|

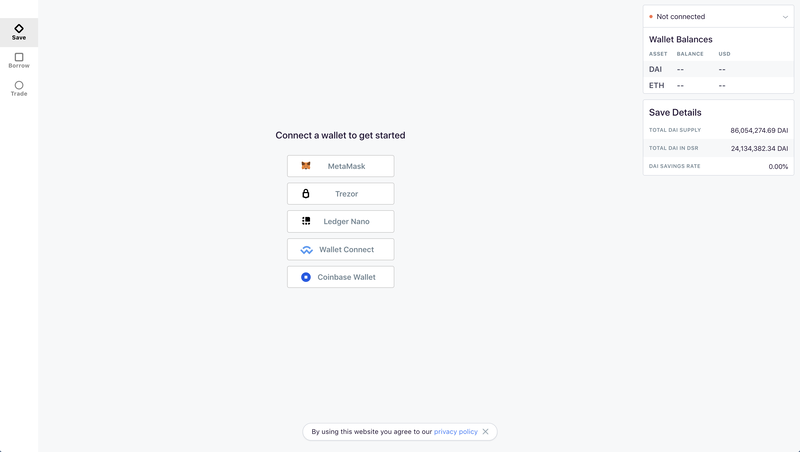

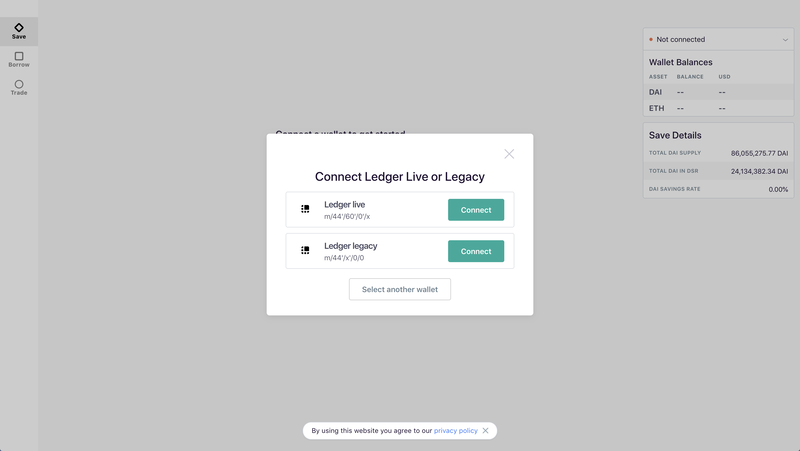

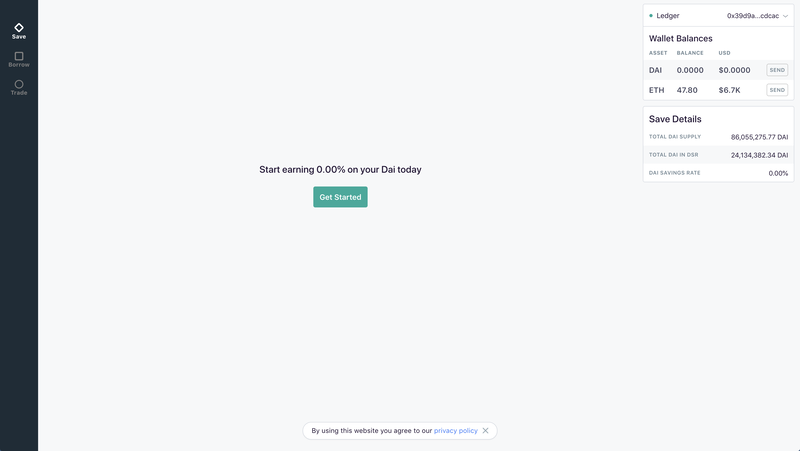

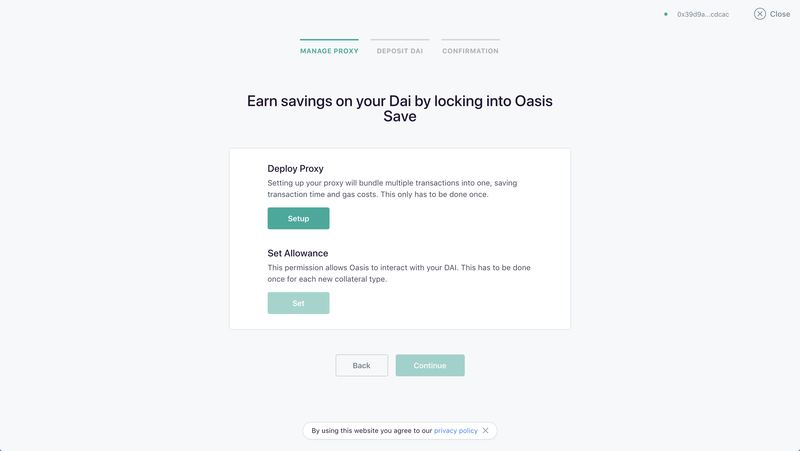

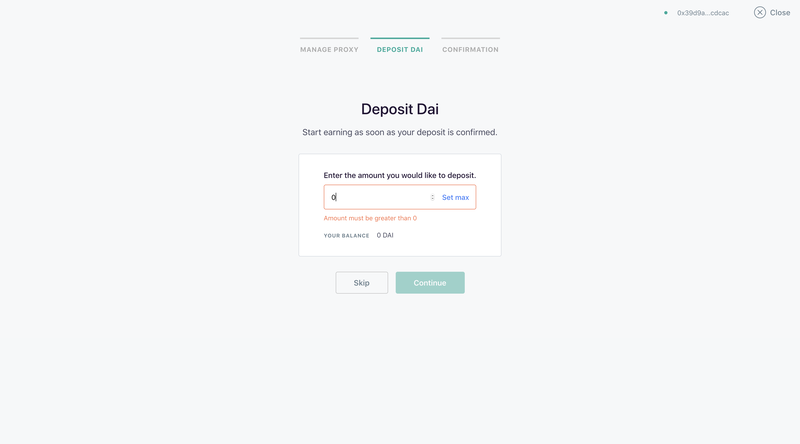

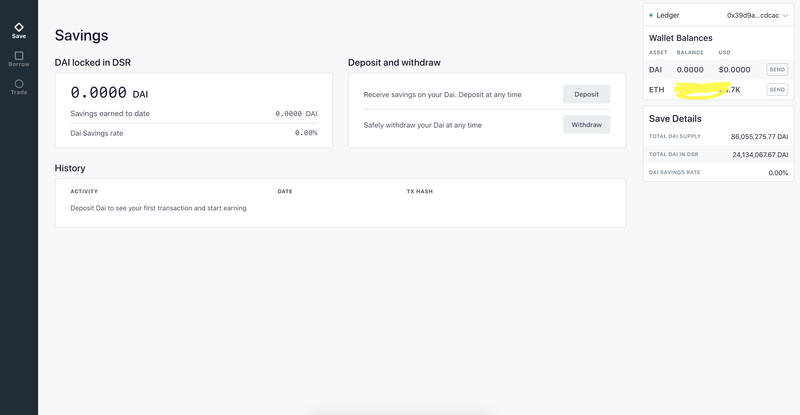

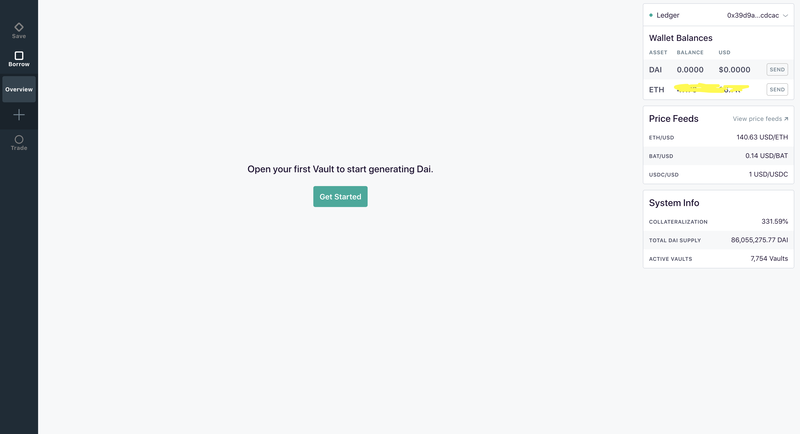

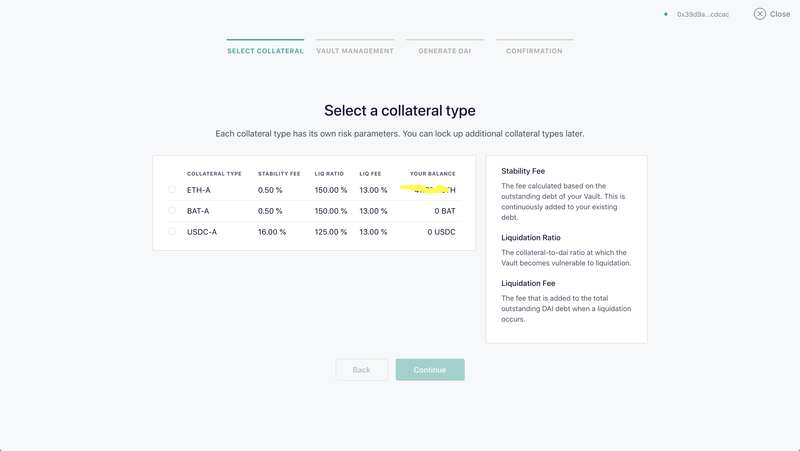

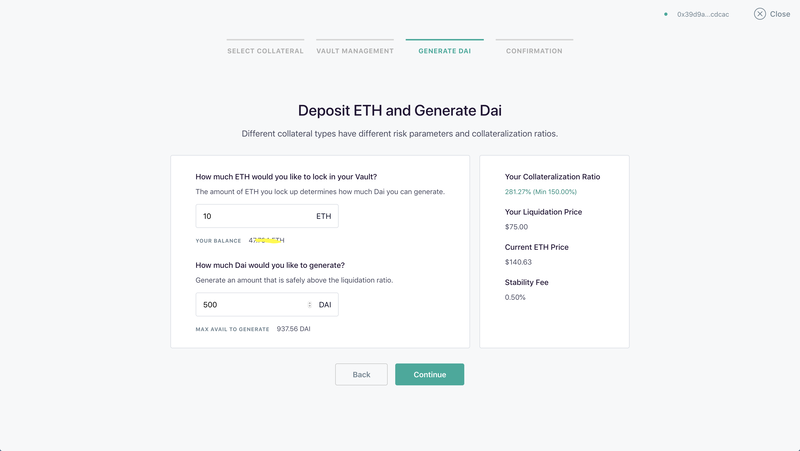

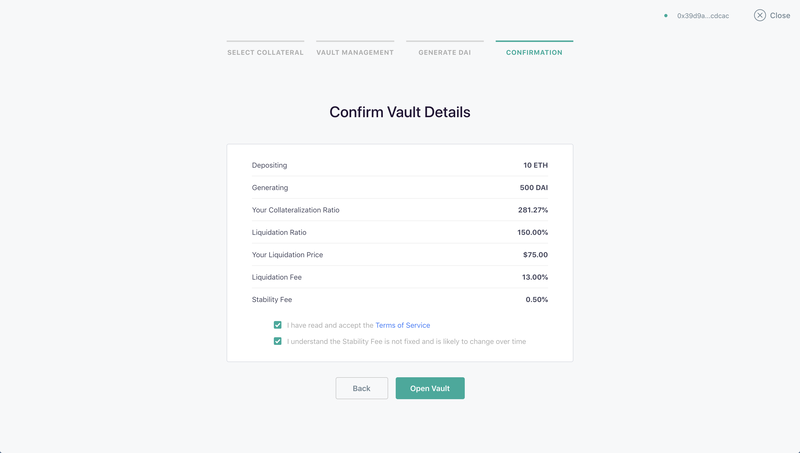

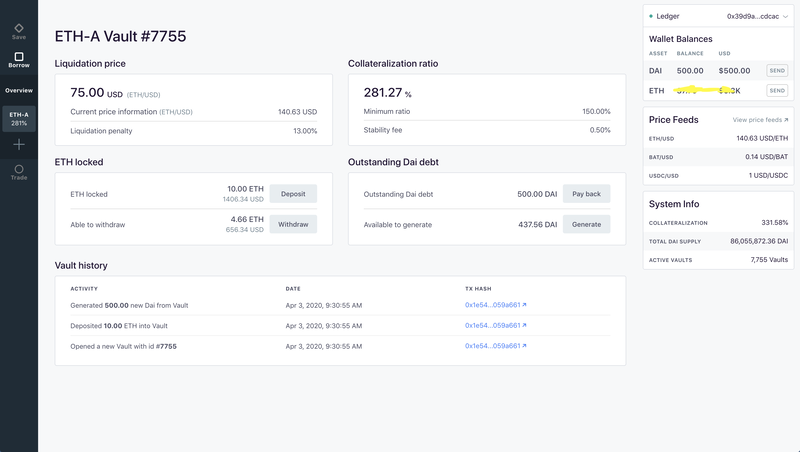

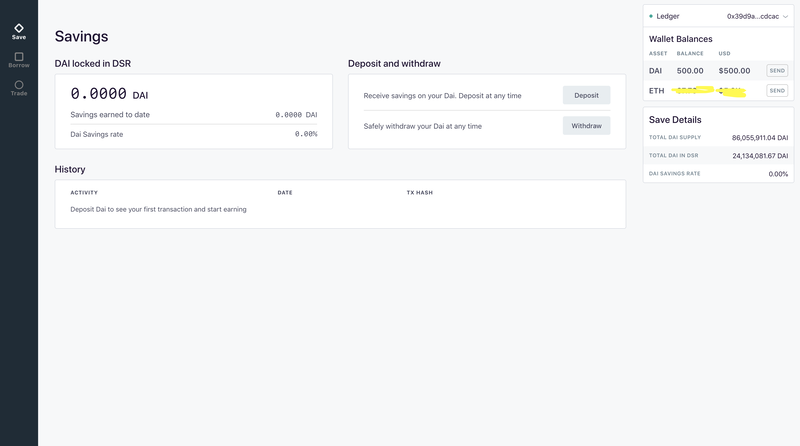

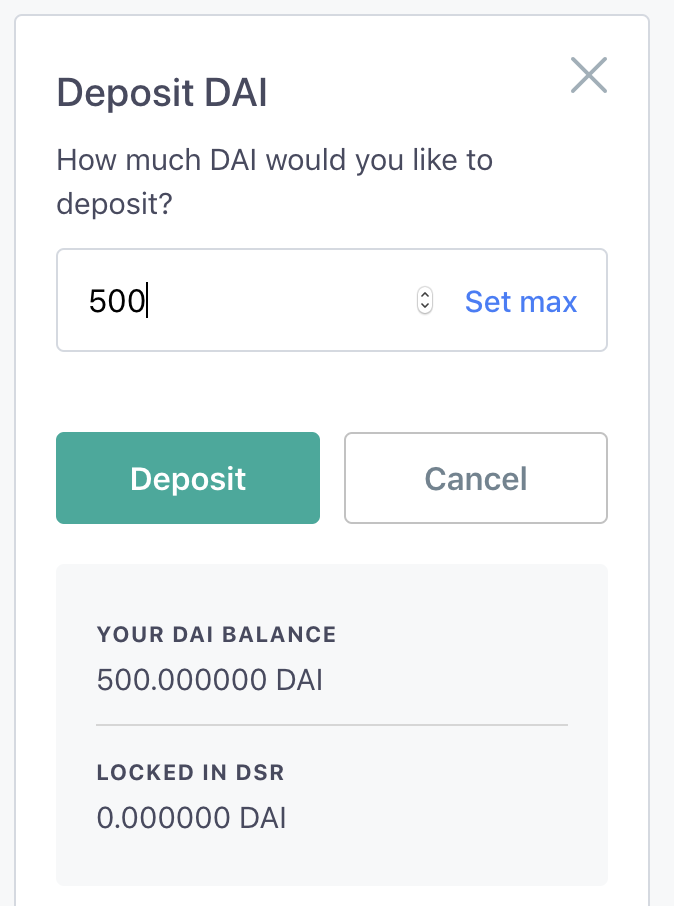

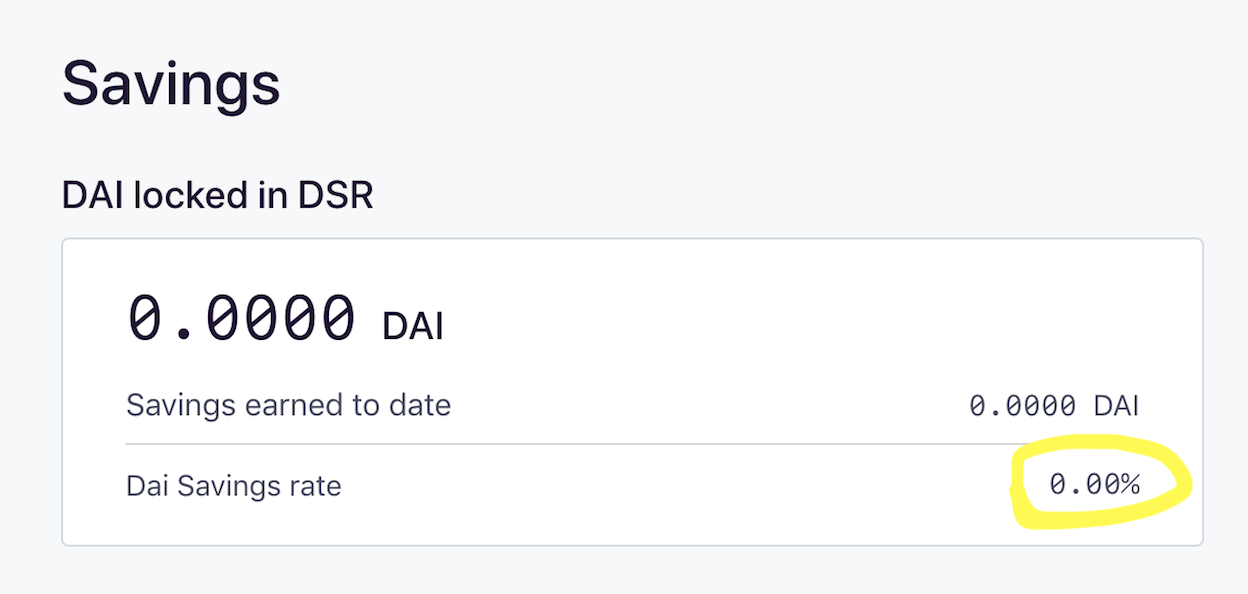

