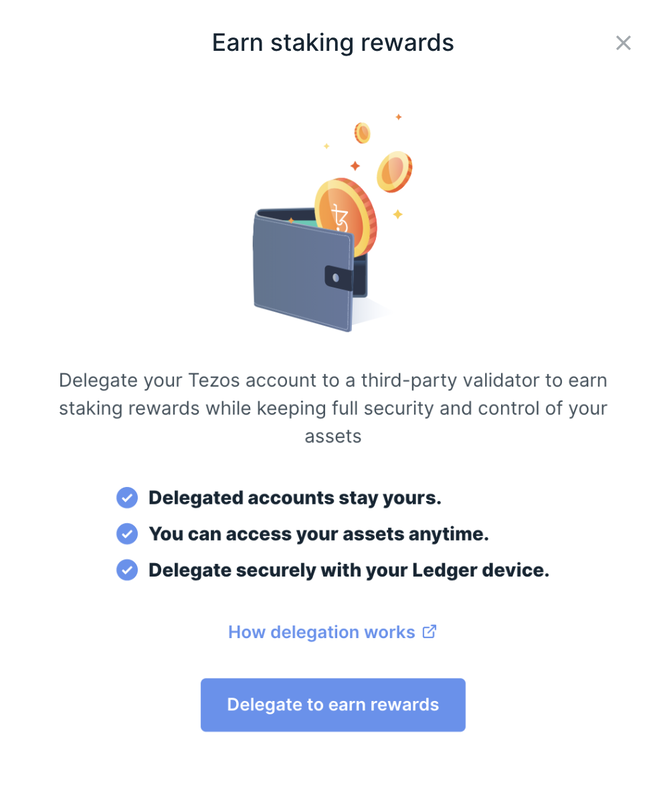

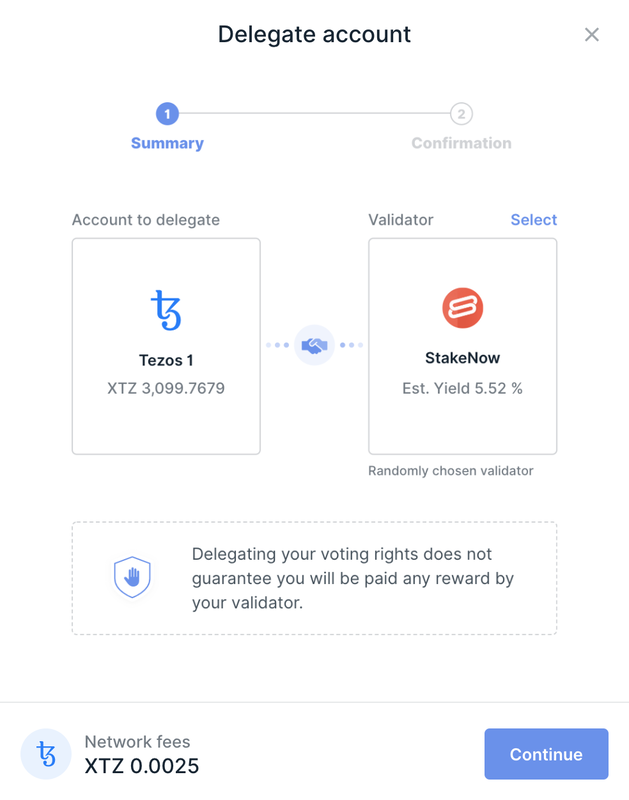

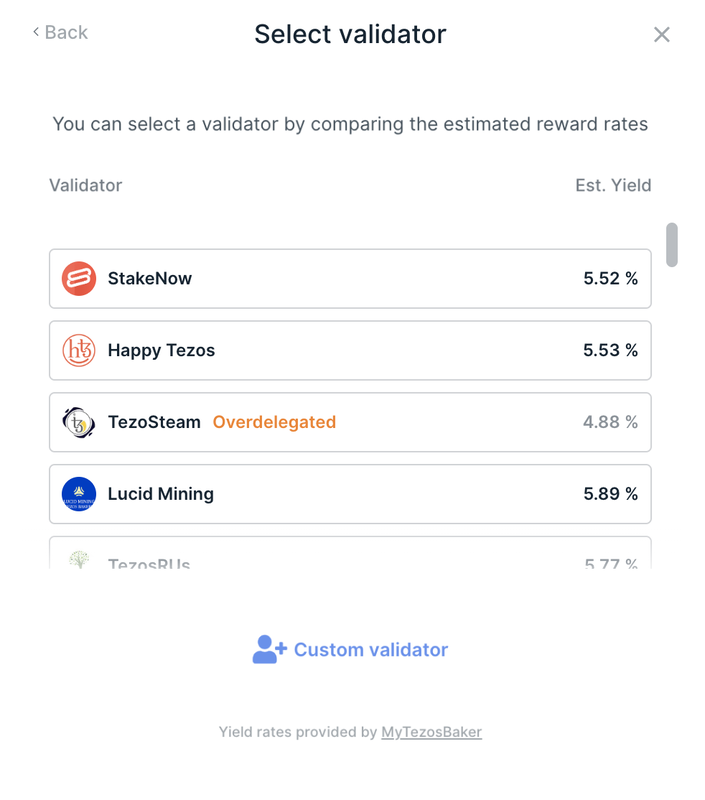

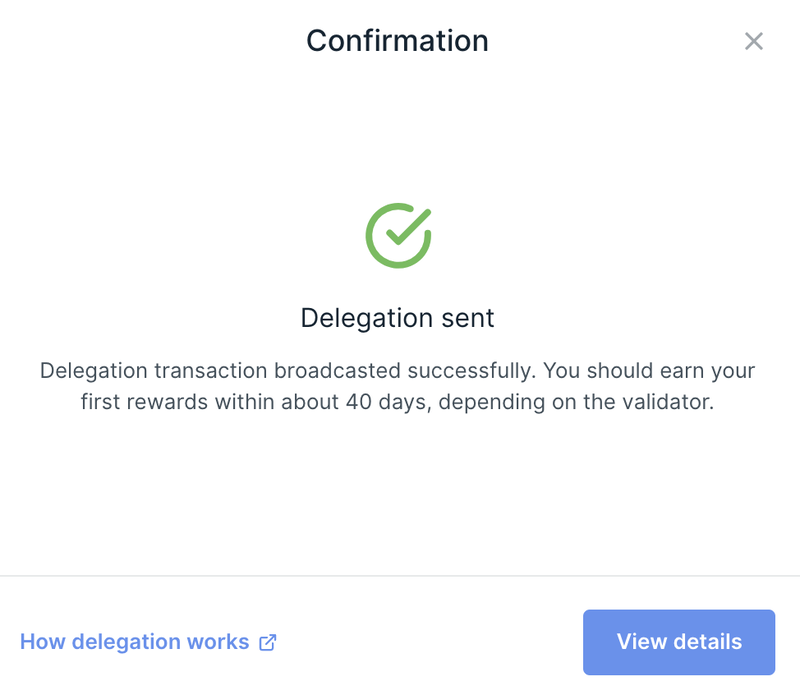

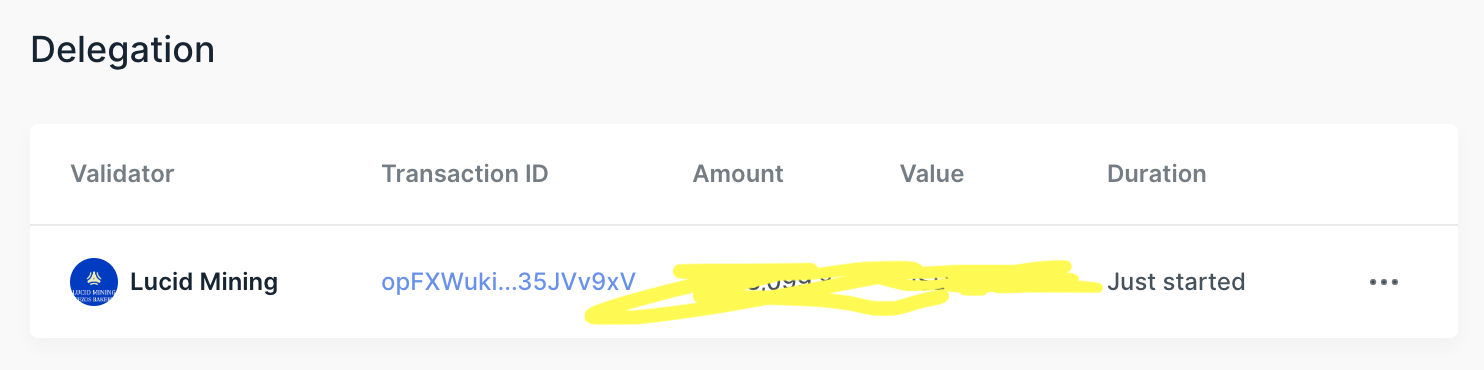

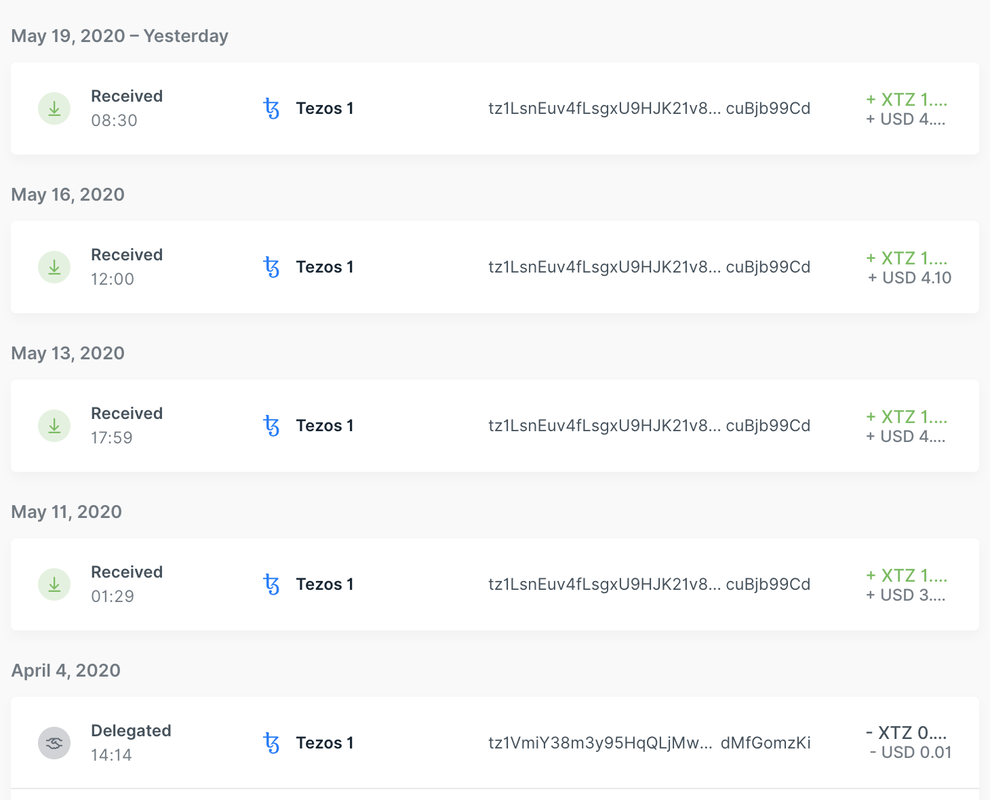

Tezos staking with Ledger hardware wallet tutorial: Tezos website: https://tezos.com/ You can estimate how much you can earn by staking here. https://www.stakingrewards.com/asset/tezos Other staking coins list is below. https://www.stakingrewards.com/ Tezos staking with Ledger https://www.ledger.com/staking-tezos/ Here is the walk through what it loos like. 1: Get Tezos (XTZ) Buy at exchange 2: Install Tezos app on ledger live 3: Create account 4: Send XTZ to your account 5: Start staking 6: Choose stake pool Annual interest is about 5% - 6%, this is probably the most important part. Here is the link for some source of pools https://www.mytezosbaker.com/ Done! You can see the delegation on Ledger live now. First payout is in 40 days. This is what looks like after a month. Staking reward every 2-3 days. I am not going through how to operate staking pool but here is the link.

