|

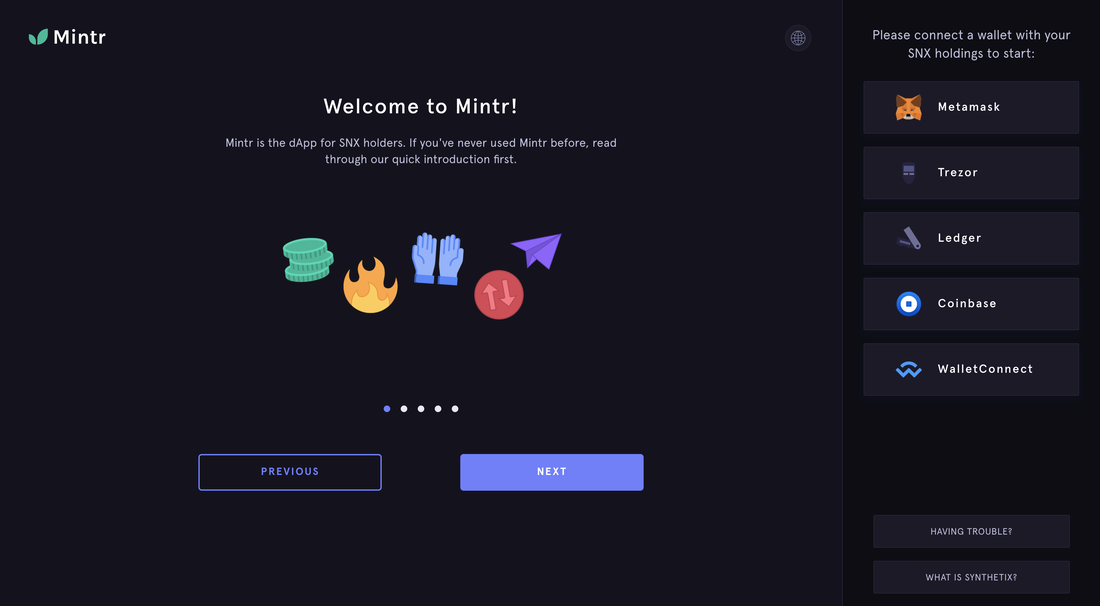

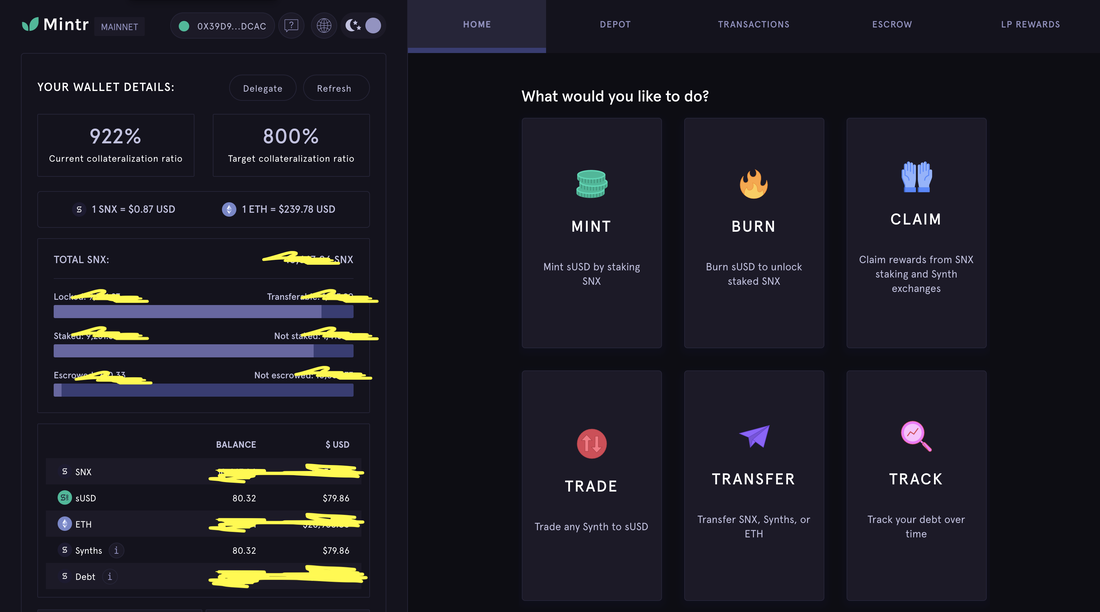

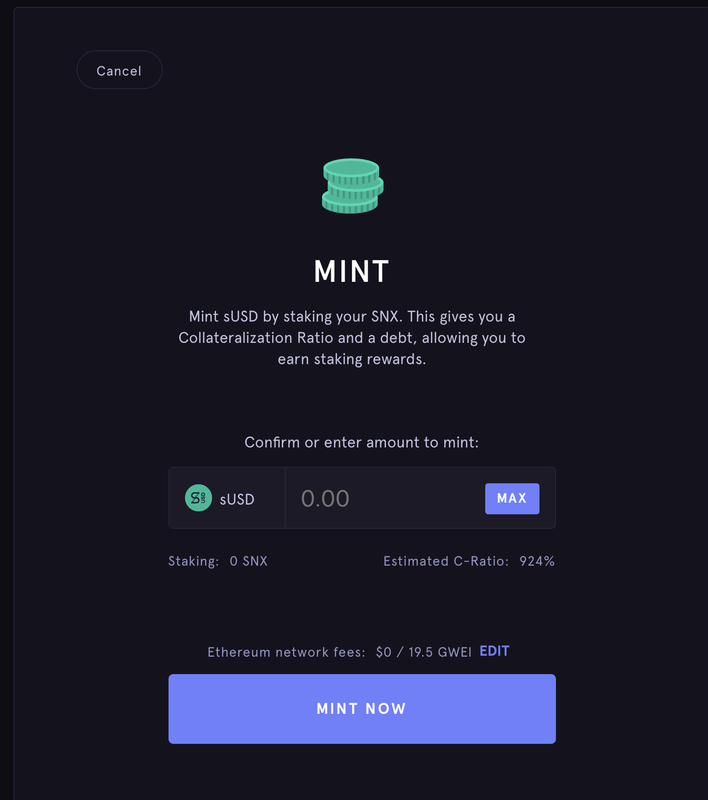

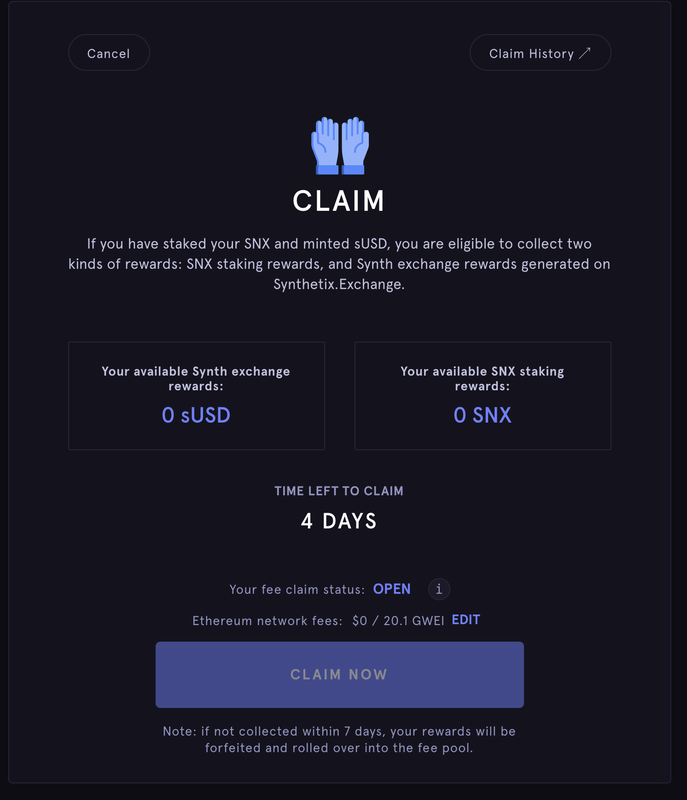

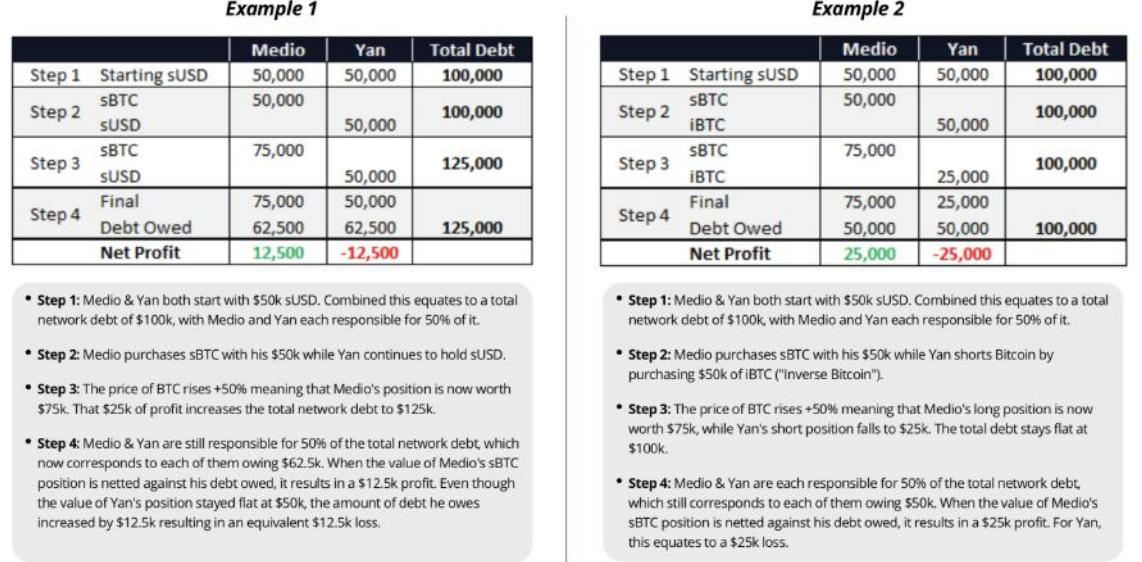

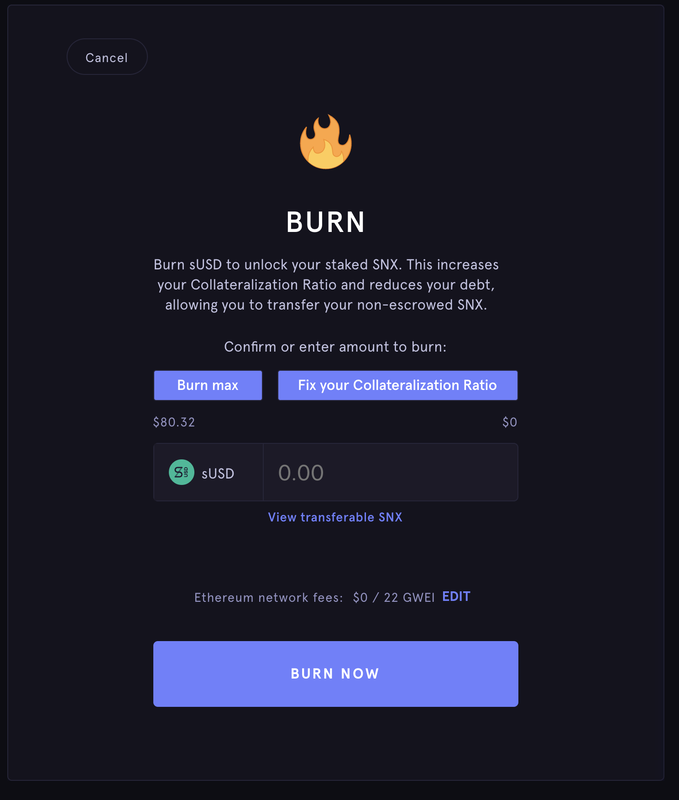

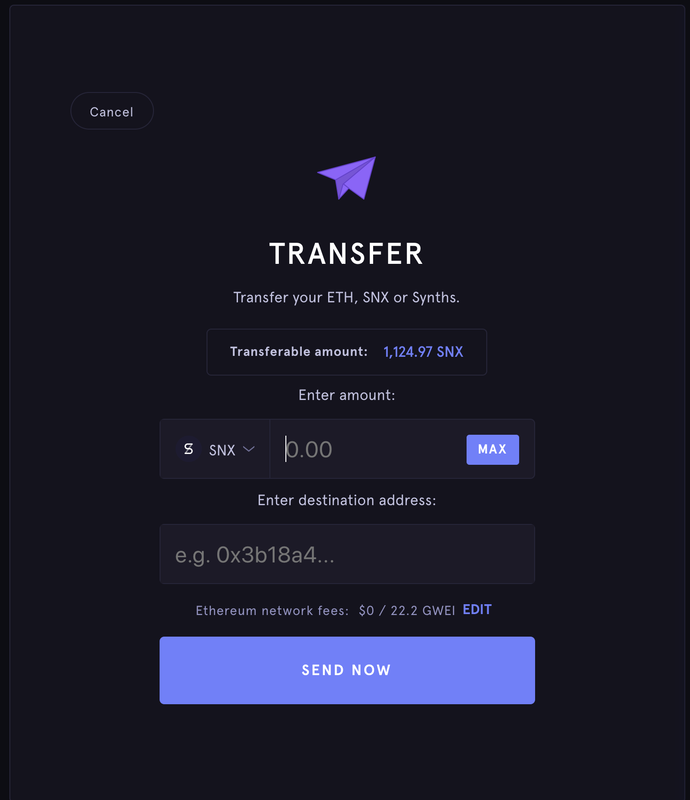

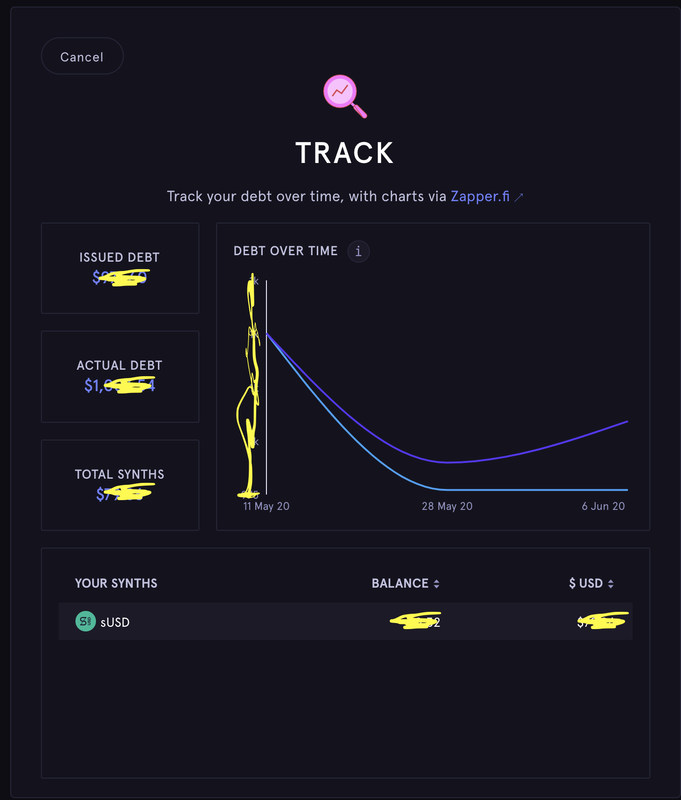

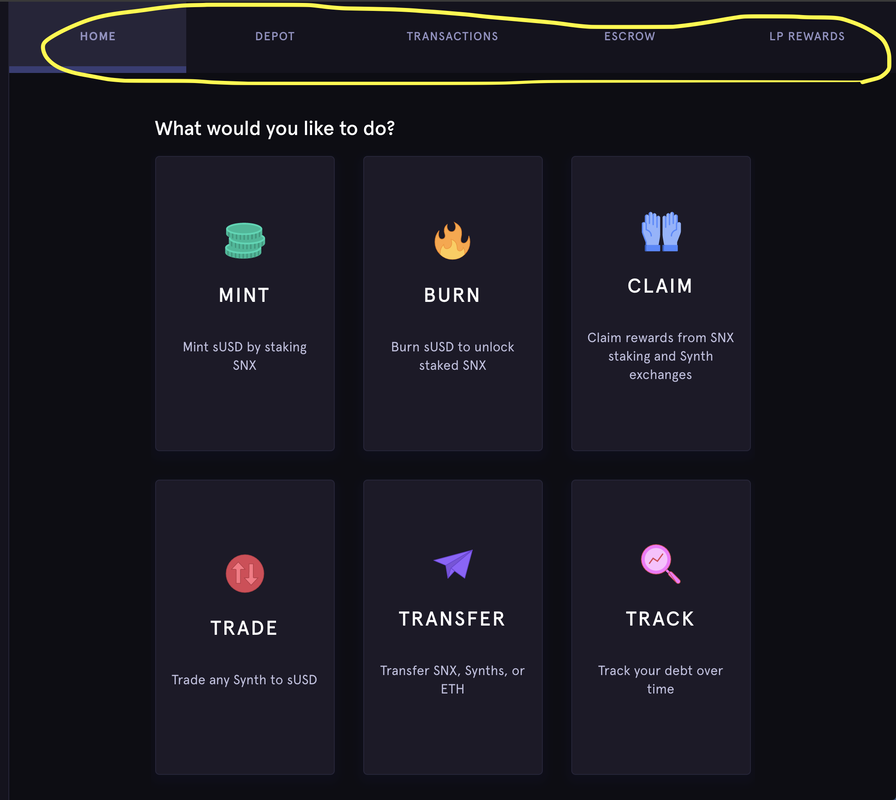

Synthetix staking and basic functions (There are "Exchange", "Mintr" and "Dashboard".) https://www.synthetix.io/ It is high staking reward, one of the highest as you can see from the link below. https://www.stakingrewards.com/asset/synthetix-network-token I am going to talk about