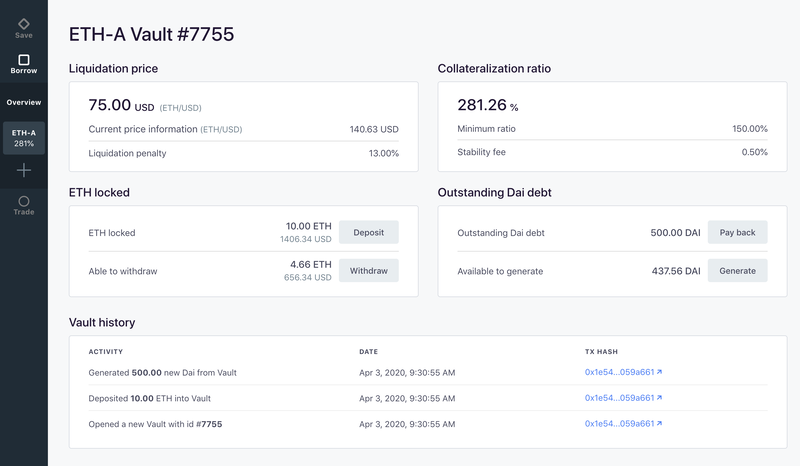

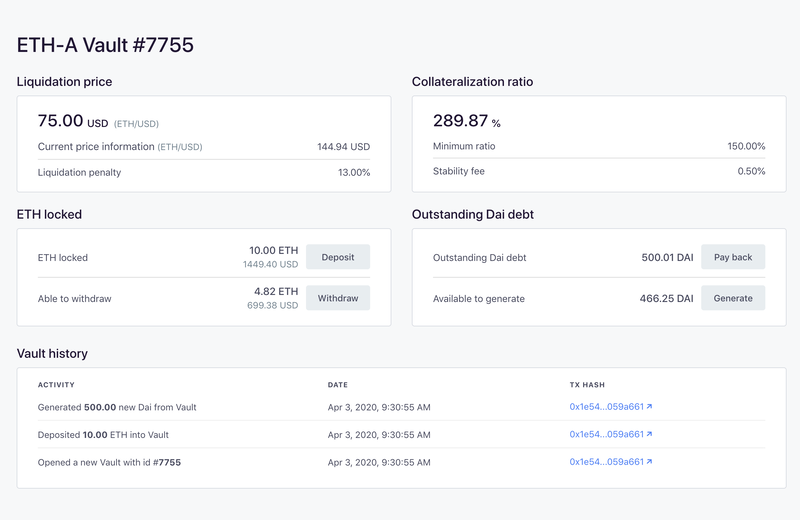

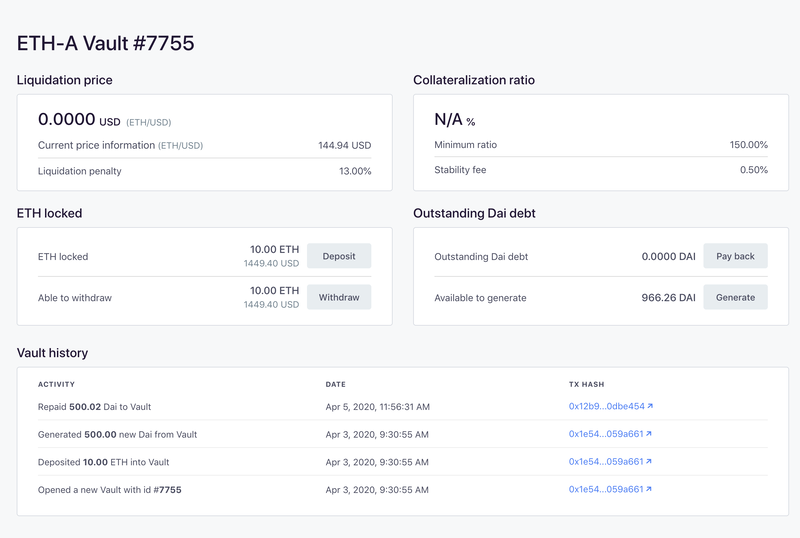

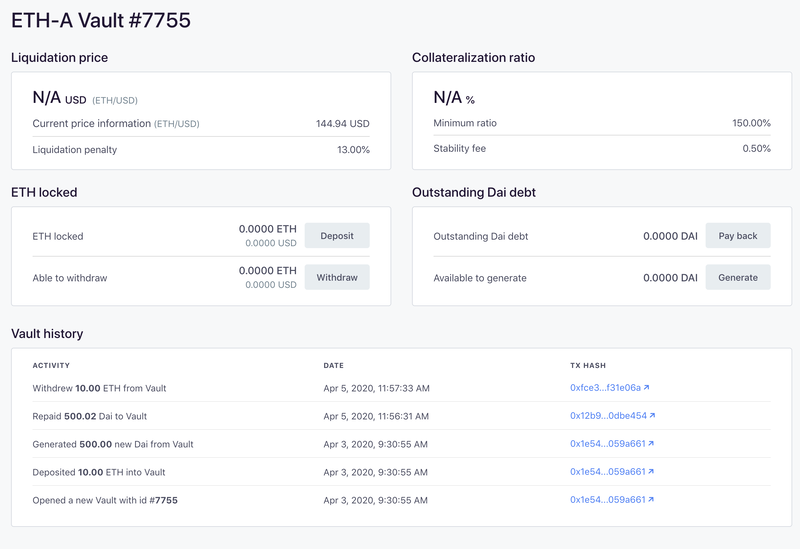

This is a tutorial for how to acquire DAI and deposit to earn interest rate (However it is 0% currently due to DAI shortage. Maker website: https://makerdao.com/en/ 1: Go to: https://oasis.app/ and click "Borrow" and you will see the page below 3: Connect to your wallet I am connecting to ledger nano S in this tutorial. 4: Open Ledger and choose Ethereum app I assume you know how to use ledger nano S here. 4: Choose Ledger Legacy Note: Choosing