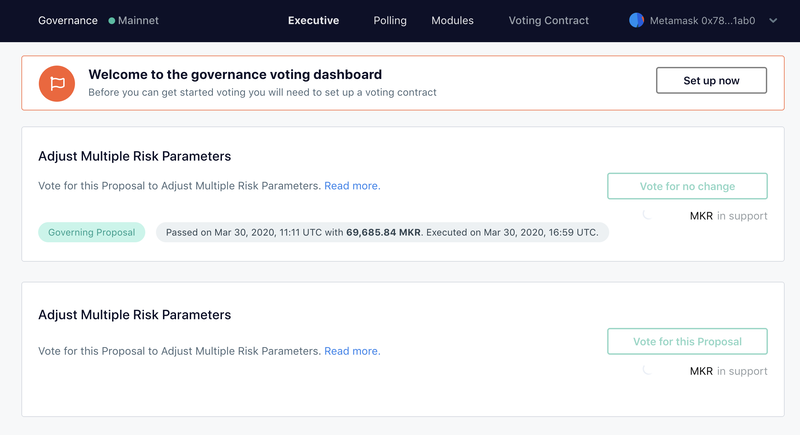

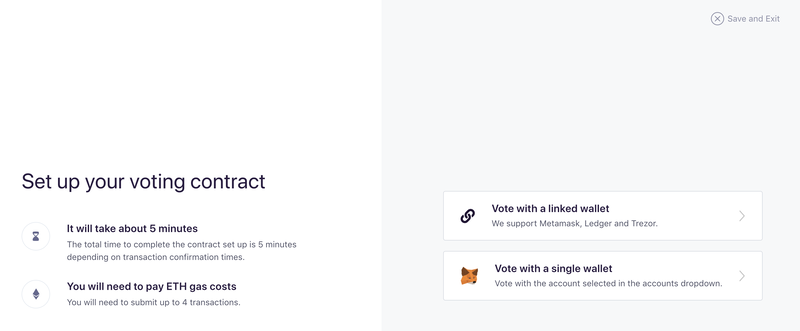

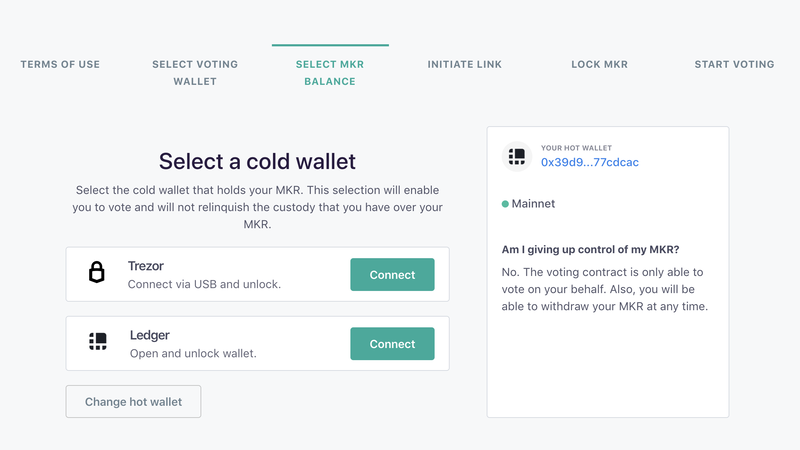

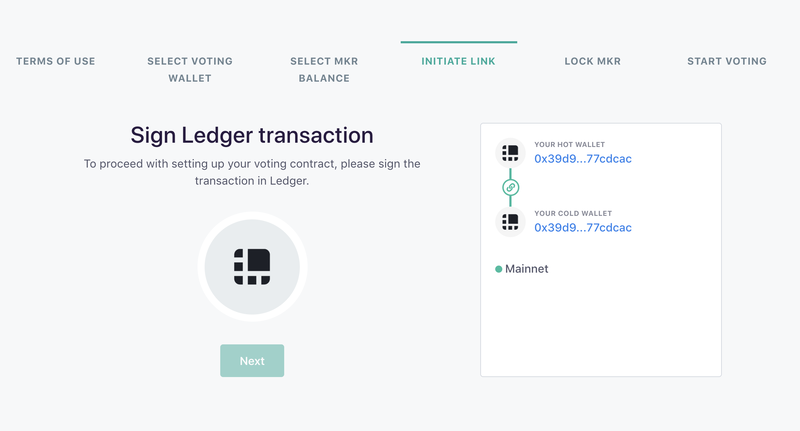

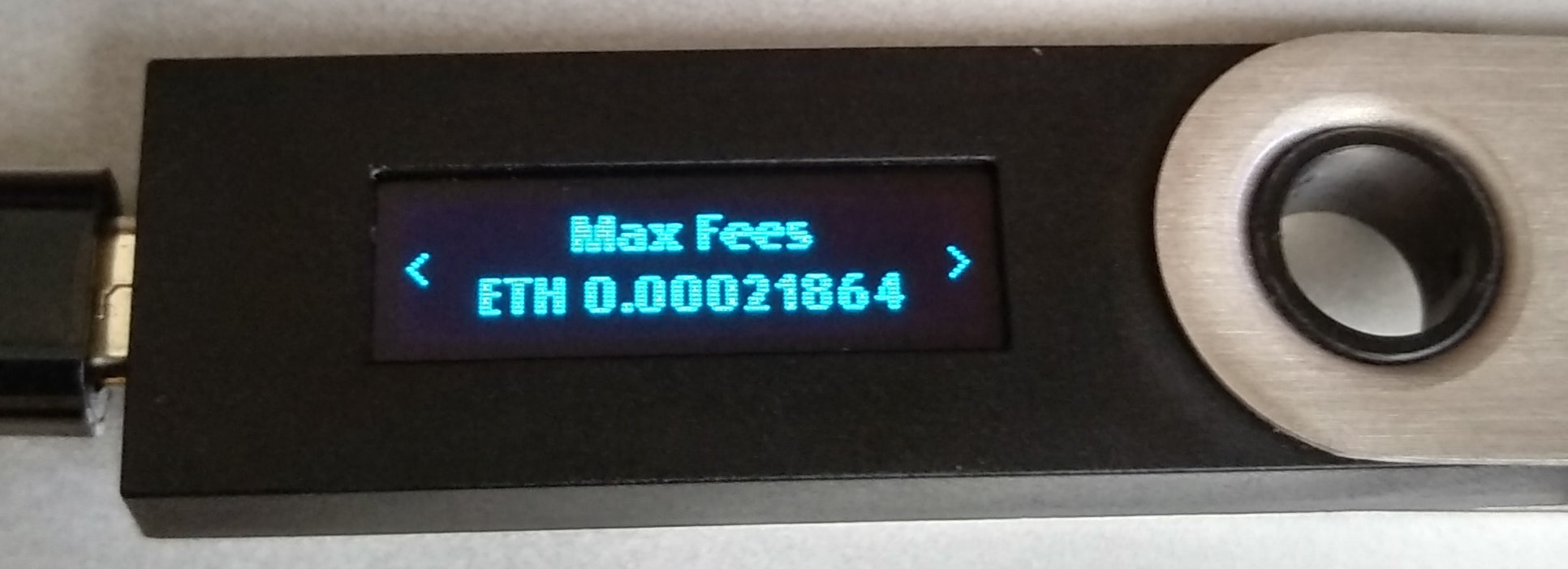

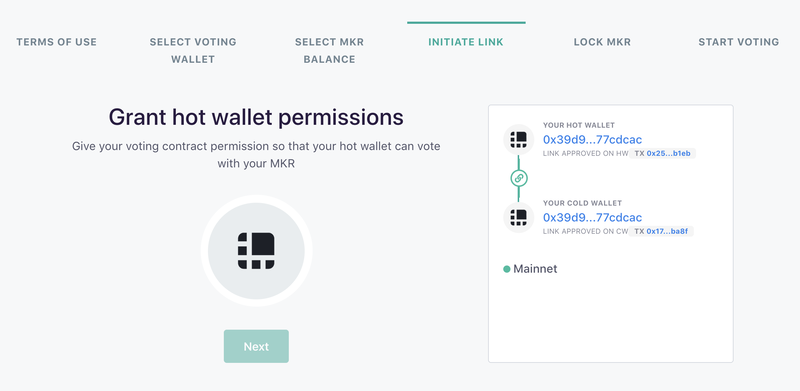

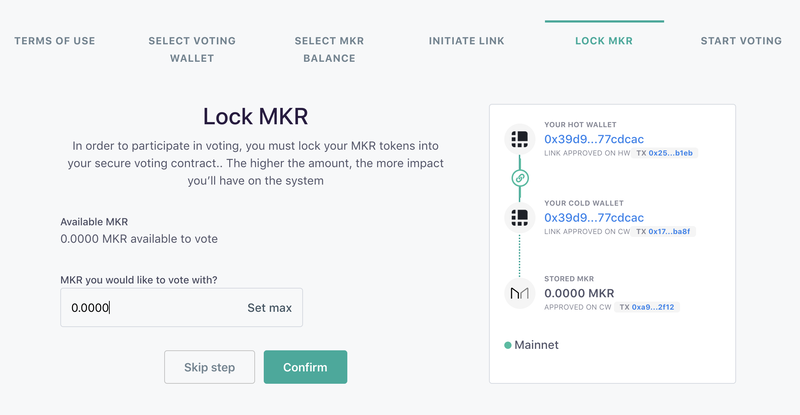

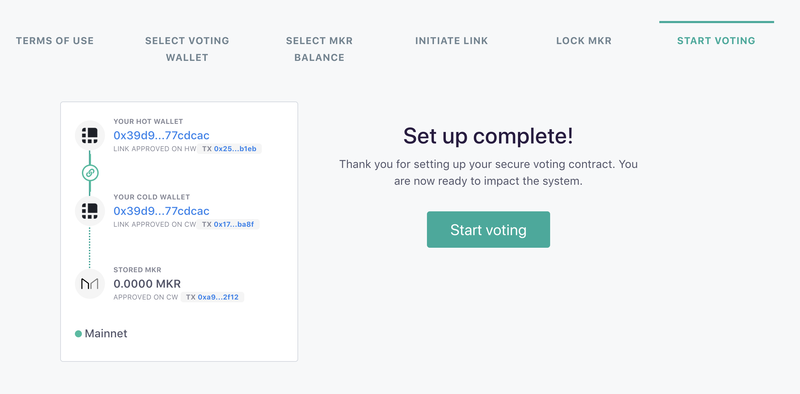

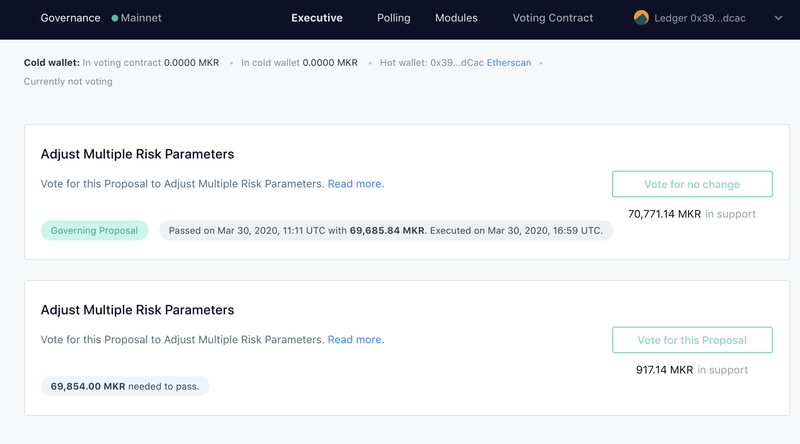

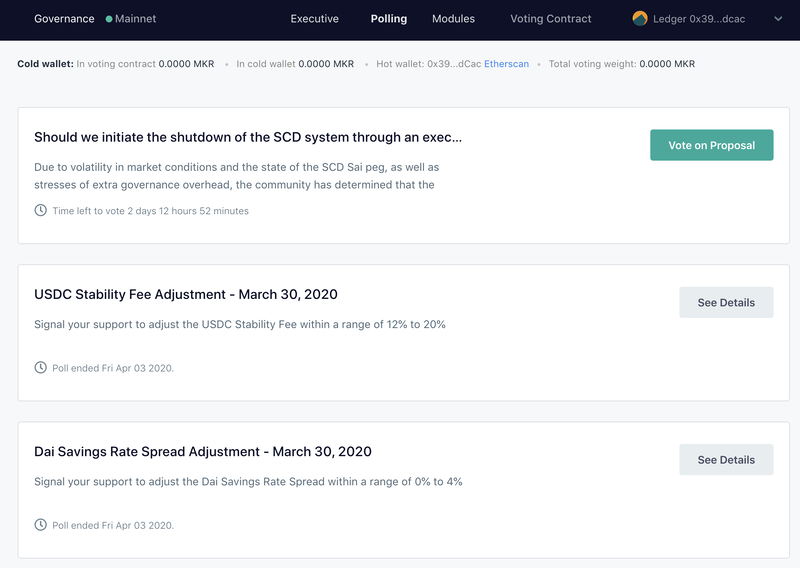

