|

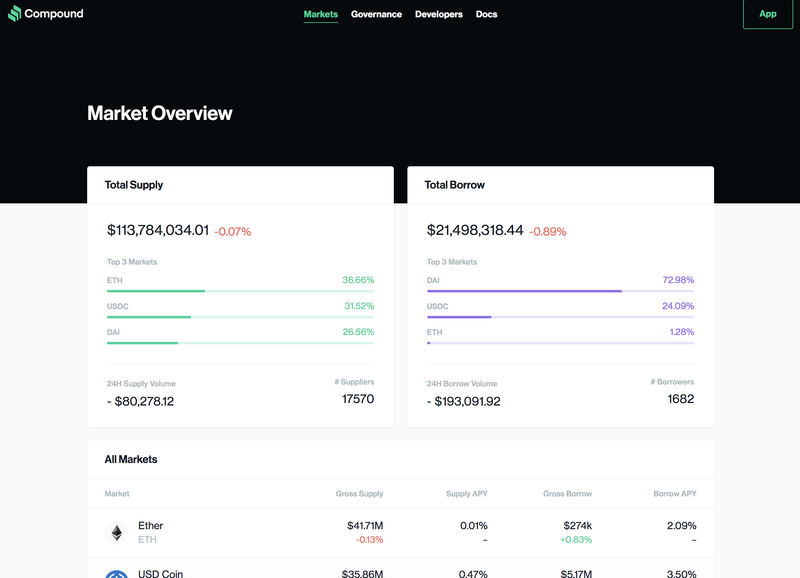

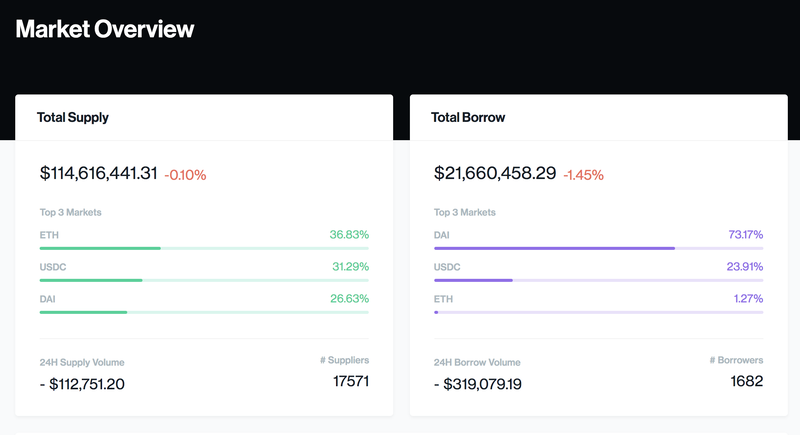

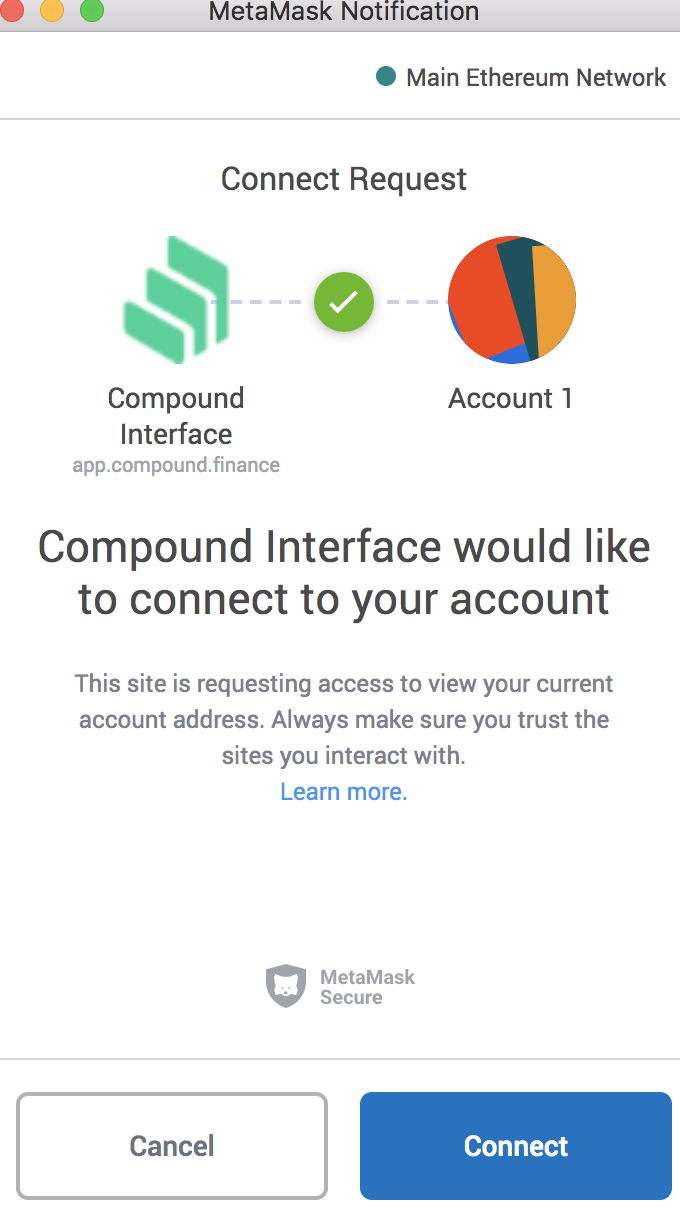

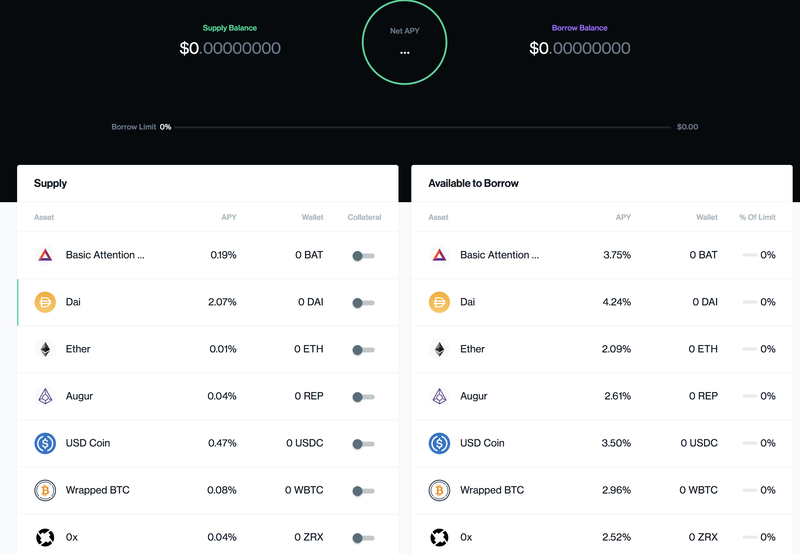

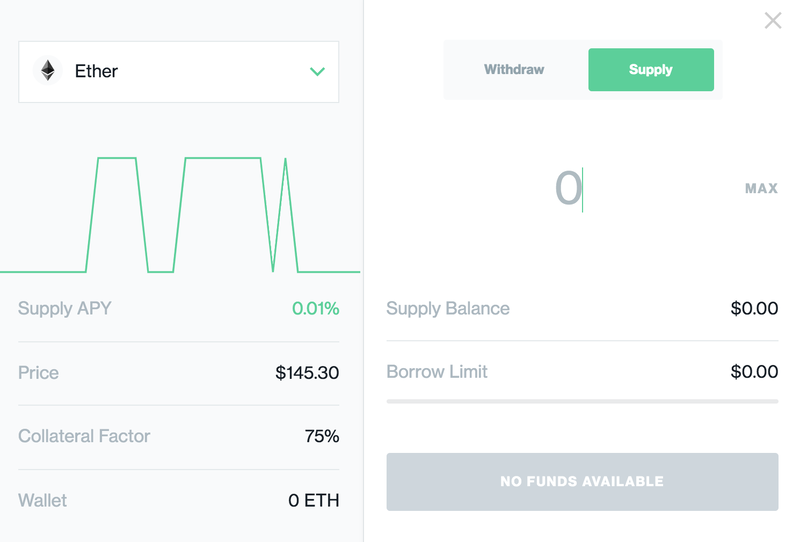

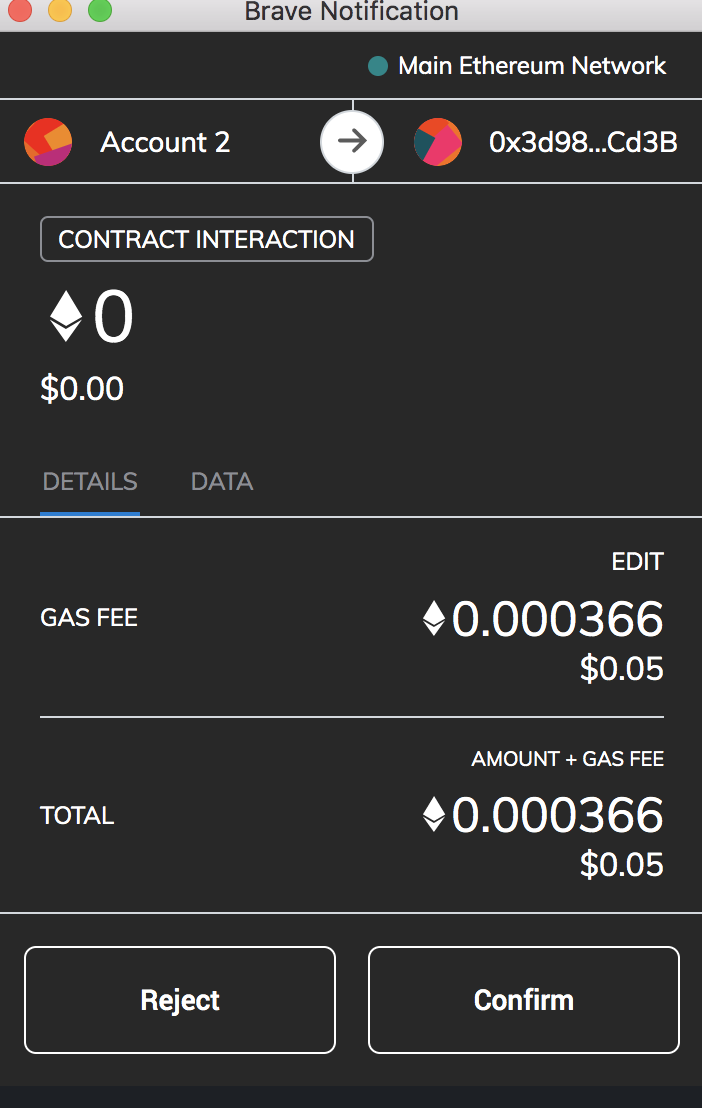

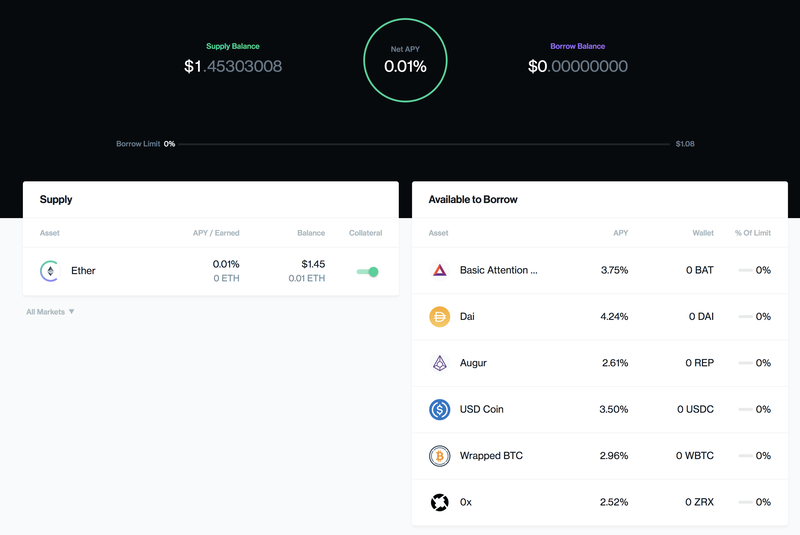

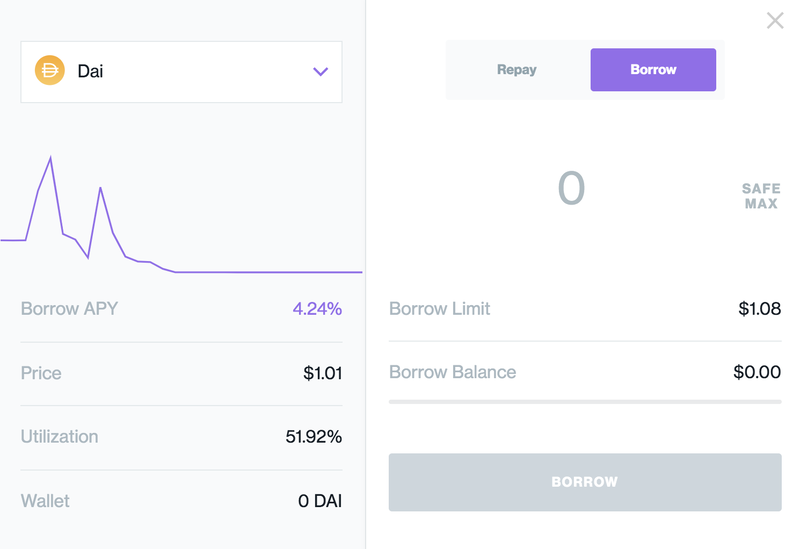

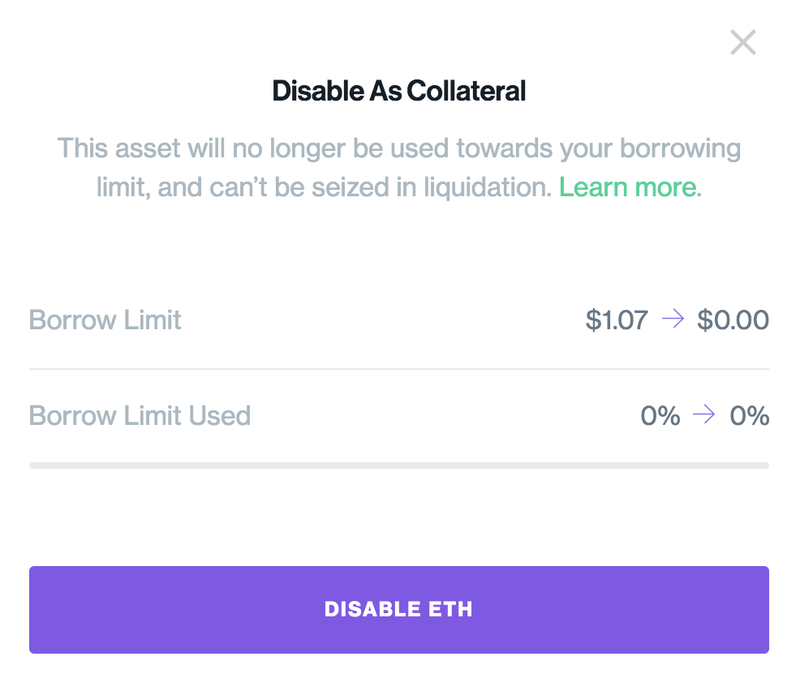

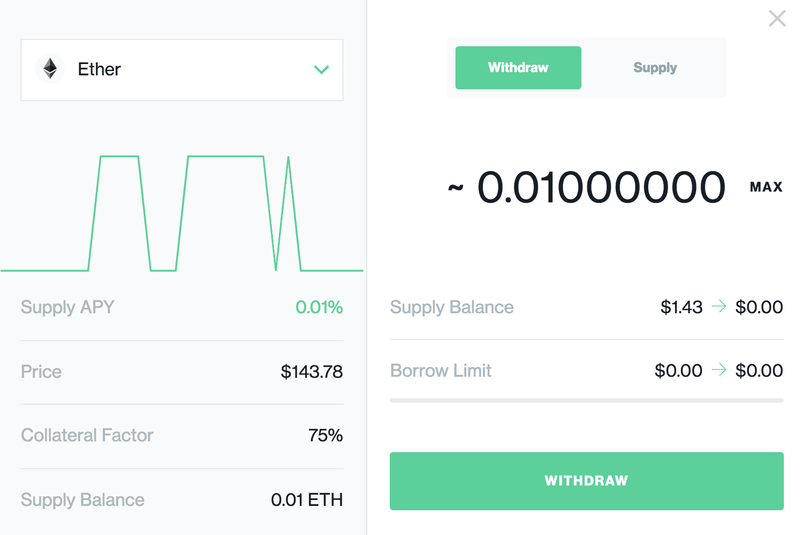

Compound, Ethereum platform DeFi application: Compound is a platform to earn interest and borrow cryptocurrencies. This is a walkthrough of what it loos like to use. Compound website https://compound.finance/ Current market size screenshot as of April 5 2020, 114m USD total supply, is not big. Earn interest by locking ETH (or other asset you choose) as collateral 1: Go to https://app.compound.finance/ 2: Connect to your wallet I am using Metamask for this walkthrough. Current market asset and APY (Annual Percentage Yield) below, 0.01% interest by collaterizing ETH.. Not much. 2.07% for DAI 3: Click Ether to deposit Collateral factor: Percentage of asset collateral price that you can borrow e.g. 1000 USD ETH collateral = you can borrow 750 USD of asset. It is different each crypto asset. e.g. Augur = 40% For more info: https://medium.com/compound-finance/faq-1a2636713b69 Metamask or your connected device will ask you to confirm the transaction. The screen it looks like this now. Yes I deposited only a little. That's it. I can earn 0.01% of annual interest now. Additionally, this is what it looks like to borrow. Click Dai in the "Available to borrow" and you will se below. APY is 4.24%. I have disabled as collateral at the end of this tutorial and withdrew to Metamask.

Comments are closed.

|