ledger nano does not show the Ethereum address which I have some ETH even though unlocking and openings ledger live app. 5: Create vault and deposit ETH to borrow DAI later This takes some time, follow the instruction by the app and (5): Make sure to your ETH app on ledger nano allows contract data which is in setting and choose click approve for each contract to execute such as "Deploy proxy" and "Set allowance". 6: You will see the window below, skip it for now This is what looks like now. 7: Borrow DAI Click "Get started" and choose ETH-A in the next page. You can also choose BAT and USDC 8: Decide how much to borrow based on liquidation risk Make sure that current ETH price and liquidation price is not close. I chose 10ETH (1400USD= current ETH price of Apr 2020, 140USD x 10) collateral and 500 DAI to borrow and the liquidation price is 75USD/ETH. 9: Now the vault is created and the detail below This is the overview below. You can see that liquidation penalty is 13% of the collateral. 10: Deposit DAI (Note that it is not a good idea to borrow DAI and and and save the DAI as there is 0% interest rate for deposit and you will be paying interest by borrowing. Borrowing rate per day as of now = 500 USD => 500.014309258276524579 USD) Deposit and choose the amount. However DAI is having an issue currently and the interest rate is 0% (It is about 8% previously), lower the stability rate is 0.5%. Please see for more information from the link below. https://defirate.com/maker-dai-shortage/ The overview looks like this now. Case study: Liquidation Liquidation Penalty = 0.13 (13%) Amount of collateral ETH = 10 Current ETH Price = 140.634 USD Liquidation price = Amount of DAI borrowed * 1.5/ Amount of collateral = 75 USD Amount of DAI borrowed = 500 USD Collateralization ratio = Amount of ETH * ETH Price/ Amount of DAI borrowed = 140.634*10/500 = 2.81268 Collateralization ratio > 1.5 Liquidation, lets say collateral auction did not go well, just enough to cover the borrowed amount in other word lose all the collateral. I should have some left over back to my vault though this is the worst case scenario. Collateral price = Amount of collateral ETH * ETH Price = 1406.34 USD If liquidate I have 500 USD of DAI If I bought ETH with the borrowed DAI Amount of DAI borrowed / ETH Price * 75 = 266.65 If I did not borrow in the first place Amount of collateral ETH * Liquidation price = 750 Potential leftover = Amount of collateral ETH * Liquidation price * (1 - Liquidation Penalty) - Collateral price sold at auction = 652.5 - Collateral price sold at auction For more detail: https://community-development.makerdao.com/ 11: Close vault First you need to pay back the DAI debt by pressing "Pay back" button. If you do not have enough DAI and you will need to buy some from exchange or "Trade" function in the Oasis app if it is small amount. This is a walkthrough of Oasis trade: https://www.btcjp.co/research/maer-oasis-trade-function Withdraw the deposited ETH Done!

Comments are closed.

|