Mintr to focus on staking for what it looks like, how it works and risk. I spent some time on this staking rewards and this is the result. 1: Go to https://mintr.synthetix.io/ And connect to your wallet with ETH and SNX. It looks like this below after connecting to your wallet. 2: Go to "MINT" And stake SNX by minting sUSD. It will be locked for 24 hours in the current rule. This adds liquidity pool of their "Synthetix" exchange and you can check at "Dashboard". Current minimum collateralization ratio is 800% (792% to be exact to claim reward) which means you mint sUSD 1/8 of staking SNX USD value. Your minted sUSD also goes to debt in other words you need to pay back the debt to unlock the staked SNX. I will explain these more later. 3: Go to "CLAIM" This is to get paid with your staking. The payout is on every Wednesday 10:00 UTC and 1 week to claim the reward. You will lose the reward if you didn't claim. ***Note that the claimed SNX is locked for a year. *** It would be necessary to forecast the market in a year. If you think it will be gone in a year and you should not be staking. Collateralization ratio needs to be higher than 800% to be able to claim. The ratio can be changed by the price of SNX as liquidity pool increase/decrease. You will need to burn sUSD to add Collateralization ratio if it is lower than 800%. This is how it works below. https://www.synthetix.io/uploads/synthetix_litepaper.pdf Liquidity pool increase = SNX and sETH price increase Liquidity pool decrease = SNX and sETH price decrease sUSD price is stable = Ratio of debt goes high/low of total liquidity. In general, it is good to have SNX or sETH when the market is going up, and hold more sUSD when the market is going down. 4: "BURN" Click "Fix your Collateralization Ratio" to be able to claim if your ratio is not enough. And also pay off all the debt by burning sUSD to unlock the staked SNX. 5: Other functions "TRADE" Not available as of June 6 2020. Go to "Exchange" instead. "TRANSFER" As