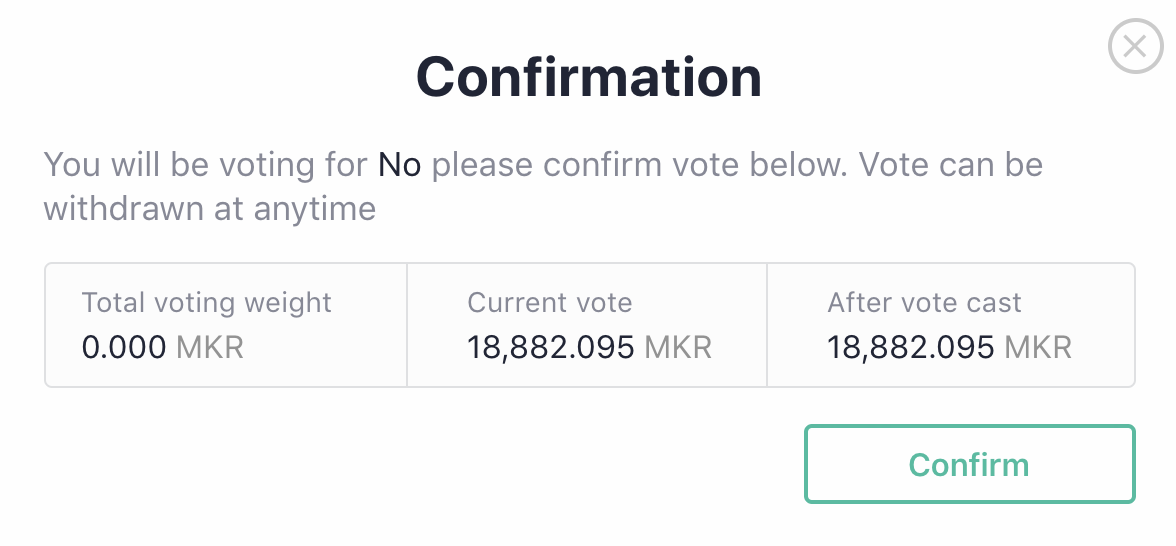

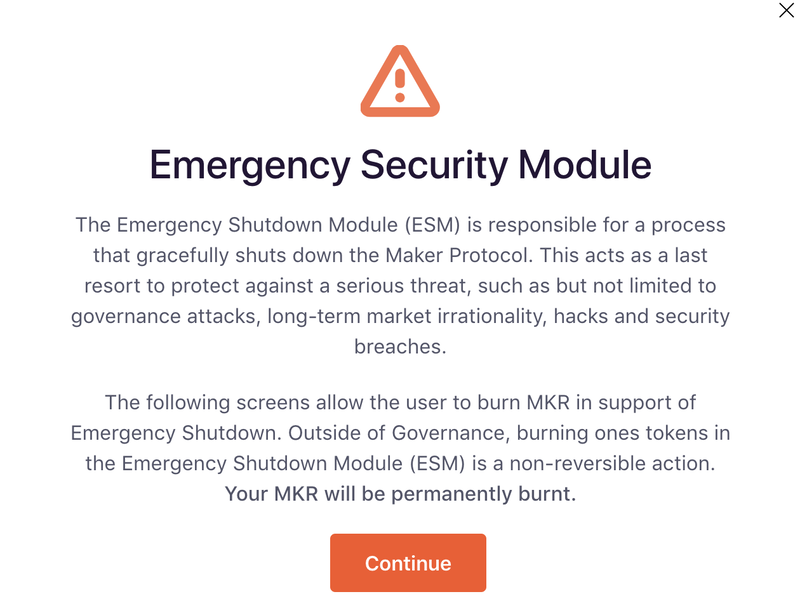

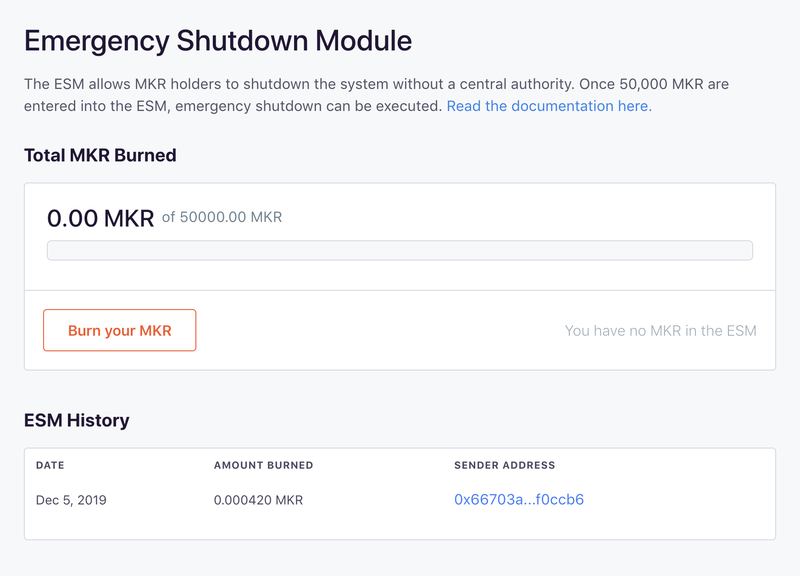

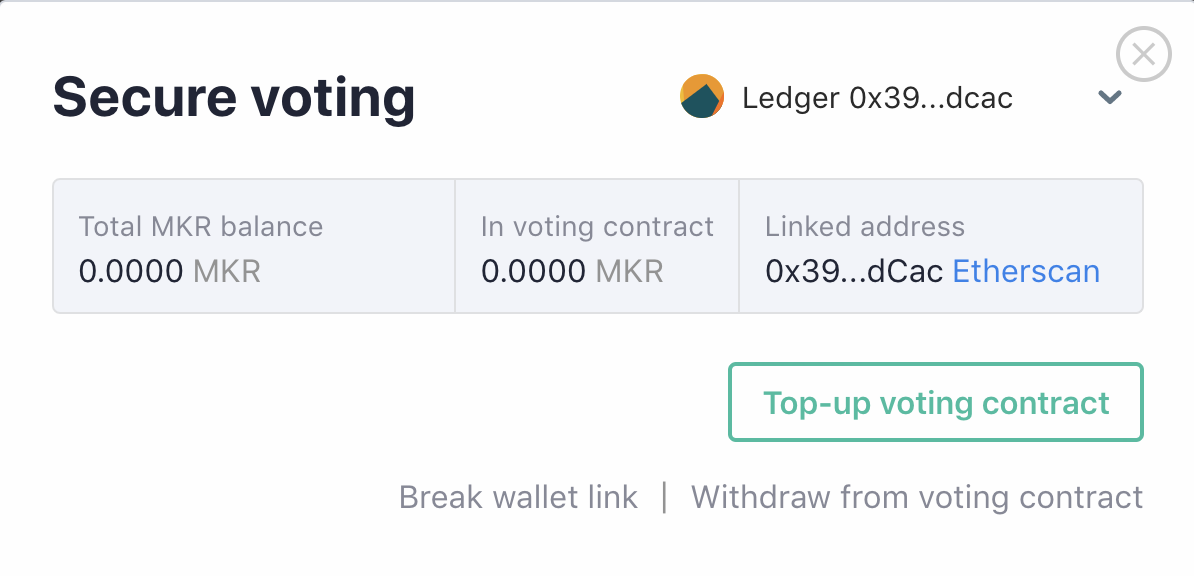

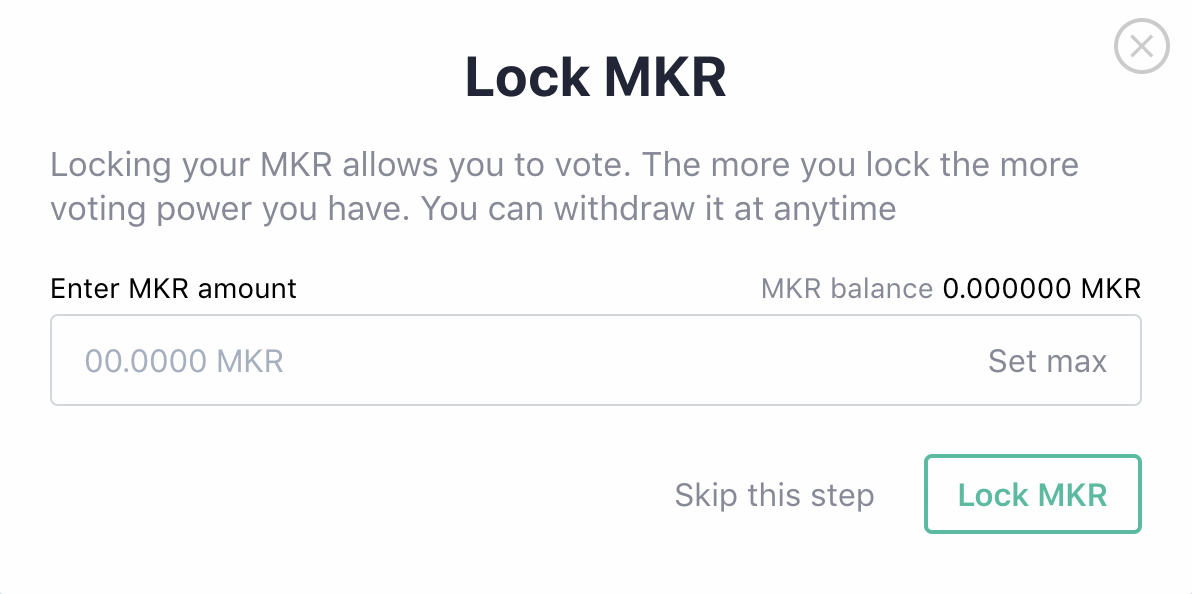

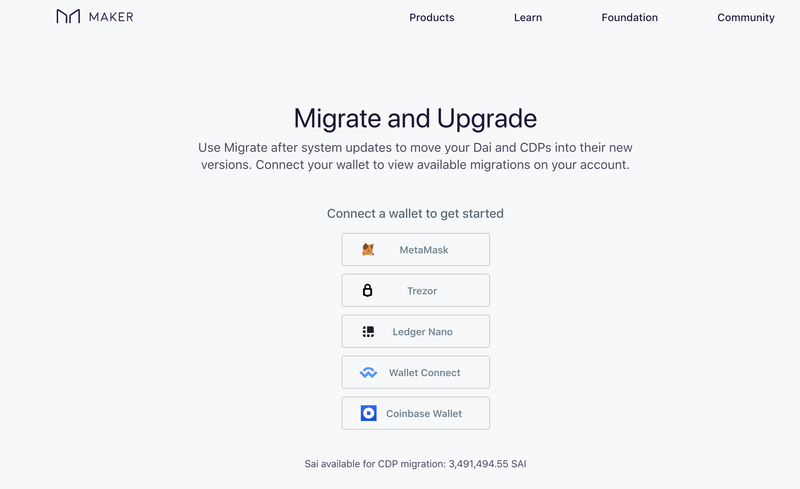

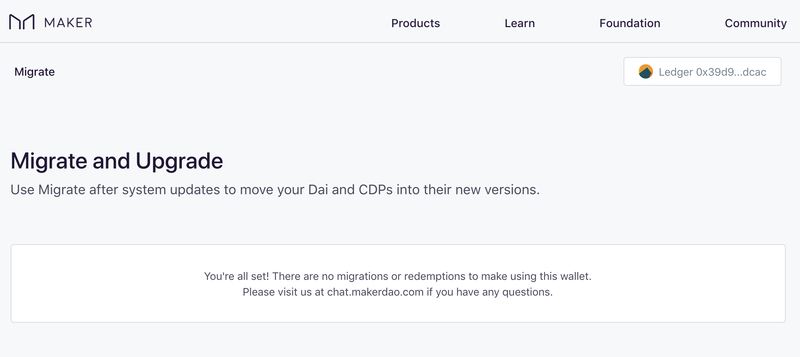

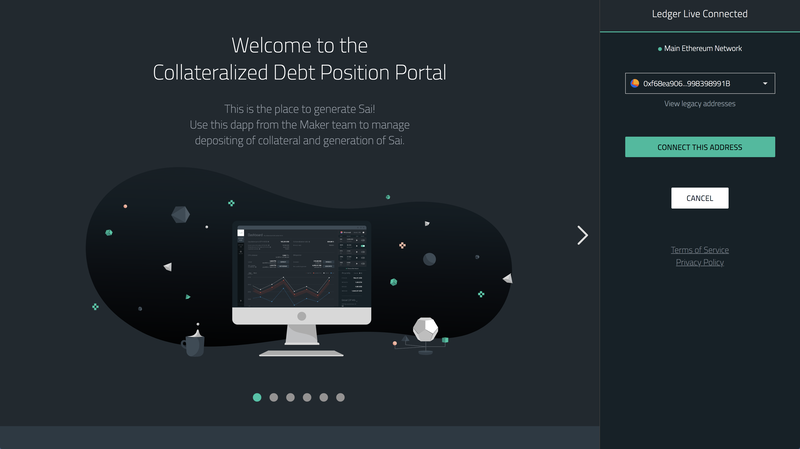

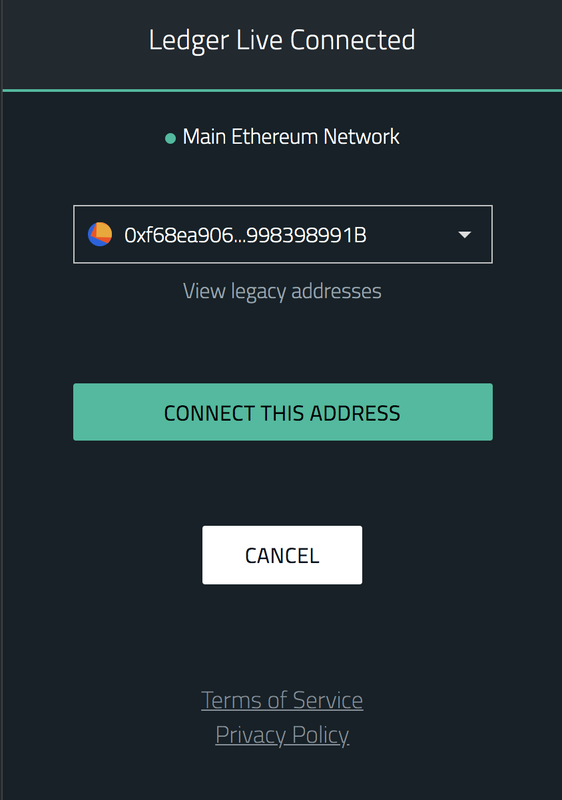