it says, transfer SNX. Nothing much. "TRACK" To track your debt, minted sUSD by staking SNX Finally to talk about these tabs. "DEPOT" stands for deposit to sell your sUSD for ETH. You can do it as their exchange and also Uniswap and other DEX.

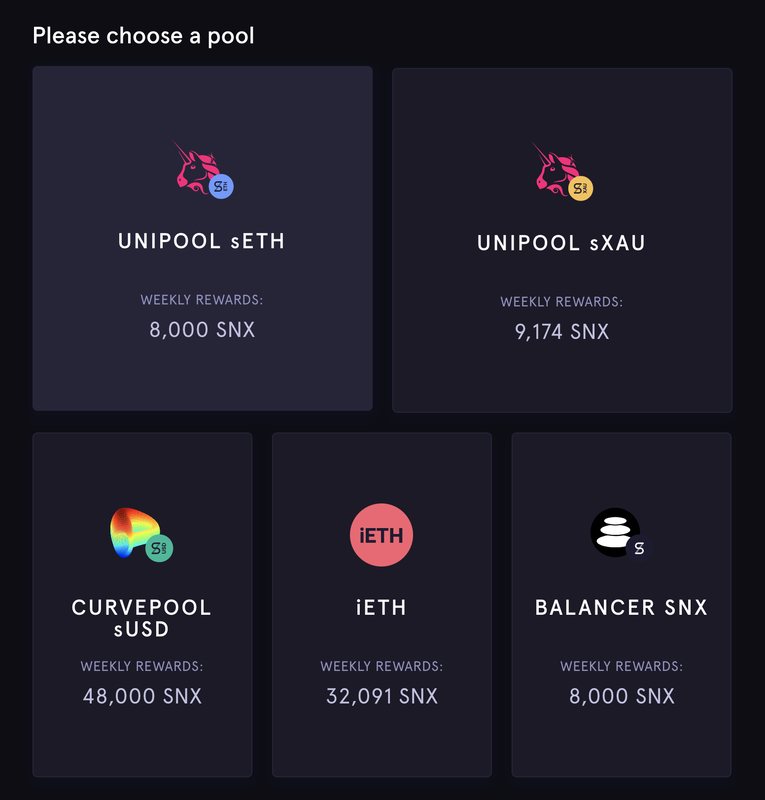

"TRANSACTIONS" shows your previous related transaction such as mint, burn, claim, depotsit and sell sUSD etc. "ESCROW" is to escrow rewards SNX therefore nothing you can do for a year. "LP REWARDS" is an interesting part that you can add liquidity to Synthetix exchange by Uniswap and other things which are more complex. The options are below. Comments are closed.

|