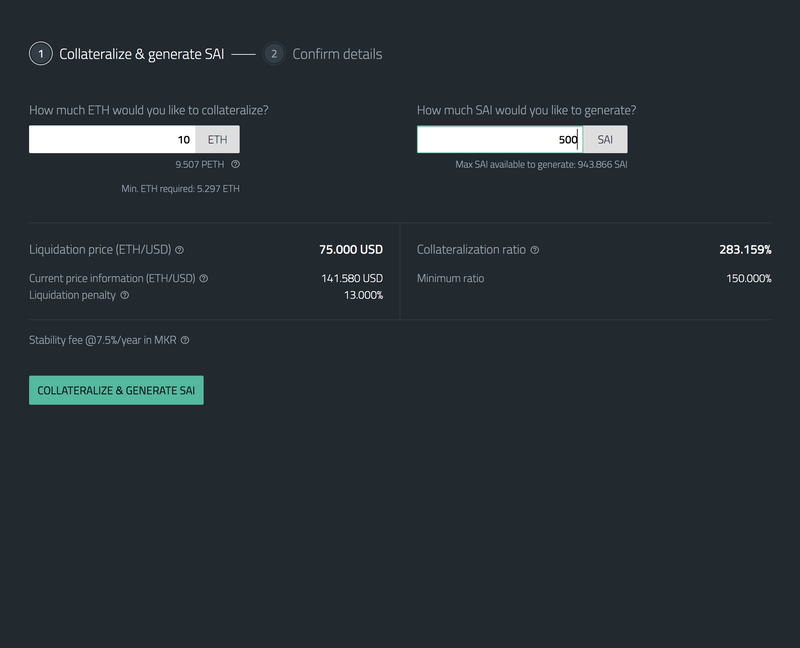

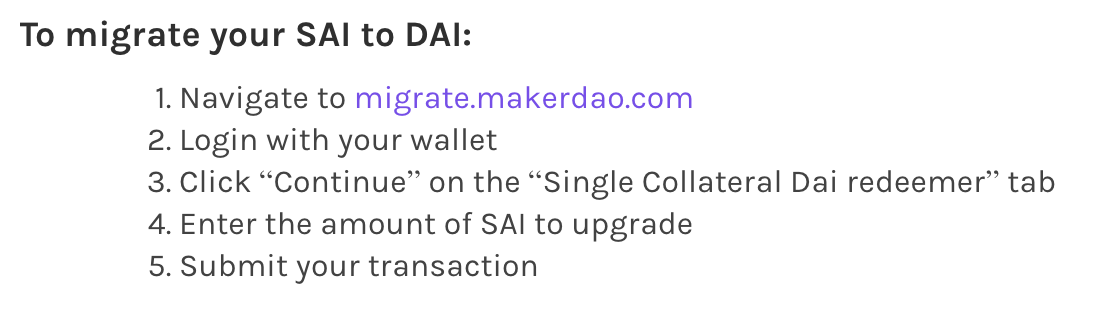

Check "Bake (Validate)" https://tezos.com/get-started Developer installation: https://assets.tqtezos.com/docs/setup/1-tezos-client/ These are other applications from MakerDAO. Maker Governance. This is a voting system as MKR token to be used as voting power. 1: Governance https://vote.makerdao.com/ (I am using ledger HW and choose "Ledger legacy", you can also choose Metamask etc) These are how to connect with ledger Choose "Ledger" This is how much GAS costs for each execution at the time of writing. 0.00021864 ETH = $0.03 USD I skipped this below as I don't have MKR. Done! This is what it looks like now. I will go through each tab. Executive: Important proposal such as governance. You can't vote without MKR. Polling: Other proposals. I managed to vote without MKR. Module: Kill switch in case of emergency which requires 50,000 MKR to burn (Total circulation, 1,005,949 according to coinmarketcap.com). This is possible if MKR isn't decenterized enough? I don't see the point though other than wasting money. Voting contract: To lock MKR in the voting contract I will need to get MKR and lock here to vote on executive governance vote. This is to upgrade SAI to DAI. You have nothing to do if you don't have SAI. You will need to upgrade in case of future change. 3: SAI CDP Portal https://cdp.makerdao.com/ You do not need to do anything here. This is for someone previously collateralize SAI and need to upgrade to DAI. Information about SAI and DAI:

https://defipulse.com/blog/what-is-sai-where-is-my-dai-migrating-to-multi-collateral-dai/ |